Falling Oil Prices Will Stimulate Consumer Spending

Economics / US Economy Aug 10, 2011 - 01:43 AM GMTBy: Paul_L_Kasriel

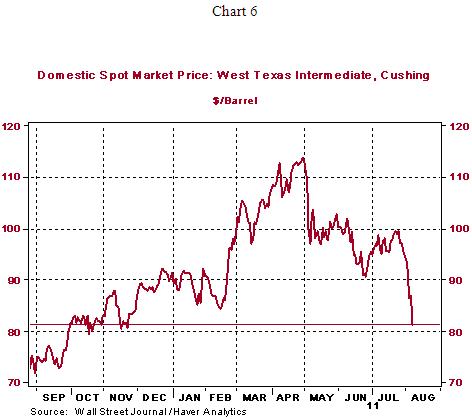

As shown in Chart 6, the price of a barrel of West Texas Intermediate crude oil fell to $81.31 on August 8, the lowest price since November 23, 2010. Some talking heads on the cable financial news channels will tell you that this decline in oil prices could be the catalyst for stronger growth in consumer spending in the coming months. Could be, but might not be. You see, it all depends on why the price of crude oil has been falling since late April. If the price of crude is falling because there has been an increase in the supply of crude oil, then yes, this decline in the price of crude is positive for consumer spending and economic growth in general. But, if the decline in the price of crude is due to a decrease in the demand for crude oil, then the decline in the price of crude oil is symptomatic of weakening global economic growth.

Is that bullish for U.S. consumer spending? Now, it has been reported in recent months that the Saudis have stepped up their production of crude and the U.S. and other governments have released crude oil to the market from their strategic reserves – good news for global growth and U.S. consumer spending. However, in recent months, global Purchasing Managers reports have been signaling weaker global economic growth – bad news for global growth and U.S. consumer spending. Putting together the drop in the price of crude oil, the drop in the price of copper and the sharp narrowing in the interest rate spread between the Treasury 10-year yield and the federal funds rate, the preponderance of evidence is that the cause of the drop in the price of crude oil is due to weaker global demand than an increase in supply. In turn, this means that the drop in the price of crude oil is not the silver lining for U.S. consumer spending that the eternal optimists on the cable financial news channels are squawking about.

Paul Kasriel is the recipient of the 2006 Lawrence R. Klein Award for Blue Chip Forecasting Accuracy

by Paul Kasriel

The Northern Trust Company

Economic Research Department - Daily Global Commentary

Copyright © 2011 Paul Kasriel

Paul joined the economic research unit of The Northern Trust Company in 1986 as Vice President and Economist, being named Senior Vice President and Director of Economic Research in 2000. His economic and interest rate forecasts are used both internally and by clients. The accuracy of the Economic Research Department's forecasts has consistently been highly-ranked in the Blue Chip survey of about 50 forecasters over the years. To that point, Paul received the prestigious 2006 Lawrence R. Klein Award for having the most accurate economic forecast among the Blue Chip survey participants for the years 2002 through 2005.

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

Paul L. Kasriel Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.