Where Oh Where Are The Safe Havens From Yesteryear?

Stock-Markets / Financial Markets 2011 Aug 10, 2011 - 01:49 AM GMTBy: Jeb_Handwerger

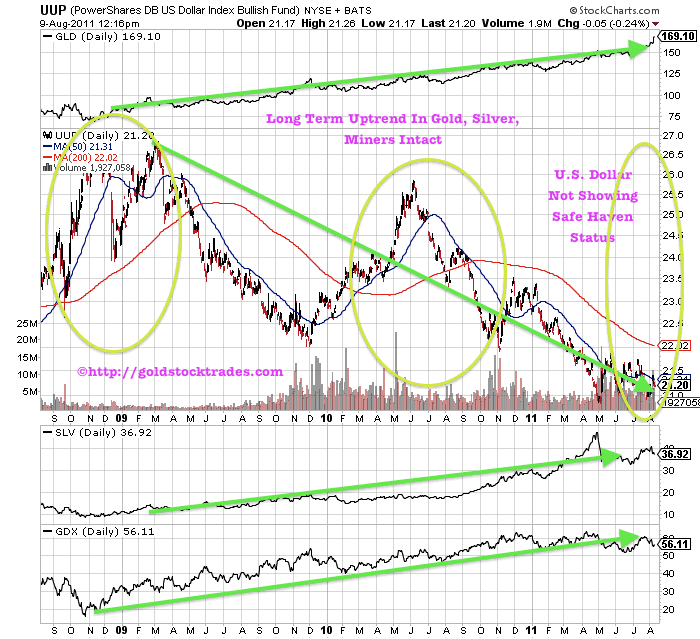

Gold Stock Trades (GST) is witnessing the resumption of the long term uptrend in gold(GLD) and silver(SLV) bullion and precious metals mining stocks(GDX). Along the way there have been many negative voices that were counseling throwing in the towel and moving into the U.S. dollar and long term treasuries. We see no underlying fundamental reasons and find that the safe havens of yesteryear are falling by the wayside. A few months ago Gold Stock Trades alerted readers that investors are being prepared for further accommodative moves by the Federal Reserve Board.

GST has firmly rejected these Cassandra's. Instead our service advised patience and fortitude in precious metals. Truth to tell, any retreats are regarded as a healthy event in the long range upward trend.

Today, the general markets responds to Bernanke's announcement to turn the printing presses on by keeping interest rates low until 2013 and indicating that QE3 in whatever guises necessary will be employed on any equity market weakness. We notice that the general market faded after a strong start. Volume fell and the indexes finished in the lower part of their range. This may have indicated profit taking.

The general market (SPY) should not be confounded with the precious metals, which triggered a buy signal as it resumed its upward trend. Gold is leading the way, as everyone and their brother try to buy some. However, we must not forget the miners (GDX) which are extremely undervalued as gold tests $1800. Once again the miners should capture the heights of various industry groups once the panic selling and de-leveraging ends.

The U.S. dollar is breaking down as Bernanke announces the possibility in some form of renewed quantitative easing. At the same time credit agencies are warning that it may reduce the credit rating of the United States even further.

There is a lack of confidence among many citizens regarding the policies of our economic savants as is so often the case in the lives of individuals, so it is in the fortunes of nations. Psychology certainly has a role to play in the marketplace. The apprehensions of the general public is dour indeed. Pessimism and doubts are increasing. It is said that 30 million people are looking for full-time employment.

The average person may be sensing that our guiding elites are impotent in their attempts to invigorate a weak economy. The on again-off again comments by Bernanke to the effect that the QE3 approach is once again on the table, sweeps the land with the increasingly uncomfortable feeling that our professors and our politicians may not really know what they are doing. These sentiments are reflected in a number of current polls.

Additionally, the U.S. dollar reveals growing weakness as does the Euro. This leaves precious metals firmly standing in the center of the ring.

Where oh where are the safe havens of yesteryear? To use a boxing metaphor, the old champions of the U.S. dollar and the Euro are growing "weak in the pins". There was a time when dollars and euros were viewed as safe havens. Now they are losing their luster. Precious metals dominate the investment arena as an increasingly safe haven and the currency of choice.

Disclosure: Long GLD,SLV,GDX

I invite you to partake of my members only stock analysis service for free by clicking here.

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.