Gold and Asset Allocation

Commodities / Gold and Silver 2011 Aug 13, 2011 - 03:53 AM GMTBy: Submissions

Henry Smyth writes: A few months ago, my friend and former colleague Mike Kastner of Halyard Asset Management send me an email with an article from Credit Suisse Portfolio Strategy Group entitled The Best and Worst Assets of the Decade.

Henry Smyth writes: A few months ago, my friend and former colleague Mike Kastner of Halyard Asset Management send me an email with an article from Credit Suisse Portfolio Strategy Group entitled The Best and Worst Assets of the Decade.

Here is the link to the article.

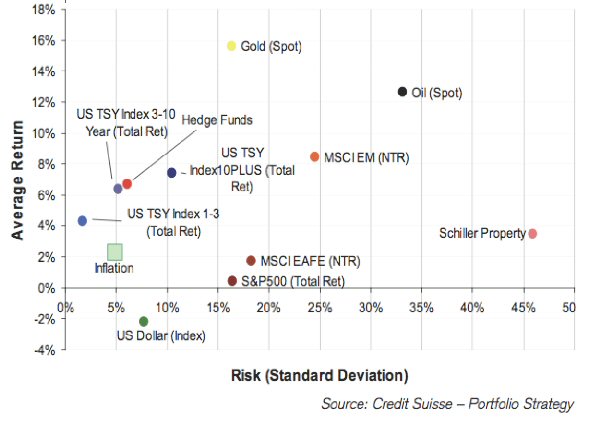

Exhibit 2

My eye was drawn immediately to Exhibit 2, from the article shown above, which shows the annualized net return of various asset classes over the ten years from 2000 to 2010 against their volatility. In portfolio theory, this plot produces a curved line known as the efficient frontier, which represents an optimal risk/return investment portfolio.

To quote the article:

"Looking at the risk/return tradeoff, (exhibit 2), an efficient frontier for the period would sit close to US Treasuries, hedge funds and gold - being the best investment for their realized volatility."

Exhibit 2 deserves careful scrutiny by anyone who invests for long term performance. Who would have thought in 2000 that gold would produce the highest risk/return of any asset class over the coming decade. Conversely, US equities risk/returns over the decade must have come as a shock to investors anticipating a continuation of the previous two decades of bull market performance.

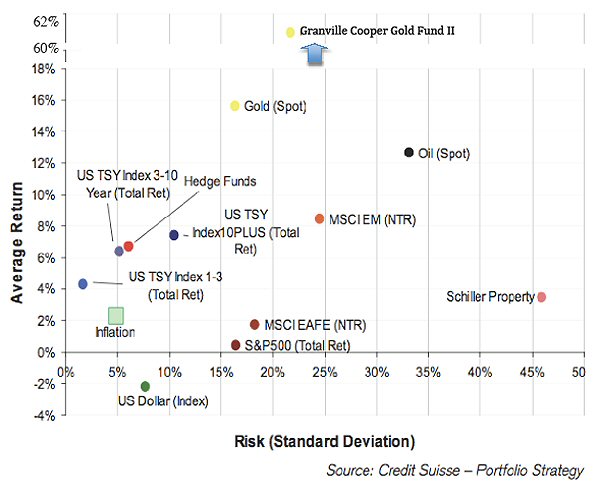

Intrigued, I asked my colleague Zeke Brustkern to once again do his magic and add to this chart the risk/return performance of the Granville Cooper Gold Fund II Ltd. over the same period. Here is the result which I call Exhibit 2a.

Exhibit 2a

I know, I didn't believe it either, so I had Zeke rerun the data, but he came back with the same result. To make sure, I even had him call up the author of the article to confirm we were using the same calculation for measuring volatility. We were.

In looking at and thinking about these two charts a few things came to mind:

1. Asset allocation matters. While your attention is being directed toward expense ratios, tax consequences, volatility etc. it is asset allocation that makes the biggest difference in long term investing success or failure;

2. Success in asset allocation requires identifying and investing in line with the primary trend. This is far more difficult than it might seem, in large measure because;

3. Most people tend to extrapolate the present into the future. This works for most of a primary trend but not at the beginning and most certainly not at the end.

4. A change in the primary trend will by definition require a change in the optimal asset allocation model.

5. If you are invested with the primary trend, volatility is not necessarily your enemy.

Henry Smyth

Director

Granville Cooper Asset Management Ltd.

www.granvillecooper.com

© 2011 Copyright Henry Smyth - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.