Germany’s Best-Selling Tabloid Bild's Front Page Encourages Readers To Buy Gold

Commodities / Gold and Silver 2011 Aug 11, 2011 - 11:32 AM GMTBy: GoldCore

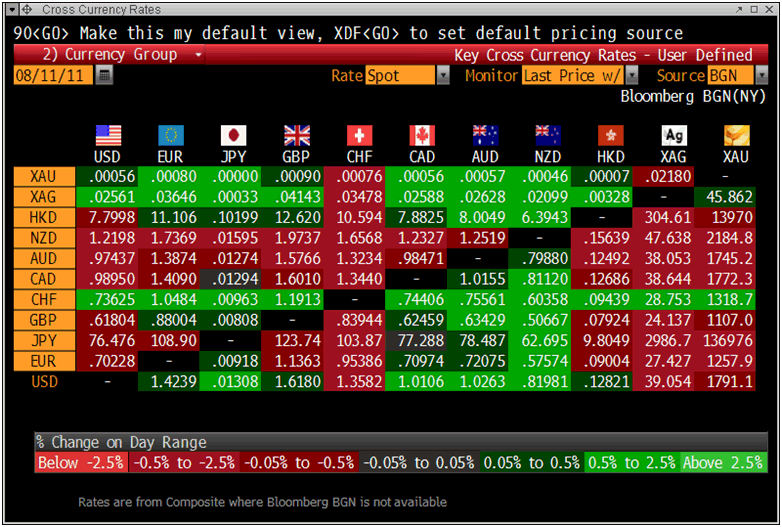

Gold has fallen today in all major currencies except the Swiss franc which has fallen on SNB intervention rumours. Gold is trading at USD 1,791.40, EUR 1,257.10, GBP 1,107.70, CHF 1,318.80 per ounce and 136,976.00 JPY/oz. The yen has fallen by 8.7% against gold so far in August as the yen, while rising in dollar terms, is falling sharply in gold terms (see chart below).

Gold has fallen today in all major currencies except the Swiss franc which has fallen on SNB intervention rumours. Gold is trading at USD 1,791.40, EUR 1,257.10, GBP 1,107.70, CHF 1,318.80 per ounce and 136,976.00 JPY/oz. The yen has fallen by 8.7% against gold so far in August as the yen, while rising in dollar terms, is falling sharply in gold terms (see chart below).

Gold reached new record nominal highs at $1,814.95/oz and new nominal highs in euros and sterling yesterday. Gold’s London AM fix this morning was USD 1,786.00/oz, EUR 1241.75/oz, GBP 1105.75/oz.

Cross Currency Rates

The CME announced margin requirements on gold will rise by over 22% by close of business today. This saw an initial slight sell off prior to further gains.

A rise in CME margin requirements may lead to speculative long elements getting squeezed and to short term weakness in gold. However, the scale of physical demand internationally is such that any sell off will likely be brief and reasonably shallow.

Gold remains in a strong upward trending channel and until we see a breach of this to the downside, it should continue to move higher. Any pullback will again be used by astute buyers to accumulate bullion on the dip.

There continue to be many important breaking news stories regarding the global debt crisis and pertaining to gold – indeed it is often difficult to keep up with developments.

One such development is today’s edition of Germany’s best selling newspaper Bild which encourages German people to buy gold due to the risks posed to the euro and to cash (see Bild article in Commentary).

Bild Zeitung, is Germany’s biggest- selling newspaper, is the best-selling newspaper outside Japan and has the sixth-largest circulation worldwide.

Bild encouraged German people to invest in gold as the global debt crisis continues to deteriorate and cause turmoil in global markets.

“While the companies listed on stock exchanges have lost over the past 14 days, about $8 trillion dollars in value, the price of gold climbed to a record high.”

“While money can be printed, gold reserves are limited. To date some 150,000 tonnes of gold have been mined.”

Gold “is better than cash,” the newspaper said. “While any amount of money can be printed, gold is limited,” making it “one of the safest investments in crisis times.”

The article is interesting as gold has remained taboo is much of the non specialist European press and media and was only briefly covered in recent days due to the deepening crisis and succession of new record nominal highs.

