JP Morgan Warns Gold to Go Parabolic and Rise to $2,500 By Year End

Commodities / Gold and Silver 2011 Aug 09, 2011 - 06:42 PM GMTBy: GoldCore

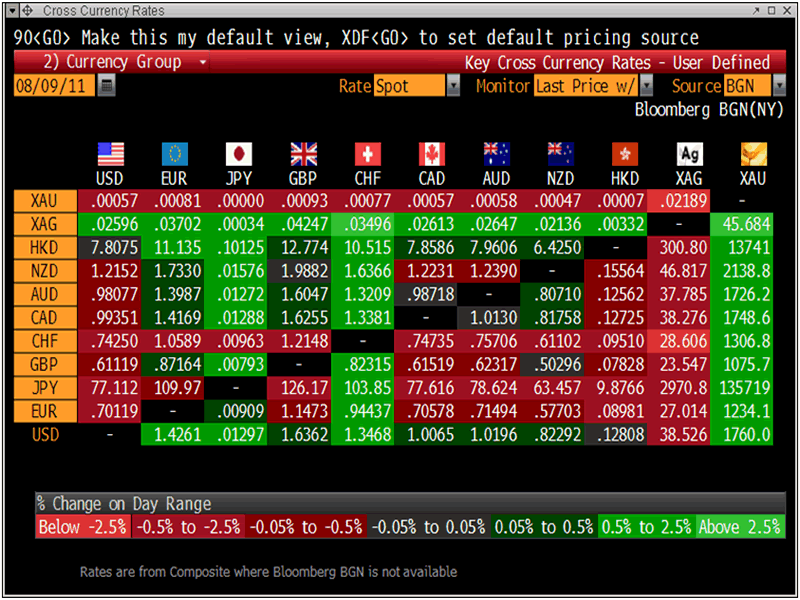

Gold in USD terms is 2.4% higher and is higher against all currencies and trading at USD 1,760.40 , EUR 1,234.10, GBP 1,075.70, CHF 1,306.80 per ounce and 132,719.00 JPY.

Gold in USD terms is 2.4% higher and is higher against all currencies and trading at USD 1,760.40 , EUR 1,234.10, GBP 1,075.70, CHF 1,306.80 per ounce and 132,719.00 JPY.

Gold’s London AM fix was USD 1,770.00, EUR 1,241.75, GBP 1,080.98. Gold reached new record nominal highs at $1,780.10/oz and new nominal highs in euros and sterling also this morning.

Cross Currency Rates

Asian equities were mixed with sharp falls seen on the Hang Seng but the Nikkei recovered to only finish down 1.7% and the Chinese and Australian stock markets actually managed to rise on the day.

The FTSE, DAX and CAC are down 0.7%, 1.9% and 0.2% respectively but US futures are showing tentative gains.

There were further signs of stagflation in the UK as manufacturing unexpectedly fell in June and the trade gap widened. This is further evidence that the economic recovery is faltering in the UK and QE has not worked.

