Gold vs Paper, Paperbugs Won't Get It Until It's Too Late

Commodities / Gold and Silver 2011 Aug 13, 2011 - 07:03 AM GMTBy: Adam_Brochert

A brutal cyclical common equity bear market within this secular bear market for common stocks has already begun. Meanwhile, the parabolic phase in the uncommon Gold secular bull market has just begun with the latest thrust higher. Please don't mistake the forest for the trees: Gold should be correcting now and common stocks are due for a dead cat bounce higher. But these shorter-term considerations are not where the big money is made for retail investors now are they?

A brutal cyclical common equity bear market within this secular bear market for common stocks has already begun. Meanwhile, the parabolic phase in the uncommon Gold secular bull market has just begun with the latest thrust higher. Please don't mistake the forest for the trees: Gold should be correcting now and common stocks are due for a dead cat bounce higher. But these shorter-term considerations are not where the big money is made for retail investors now are they?

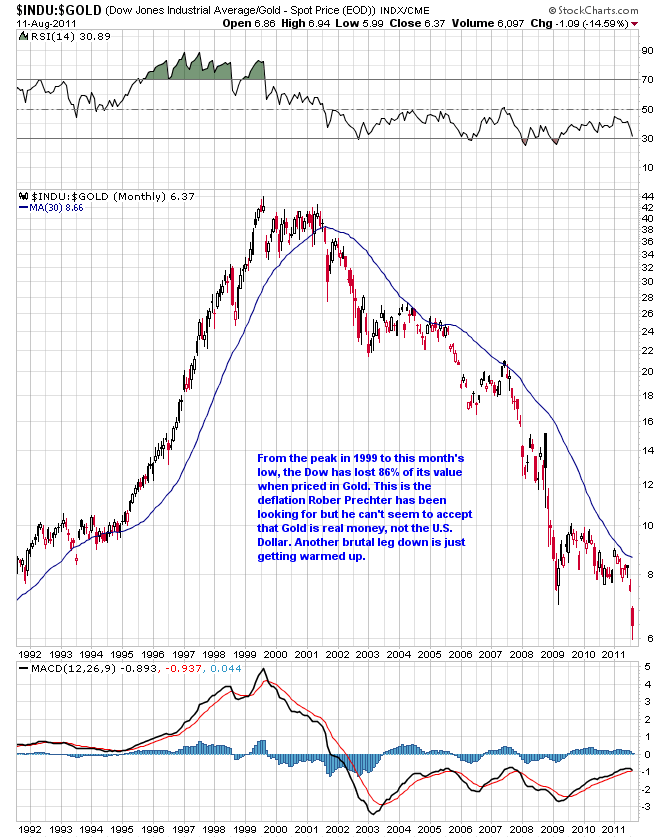

A shiny piece of metal continues to trounce common equities and this trend is set to continue. The best way to view this for American investors is by using the Dow to Gold ratio (i.e. $INDU:$GOLD), a chart I have been harping on long before I started ranting on the internet. How now Dow over this secular period of stock investor misery? Let's look at a 20 year monthly chart of the $INDU:$GOLD ratio:

This ratio is going to 2 and we may well go below 1 this secular cycle. The paperbugs still talk of dividend yields and how they are higher than the bond yield. This is true, but what good is a 3% dividend yield if the stock goes down another 50% over the next few years? And, using the dividend yield with an appropriate historical perspective (next chart stolen from a piece by Mark Lundeen), we are near a top in the stock market, not a bottom:

Trust me, we will get back to a 6% yield in the stock market before this secular bear is done mauling the paperbugs. A double digit yield wouldn't be surprising. The calls for a bottom here with a continuation of the cyclical equity bull market are amazing to me and show just how entrenched the belief in infallible central banksta wizards has become. These wizards are powerless to stop the new cycle now that the tide has turned, just like in late 2007. Manipulation works well only when it is in the direction of the trend, otherwise a few days to a few weeks is about it. The fact that Europe had to ban short selling to get a bounce in their markets suggests that we likely will make one more low before a multi-week dead cat bounce. This dead-cat bounce could be anemic or fast and furious - I don't know. A fast and furious bounce would be anticipated and better to keep the bulltards in this thing as long as possible before wiping them out.

