It is not Enough to Tell the Fed to Target Nominal GDP - You Have to Tell it How

Economics / Central Banks Aug 15, 2011 - 06:55 PM GMTBy: Paul_L_Kasriel

In the August 15 edition of the Financial Times, Clive Crook wrote an op-ed piece urging the Fed to target nominal GDP growth. This is not the worst Fed "mandate" that has been recommended. But it is not enough to recommend a mandate or a target to this Fed. You also have to explain to it how to maximize the probability of actually achieving its mandate. Targeting a fed funds rate won't do the trick, especially under current circumstances.

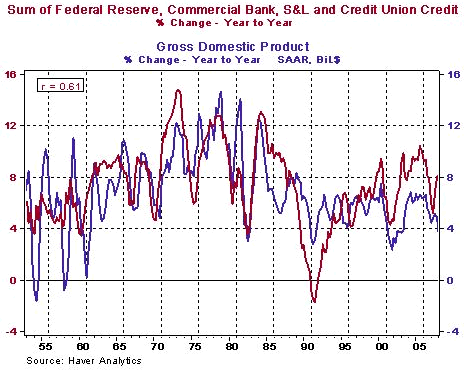

I would suggest that if the Fed were to accept Mr. Cook's recommendation of it targeting nominal GDP growth, the Fed should choose as an intermediate target growth in the sum of Federal Reserve, commercial bank, S&L and credit union credit. Chart 1 shows that the correlation between the year-over-year percent change in this credit aggregate and the year-over-year percent change in nominal GDP is 0.61 from Q1:1954 through Q4:2007.

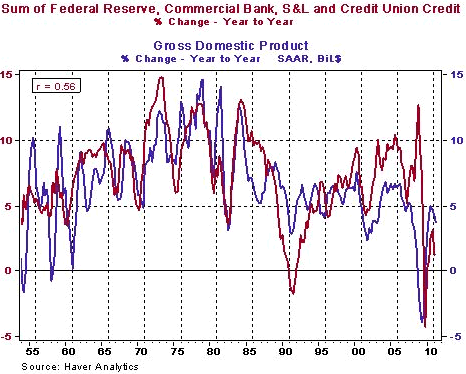

In 2008, there was a significant divergence between the growth in this credit aggregate and the growth in nominal GDP. You may recall that in 2008, the over-the-counter money and capital markets froze up. Businesses, fearing the onset of another depression and with the commercial paper market shut down, tapped their back-up lines of credit at commercial banks quite heavily. The Fed through open the discount window and created new lending facilities to nondepository financial institutions that were desperate for liquidity with the interbank loan market frozen. Thus, this credit aggregate soared. But entities were borrowing not to spend, but rather to be as liquid as possible. Thus, although the sum of Fed, bank, S&L and credit union credit soared in 2008, growth in aggregate spending, as represented by nominal GDP, plunged. Even including this unusual 2008 episode, the correlation between growth in this credit aggregate and growth in nominal GDP remained relatively high at 0.56 (see Chart 2).

I would leave it to the Fed's crack econometric staff to determine how fast the sum of Federal Reserve, commercial bank, S&L and credit union credit should grow in order to hit a nominal GDP growth target. But this is how the Fed could do it. Scrap fed funds rate targeting. Rather, increase or decrease the Fed's balance sheet such that the sum of Fed, commercial bank, S&L and credit union credit grows at the rate that the Fed's econometricians believe is consistent with the Fed's nominal GDP target growth rate.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.