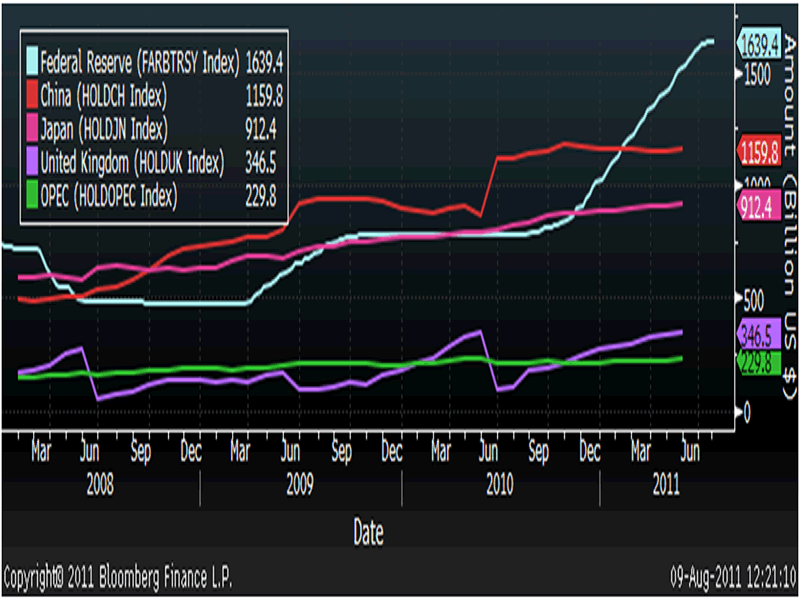

US Major Debt Holders

U.S. Treasuries dropped, pushing 10-year note yields up from the lowest level since January 2009, on speculation the Federal Reserve may introduce new stimulus measures today to boost financial confidence.

More ‘stimulus’, QE3 or whatever new fangled acronym is dreamed up by desperate policymakers will of course be bullish for gold and silver.

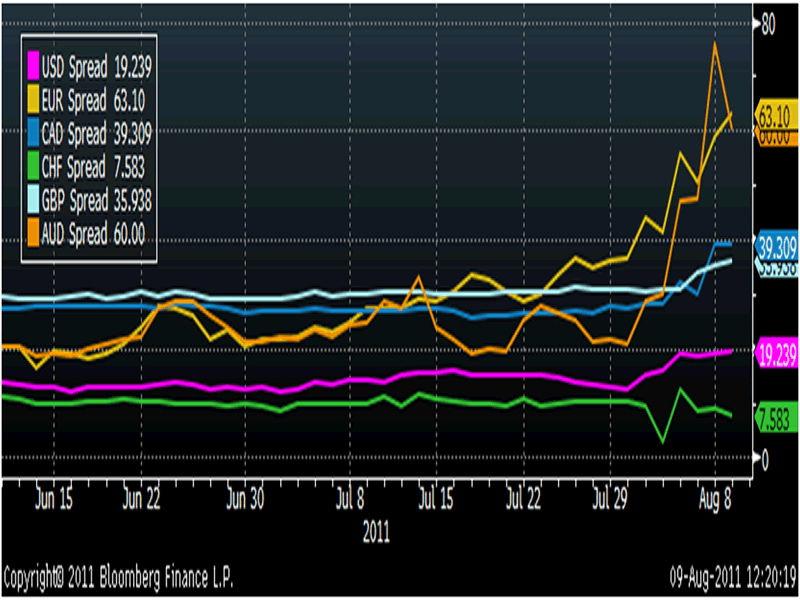

Libor-OIS

J.P. Morgan Chase & Co. (JPM) and Goldman Sachs Group (GS), raised their gold-price late yesterday.

J.P. Morgan now sees gold prices at $2,500 a troy ounce by year-end, while Goldman expects gold at $1,730 in six months and $1,900 in 12 months.

This may be a sign that the current sharp rally may have reached its zenith as neither bank has a great track record regarding short term trading calls on commodity markets.

In the short term there is the risk of a correction as gold’s rise is now becoming front page (on front page of FT today) and headline news.

The fact that silver has fallen in recent days and remains below $40/oz and the fact that gold mining equities have also not risen may also be a warning signal.

Gold has risen from below $1,500/oz to nearly $1,800/oz in 5 weeks (since the start of July) and is up nearly 18% in dollar terms.

Therefore, in conventional terms gold is most certainly overbought.

However, we are not living in conventional or normal times and the ongoing global market crash and global currency debasement means that there is a chance that gold will go parabolic as it did in the 1970’s.

Investors would be prudent to continue to make the trend their friend and any pullback should be used to buy the dip.

Those wishing to take profits might do so after two days of lower prices or a weekly lower close. However, given the level or market, systemic and monetary risk, all investors are advised to maintain a core financial insurance precious metals holding.

Gold’s bull market looks very secure for the foreseeable future due to strong institutional demand (from astute hedge funds and central banks) and store of wealth demand from Asia.

As does silver’s due to increasing investment and safe haven demand and the continuing growth in industrial demand for the versatile precious metal.

SILVER

Silver is trading at $38.14/oz, €26.73/oz and £23.29/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,722.00/oz, palladium at $732/oz and rhodium at $1,800/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.