German demand for gold has been very robust in recent years and the Germans experience of the Weimar hyperinflation means that they are very aware of the risks posed by today’s excessive money printing and global currency debasement.

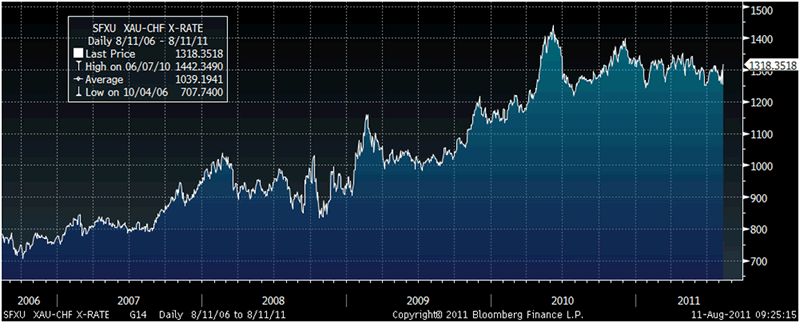

Gold in Swiss Francs – 5 Year (Daily)

Gold’s bull market continues in all major currencies but its recent strength has been more pronounced in dollars, euros and pounds.

In Swiss francs, gold has seen massive consolidation for the last 12 months and looks like it could be on the verge of breaking out and moving sharply higher.

The Swiss central bank will not and cannot allow the franc to continue to appreciate on world markets. The Swiss franc is being debased, albeit on a somewhat lesser scale than the U.S. dollar and some other currencies as Swiss money supply continues to grow rapidly and interest rates are now near zero.

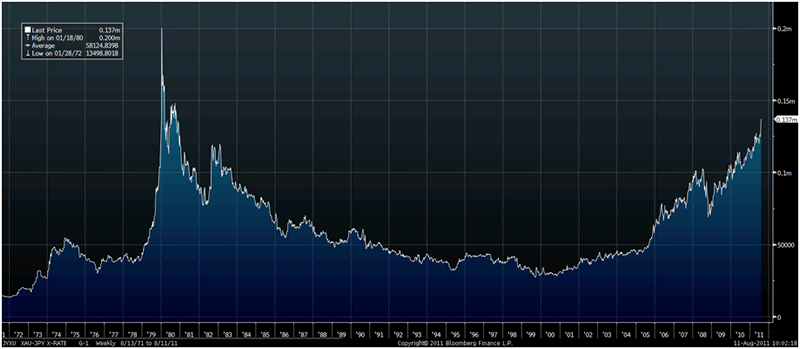

Gold in Japanese Yen – 1971 – Today (Weekly)

Meanwhile, gold in yen has broken out to new 28 year nominal highs over 137,000 yen per ounce and looks set to target the record nominal high of 1980 of 200,000 yen per ounce.

Gold’s rise in yen (see chart above) has been gradual in recent years due to the yen’s relative strength versus other fiat currencies.

Yen gold is likely to rise above its nominal high of 200,000 yen seen over 31 years ago on January 18th, 1980. In the longer term, the inflation adjusted high of over ¥500,000/oz is quite possible given Japan’s dreadful economic, fiscal and monetary position.

No fiat currency will be a “safe haven” in the coming months and years.

From the GoldCore Trading Desk: There is extremely strong demand for gold bullion in all formats at the moment. Although clients are expressing a preference for taking delivery of 1 ounce bars and coins, for allocated storage in Perth Mint and for allocated storage in Zurich. The level of demand is on a par with that seen at the height of the Lehman crisis. However, much of the demand is from existing clients (particularly high net worth) who are increasing allocations. Retail participation has increased and is increasing but remains low. There is tightness in sections of the pre-1933 semi numismatic gold market with French Rooster gold coins becoming difficult to source in volume. Silver demand is robust but there has been no significant increase this week or in recent weeks. Similarly to gold, smart money continues to add to allocations. There continues to be signs of a degree of tightness in the market which suggests that silver may soon bottom and resume its bull market targeting $50/z again.

For the latest news and commentary on gold and financial markets follow us on Twitter.

SILVER

Silver is trading at $39.16/oz, €27.58/oz and £24.22/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,779.20/oz, palladium at $733/oz and rhodium at $1,750/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.