Folks, we are already in a bear market in the majority of the world's equity markets by the standard definition: a 20% loss. Here's the list from peak to trough for multiple markets, in no particular order:

China ($SSEC): August 2009 peak to this week's lows: 30% loss

Brazil ($BVSP): November 2010 peak to this week's low: 35% loss

India ($BSE): November 2010 peak to this week's low: 22% loss

Russia ($RTSI): April 2011 peak to this week's low: 29% loss

France ($CAC): February 2011 peak to this week's low: 31% loss

UK ($FTSE): February 2011 peak to this week's low: 22% loss

Germany ($DAX): May 2011 peak to this week's low: 28% loss

United States ($SPX): May 2011 peak to this week's low: 20% loss

Italy ($INE): October 2009 peak to this week's low: 44% loss

Other PIGS countries: A little bit more than 20% down... (sarcasm off)

Get the picture here? I understand buying stocks here AS A TRADE, but not as an investment. We are going much, much lower in common stocks. And what of Gold? Ah, the shiny, worthless, barbaric metal that is the best performing asset over the past decade. Let's just say things are about to get hot to the upside after the current correction concludes.

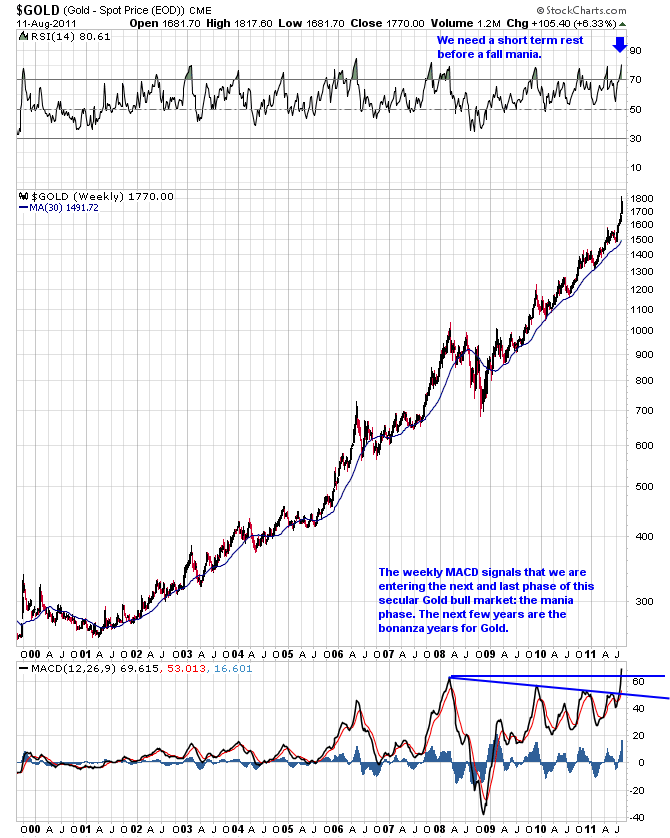

Looking at Gold on a weekly chart gives us a clue as to what comes next. Here is a 12 year log scale weekly chart thru Thursday's close to show you what I mean:

This type of MACD shift to a higher range has been seen in multiple prior secular equity bull markets as the parabolic phase higher began. I don't think this time is an exception. It's just that time in the investment cycle, nothing more. And the fundamentals support this fledgling move completely. While US Dollar-based deflationists call for a massive US Dollar rally, they will be shocked to see how high Gold goes relative to the US Dollar during a deflationary crash when no one trusts their governments and confidence is lost. And the US Bond permabears will be shocked how well government debt in the US holds up as the herd flees the stock market.

And for all those who say that this is not a replay of 2008, I agree. Things are much, much more serious now and the corresponding bear market has the potential to be even more devastating. When the banking system is broke plus many nations in the world are broke and at the breaking point, you are talking about a replay of the last year or two of the 1929-1932 bear market. It will be more drawn out this time (will it end in 2014?) due to endless apparatchik interventionism, which will fail again and again, as it always has in the past. Being a bear will become dangerous, as events in Europe this week related to abrupt banning of short selling demonstrate. Paper Gold may be banned or curtailed as things spiral out of control, so don't say you weren't warned.

Physical Gold held outside the banking system and away from the prying eyes of bankstaz and governments is the single best investment option out there. Period. The Gold bull market is not over by a long shot. Some physical cash under the mattress (i.e. outside the banking system) to cover short-term expenses is also not a bad idea.

If you're crazy enough to trade these dangerous and heavily manipulated markets, consider giving my trading service a try. We trade Gold, silver and Gold and silver stock indices, as well as other markets when opportunities present themselves.

Adam Brochert

abrochert@yahoo.com

http://goldversuspaper.blogspot.com

BIO: Markets and cycles are my new hobby. I've seen the writing on the wall for the U.S. and the global economy and I am seeking financial salvation for myself (and anyone else who cares to listen) while Rome burns around us.

© 2011 Copyright Adam Brochert - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.