Beginning of the End of the Current Fiat Monetary System

Currencies / Fiat Currency Aug 12, 2011 - 12:36 PM GMTBy: David_Galland

David Galland, Managing Director Casey Research writes: I am beginning to feel a bit like one of the French unfortunates stumbling through the fog in the Ardennes, circa 1914. Except that, instead of Germans full of deadly intent coming at me in the gloomy forest, it is a flock of black swans.

David Galland, Managing Director Casey Research writes: I am beginning to feel a bit like one of the French unfortunates stumbling through the fog in the Ardennes, circa 1914. Except that, instead of Germans full of deadly intent coming at me in the gloomy forest, it is a flock of black swans.

As it was for the French in the Ardennes, the number of problems - then Germans, now black swans - is becoming overwhelming.

Consider just a little of what we as investors, and as individuals looking forward to retirement in accommodations more commodious than a shipping box, must contend with:

-

The Euro-Stone. Despite all the bailouts and bluster flying about Europe, the yields in the wounded "piiglets" of Greece, Portugal, etc. have failed to soften to more tolerable levels. Worse, yields in the fatter PIIGS of Spain and Italy are hardening. This is of no small import to the German and French banks, which together are owed something like US$2 trillion by the porkers. At this point, it is becoming clear that the eurozone's systematic flaws doom the euro to continue trending down until it ultimately takes its place in the pantheon of failed monies.

-

The Yen Has Lost Its Zen. This week the Japanese government again began intervening in currency markets because, remarkably, the yen has been pushed to highs against the dollar. This in a nation with a government debt-to-GDP ratio that is better than twice the also horrible ratio sported by these United States.

That ratio ensures that Japan's long struggles will continue, burdened as it also is with the aftermath of the deadly tsunamis and the ongoing drama at Fukushima. Adding to its woes are the commercial challenges it faces from aggressive neighbors, and maybe worst of all, the demographic glue trap it is stuck in, with fewer and fewer young to pick up the social costs of the old. Toss in the waterfall plunge in Japan's much-vaunted savings rate - formerly a big prop keeping Japanese interest rates down - and the picture for Japan is anything but tranquil.

- China's Crucible. There are many reasons for being optimistic about the outlook for China, including a large and hard-working populace. But there is one overriding reason to expect a big bump in the path to China's emergence as the world's reigning economic powerhouse.

Simply, it's a capitalistic country with a communist problem.

Now, in the same way that some people believe in leprechauns or any of dozens of other magical beings, some people believe that an economy can be successfully commanded just as a captain commands the crew of a Chinese junk cruising along the coast. It's a fantasy.

While the comrades in charge have done quite well - largely by getting out of the way of natural human actions - they are fast reaching the limits of their ability to navigate the shoals. As I don't need to tell you, China is a massive country, with hundreds of millions of people capable of every manner of human strengths and frailties. But if they share one interest, it is in a job that allows them to keep their rice bowls full and a roof over their heads. Said jobs don't come from government dictate - at least not on a sustainable basis - but rather by the messy process of free-wheeling commerce... and the more free-wheeling, the better.

In the July edition of The Casey Report, guest contributor James Quinn discusses the very real challenges facing China, not the least of which is that in the latest reporting period, official Chinese inflation popped up to 6.4%. Even more concerning was a 14% rise in the price of food.

Scrambling to keep employment high while also keeping inflation low, the Chinese government is throwing all sorts of ingredients into the mix - building ghost cities, raising interest rates, stockpiling commodities, clamping down on dissent, hacking everyone - but in the end, the irrefutable laws of economics must prevail. And so the Chinese government will have to atone for the massive inflation it unleashed in 2008, and for the equally disruptive misallocations of capital that are the hallmark of command economies.

While the blowup in China will wreak havoc in world markets, including many commodities, a bright side for gold investors is that the country's rising inflation should help keep the wind in the sails of monetary metal. It's no coincidence that the World Gold Council's latest data show investment demand for gold in China more than doubling in the first quarter of this year.

- Uncle Scam. Then there is the United States. Casey Research readers of any duration know the fundamental setup... The political avarice that dominates both parties... The fear and greed of John Q. Public and his steady demands that the government do more... The scam being run by the Treasury and the Fed to provide the funny money to keep the government running... The cynical attempts by certain politicians to stoke a class war... The cellars full of toxic paper at the nation's financial institutions... The outright corruption and deceit of the various government agencies as they twist and torture the data to fool the people into supporting them in their scams.

But there's a growing problem: An increasing number of people and institutions are coming to understand just how intractable the problems are. This has resulted in a steady move into tangible assets - gold, especially - that are not the obligation of any government. And it's not just individuals and money managers moving into gold, but central banks as well. That is an absolute sea change from the situation even a few years ago.

Meanwhile, with the Treasury unable to borrow since May, a backlog in government financing needs has built up. Which begs the question: With the Fed standing aside (for the moment), where is the government going to find all the buyers for the many billions of dollars worth of Treasuries it needs to flog in order to keep the scam going?

If I were a conspiracy theorist, I might look at the sell-off in equities this week, triggered as it was by nothing specific, and see a gloved hand operating behind the curtain. After all, nothing like a good old-fashioned stampede out of equities to send billions chasing after "safe" Treasuries... which has been exactly the case this week.

