How The Smart Money Handles a Debt Downgrade

Stock-Markets / Stock Markets 2011 Aug 08, 2011 - 03:53 AM GMTBy: David_Grandey

These are the times where the smart money makes their money!

These are the times where the smart money makes their money!

Here’s our take on the markets and what could happen Monday:

As we’re sure you all already know S&P downgraded the US to AA+ from AAA. And of course the repercussions are being heard all over the media and the net. More hype folks more hype.

We say GOOD! It’s about time someone pulled Washington over for speeding. Of course the AAA to AA+ is the equivalent of a warning to slow down. A lot of people are talking about how it was bad form to release the news after the close Friday into a weekend considering what the bulk of us all went through (we get that) and all but we see it differently. We say GOOD because can you imagine if they did it during market hours in a highly nervous market?

This way they accomplish two things. One is it allows for maximum impact over the whole weekend which we like because it’s really the perfect time to wake Washington up! People are glued (out of fear) to the TV about all the goings on in Washington and the markets.

It brings the issue of WASHINGTON GET YOUR ACT TOGETHER front and center. We pray they got the message!

The second thing it allows for is cooler heads to prevail and sort the impact it may or may not have come Monday morning.

Speaking of accomplishing, believe it or not last week was positive in the sense that we got a lot of pressure relieved over the last week that has been hanging over the markets the past few weeks. Let us explain:

•We had the debt ceiling pressure issue - relieved

•We had the jobs report pressure issue- relieved

•We had the ECB issue about buying PIIGs debt- relieved

•NOW we just relieved the S&P downgrade pressure issue.

So now that we have all the fears answered and relieved?

The downgrade is just a downgrade of quality. Albeit it seems a lot is also directed at the politics involved and to that we whole heartedly agree. We disagree that a big part of that was the basis for the downgrade but applaud them for bringing it front and center to mainstream America in a major way.

Sure it’s a bit of an issue however it changes nothing. The US doesn’t have a default issue — it has a WASHINGTON SPENDING ISSUE and political issue if anything it’s another wake up call to WASHINGTON to get its act together once and for all. Time to take off the gloves boys once and for all and play nice.

Now to those of you who are thinking or rather FEARING the open you are fearing A MOMENT IN TIME subject to the next moment in time. Could we get a knee jerk open? Of course, in fact we’d expect it. So if that happens what are you going to do sell AFTER THE GAP DOWN? AFTER THE OPENING DAMAGE has already been priced in? Or are you going to let the dust settle and think forward and let a cooler head prevail. You can choose to fear or you can choose to use it as an opportunity.

We mean think about this (and it’s very important) just who are you going to sell to AFTER the markets have been selling off the last 10-12 days? Nellie? We doubt it. Just remember for every seller there has to be a buyer and after all Wall St. Buys Fear And Sells Greed.

Should we get a knee jerk open and honestly the only reason we see for that is the nervous money over the weekend who will do anything they can to stop that unsettled feeling of fear which usually ends up being the wrong decision that they only find out AFTER the fact days later.

For us, it’s an opportunity to buy two kingpin stocks — they are the first stocks the market will run to once the market wants to move up.

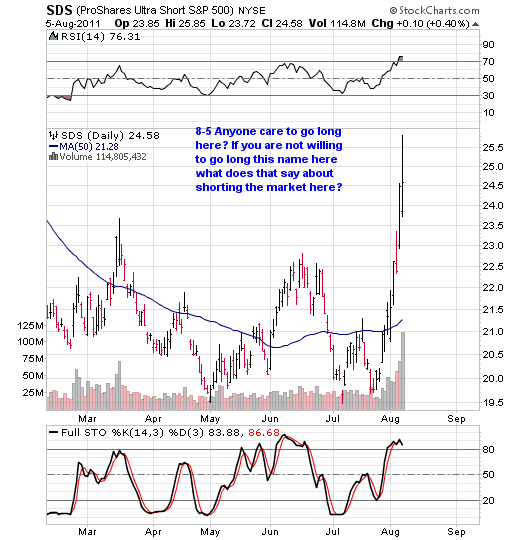

In Friday’s mid-day update to our paying subscribers we highlighted a chart of SDS as an example of just how extended the short side of the market is here via inverse ETFs. This chart is telling us that the short side is currently the wrong side to be establishing new positions in at this moment in time. To do so is being impulsive and if it’s too late to establish new positions on the short side? Well you know where we are going with this.

