Gold and Silver Break Higher As ECB to Accelerate Euro Debasement

Commodities / Gold and Silver 2011 Aug 08, 2011 - 02:43 PM GMTBy: GoldCore

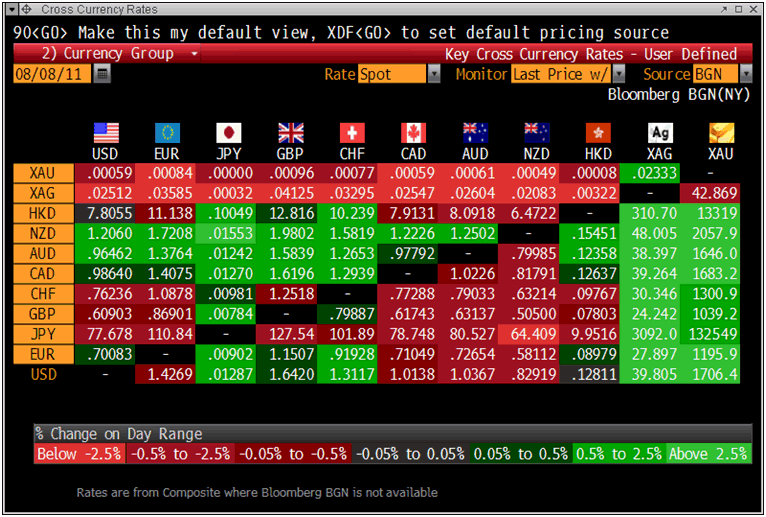

Gold in USD terms is 2.5% higher after the weekend U.S. downgrade and is higher against all currencies and trading at USD 1,706.40 , EUR 1,195.90 , GBP 1,039.20, CHF 1,039.20 per ounce and 132,549.00 JPY. Gold’s London AM fix was USD 1,709.75, EUR 1195.21, GBP 1,040.94.

Gold in USD terms is 2.5% higher after the weekend U.S. downgrade and is higher against all currencies and trading at USD 1,706.40 , EUR 1,195.90 , GBP 1,039.20, CHF 1,039.20 per ounce and 132,549.00 JPY. Gold’s London AM fix was USD 1,709.75, EUR 1195.21, GBP 1,040.94.

Cross Currency Rates

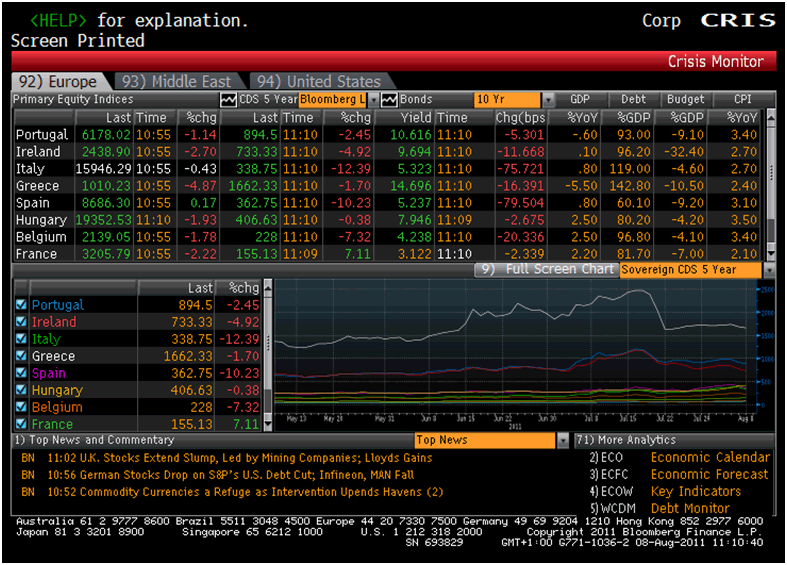

There has been massive intervention by the ECB in the Spanish and Italian bond markets. 10 year yields have plummeted by more than 12% from above 6% to 5.27% and 5.34% respectively.

Other peripheral bond markets have fallen but Portuguese and Irish yields are only slightly lower. 5 year CDS have also fallen sharply for Spanish and Italian debt but falls in other markets were slighter and the cost to ensure French debt increased by 7 basis points.

There is increasing talk of a French downgrade and some are wondering why the UK has not been downgraded.

Gold is up 2.6% in euro terms to nearly EUR 1,200/oz which is not a ringing endorsement of the ECB’s intervention.

Non debase-able silver has surged nearly 4% and is back just below $40/oz.

European Bond Market Monitor

It is quite possible that there was also intervention in equity markets as well as European indices fell sharply on the open prior to sharp reversals and going positive early morning. If there was intervention (by Working Group on Financial Markets or the ‘Plunge Protection Team’) in equity markets they were futile as equities have resumed their downward trend.

The FTSE, DAX and CAC are down 1.9%, 2.9% and 2.5% respectively and US futures are showing 2% to 3% losses.

Is this intervention another short term panacea in a long line of short term panaceas?

It certainly looks like it. Piling more debt on top of already humungous debt levels will prolong and likely deepen the global debt crisis.

It makes contagion more likely as the balance sheet of the ECB is now being infected by the peripheral European countries.

The electronic creation of hundreds of billions of euros to bail out bankrupt countries is currency debasement which has a long history of not working out to well.

What is needed is debt forgiveness and debt restructuring and a gradual deleveraging and downsizing of the balance sheets in the banking sector and financial system. Taxpayers should not be further burdened. This is unjust and will inevitably prolong and delay a recovery.

Those with little or no knowledge of financial, economic and most importantly monetary history continue to warn that gold is or may be a bubble. They should be urging diversification but alas do not understand diversification or gold.

They focus exclusively on the nominal dollar price and fail to consider the price in euros and other fiat currencies.

XAU-EUR Exchange Rate

They do not adjust for the significant inflation of the last 31 years. Gold’s real record high in 1980 was $2,400/oz.

They do not compare gold’s price performance in last 10 years with that of its last bull market in 1970’s.

Considering gold purely in terms of price is misguided anyway as what is more important is gold’s value.

Gold’s value is as a safe haven asset that cannot go bankrupt, as financial insurance and as a store of value.

Many today know the price of everything and the value of nothing. This is especially the case with gold.

SILVER

Silver is trading at $39.85/oz, €27.91/oz and £24.28/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,723.00/oz, palladium at $737/oz and rhodium at $1,825/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.