Regardless, with the crossroads for hard choices now behind us, the global economy finds itself at the top of a long hill... with no brakes.

From here on, it will increasingly be every nation for itself - meaning a return to competitive currency devaluations and, in time, exchange and even trade controls.

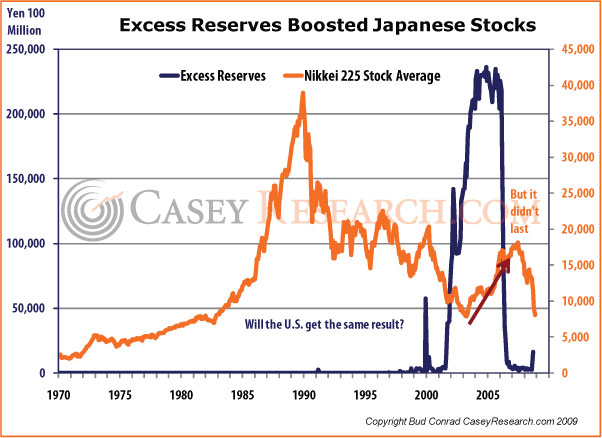

And we will see a return of the Fed to the markets. On that topic, I will once again trot out a chart from an article by Bud Conrad that ran in The Casey Report a couple of years back.

I do so because it shows what I think is a very strong corollary between what occurred in Japan after its financial bubble burst and what is now going on here in the U.S. (and elsewhere). As you can see, as a direct result of the Japanese central bank engaging in quantitative easing, the Japanese stock market bounced back strongly. But then, when the quantitative easing stopped, the market quickly gave back all its gains.

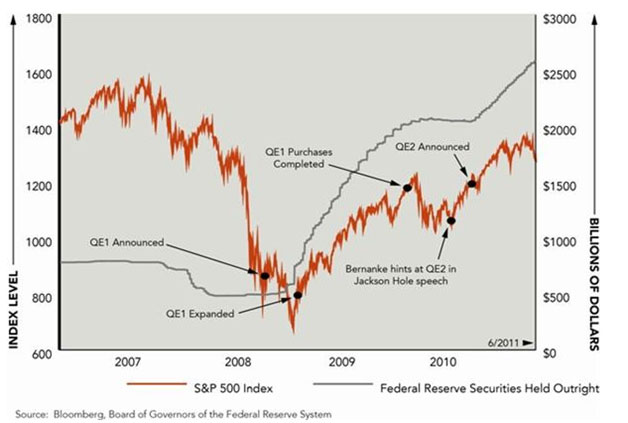

If I had the time and the resources to whip up a chart overlaying the quantitative easing here in the U.S. of late versus the equity markets, I would. But I don't, and so will delve into that fount of all information - the Internet - and grab a chart constructed by someone else (in this case, Doug Oest, managing partner of Marquette Associates - thanks, Doug!)

As one can readily see, the Japanese experience is indeed a corollary to what's happened here, with QE pushing the stock market higher. Conversely, until the Fed comes back in, equities could be in for a rough ride. Likewise, when the Fed returns with the next round of QE, stocks could put in a very nice rally.

Some conclusions:

-

The Fed will have to roll out another round of quantitative easing. And it will likely have to once again provide swap lines to the European central banks as it did in 2008 - though this time around, a belligerent Congress is watching the Fed's every move, so it may not be able to move as quickly as it would have otherwise. In the end, however, given there is less than nothing being done on the front of fiscal policy, it will fall to the Fed to once again ride to the rescue. But it will do so on a lame horse.

-

A delay by the Fed to act could help the Treasury, at least temporarily. Per above, the U.S. government has to move a boatload of paper by the end of this year. If it wants to avoid the dire consequences of having to pay out higher yields in order to attract sufficient buying, it will have to find a lot of demand in a hurry. Should the Fed sit on its hands a bit longer, especially in the face of the escalating euro crisis, the resulting turmoil in global equity markets could provide the necessary demand to clean up the backlog and keep the U.S. government operating.(In July's Casey Report, Bud Conrad dissects the situation and comes to some startling conclusions... and an emerging profit opportunity.)

-

The return of the Fed may signal the beginning of the end. In the face of broad weakness in the global economy and in most commodities, the fact that gold has held up so well is a clear indication that there has been an intrinsic change in the gold market. Barbarous relic no more, it has clearly been returned to its longstanding role as sound money - unique and increasingly valued when compared to the fiat competition.

This role will only become more crucial as the world's desperate nation-states fire their currency cannons in the war to remain viable. The Fed's return to Treasury markets will be, in the rear-view mirror of future history, seen to be a seminal event - the beginning of the end of the current fiat monetary system.

Simply put, too much of a good thing is too much of a good thing. And make no mistake, the decades of operating under a fiat monetary system have been a very good thing for the political classes and their pandering cronies.

Those good times are coming to an end.

[Savvy investors can still make money in a crisis… often the returns are even greater when times are tough. Learn all about the smart money’s way of crisis investing and Bud Conrad’s profit opportunity mentioned above – with a risk-free trial subscription to The Casey Report.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.