JP Morgan Sees Gold At $2,500 By Year End

Commodities / Gold and Silver 2011 Aug 09, 2011 - 05:06 AM GMTBy: Bob_Kirtley

Apologies for whizzing you around to all the corners of the web but we thought that this post would be of interest to you, it can be found on zerohedge, which in our humble opinion is well worth a visit when you can find the time.

We though we had seen it all… Then JPM’s Colin Fenton came out with a prediction of gold hitting $2500 by year end. That’s right: JP Morgan… $2500….”Gold and sugar have potential to run a lot higher. It has been clear for weeks that the prompt CMX gold price has been building in a rising probability of a reflaring of financial crisis, gaining by 9.7% since June 30 as the MSCI World Equity index dropped by 10.1%. The correlation in daily price changes between these two assets has dropped to –0.09 from +0.29 over the prior year. Gold’s correlation against TIPS has doubled to 0.35 from 0.18. Against Italian and Spanish 5-year sovereign CDS prices, the gold correlation has moved to 0.27 and 0.32, from 0.07 and 0.04, respectively.Before the downgrade, our view was that cash gold could average $1800 per oz by year end. This view will likely now prove to be too conservative: spot gold could drive to $2500 per oz or higher, albeit on very high volatility.” Funny, when discussing yesterday’s Goldman upgrade of gold we said: “Next up: everyone else.” Little did we know… Also, it is unclear if Blythe precleared this client note. But at this point it probably does not matter.

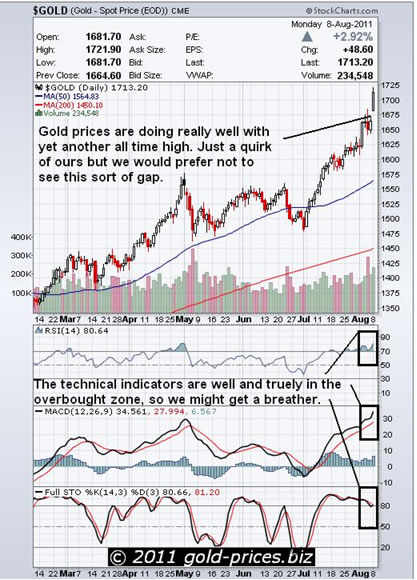

We though we had seen it all… Then JPM’s Colin Fenton came out with a prediction of gold hitting $2500 by year end. That’s right: JP Morgan… $2500….”Gold and sugar have potential to run a lot higher. It has been clear for weeks that the prompt CMX gold price has been building in a rising probability of a reflaring of financial crisis, gaining by 9.7% since June 30 as the MSCI World Equity index dropped by 10.1%. The correlation in daily price changes between these two assets has dropped to –0.09 from +0.29 over the prior year. Gold’s correlation against TIPS has doubled to 0.35 from 0.18. Against Italian and Spanish 5-year sovereign CDS prices, the gold correlation has moved to 0.27 and 0.32, from 0.07 and 0.04, respectively.Before the downgrade, our view was that cash gold could average $1800 per oz by year end. This view will likely now prove to be too conservative: spot gold could drive to $2500 per oz or higher, albeit on very high volatility.” Funny, when discussing yesterday’s Goldman upgrade of gold we said: “Next up: everyone else.” Little did we know… Also, it is unclear if Blythe precleared this client note. But at this point it probably does not matter.Taking a quick look at the chart we can see that gold prices are doing really well with yet another all time high. Just a quirk of ours but we would prefer not to see this sort of gap appearing on any chart as prices jump higher, as there tends to come a time when gold back tracks to fill the gap, but its just an observation. The technical indicators are firmly in the sell zone with the RSI standing at 80.64 and usually when the RSI pops up above the ‘70′ level that usually signals that we just might be in for a breather.

However, the world is in turmoil and as we have tried to point out, gold, as always, remains the safest haven on them all, so do try to acquire some of the physical metal and keep it in your hands, outwith the banking system.

When you have acquired both physical gold and silver you may want to acquire some of the quality producers, however, they appear to be temporarily out of favour and don’t offer the leveraged return that they did in the early part of this bull market. Our solution to finding leverage on these two precious metals is to make use of the ETFs, both GLD and SLV as vehicles for options trades. Options trading offers the possibility of handsome returns providing you get the timing right, however, the losses can mount quickly if you position yourself on the wrong side of the trade. As with any good investment decision timing is crucial to the success of your trade, whether it be in the options market or in your acquisition strategy as you build up your core position in this, the most exciting sector of the market. This is our mantra and it has been the same for many years now and we doubt that it is going to change in the next few years as we are of the opinion that both gold and silver will enter a parabolic phase and go exponential with mind boggling all time highs being made.

Looking a little further down the line we have to reiterate that the financial crisis is not behind us, it is ahead of us. The worst is not over, it is yet to come. For those who hang onto the fiat currencies things are going to become more expensive as each day passes, as inflation firstly takes hold and then becomes rampant. For those who hold gold and silver, prices are becoming cheaper as both these metals buy dramatically more than they use to and they will continue to do so. So, get your head out of your day job and draw up your very own ‘acquisition’ plan and implement it as quickly as you possibly can.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.