Any takers? Anyone interested in buying this chart? If there is one thing we’ve tried to instill in you it is to NOT chase buses.

What does this all tell you about the short side of the market here folks?

It says stay away! You are chasing a bus.

On to the indexes

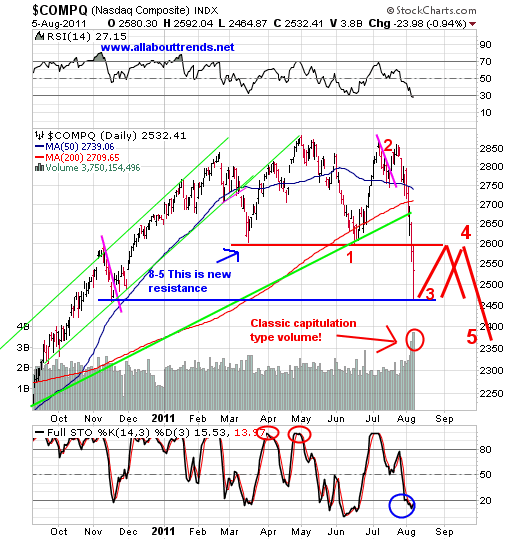

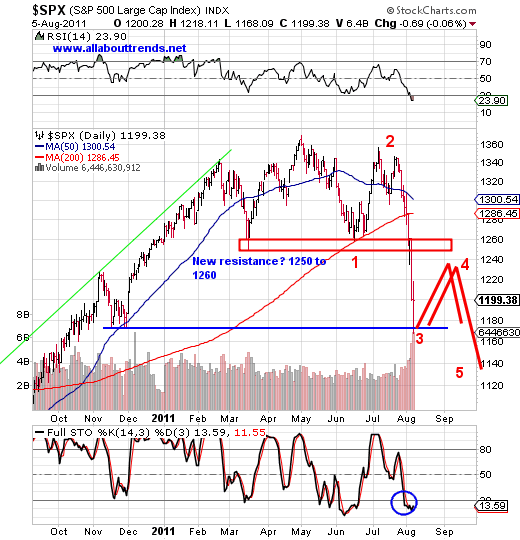

There is an old saying in Wave land for those who follow that style.

If it looks like a Wave 3, ACTS like a Wave 3 chances are it’s a Wave 3.

Wave 3′s are coined as wonders to behold, they are the strongest and wickedest depending upon which side you are on. A chief characteristic emotionally is that they are big time impulsive in nature (shoot first ask questions later).

It doesn’t take a rocket scientist to see that this current swing down has all of those characteristics. In fact from a psychological standpoint, lows of this wave typically correspond with a big fearful event and we just got one in the downgrade. Good we say because more often than not lows occur with panic selling and psychological throwing in of the towel. We saw that last week and MAY see it at the open. We sure hope so (a gap down that is). Why do we want to see the market get slammed at the open? So we can step in in the face of fear and pick a few things off and see capitulation take place in the weak emotional holders. If you see it, welcome it DON’T FEAR IT! (Nervous Nellie’s need not apply). By the end of the day it would not surprise me to see it end up being a reversal day. Surely by the end of the week.

Then once we get that out of the way (A capitulation open)? It’s bring on the wave 4 bounce up to red line resistance for those of you who don’t get Elliott.

Bigger picture, in all likelihood based upon what we are seeing here odds favor the market truly topped. It’s going to take a lot of horsepower over the coming months to repair this. The alternative count is that this whole 123 is just a big abc pullback wave 4 in an ongoing 5 waves up on a longer term chart of this cyclical bull. IF that is the case then that says a retest of the highs if not new highs for the 5th wave up. We doubt it but nothing surprises us anymore. We’ll see.

Now before you REACT (What do we preach about reacting around here? DON’T DO IT) to the statement of “In all likelihood the market has topped” Keep in mind that those 123 waves down showing sequence when all said and done should be a five waves down affair (assuming we actually did top mind you). As you can see we’ve got 3 waves showing with wave 4 and 5 yet to show up. We’ve included what those look like in the charts if they were to occur from here.

The alternative count says we are done or near done going down by the way, so that count says up is the next sequence too. But whether it’s a wave 4 bounce we are on the verge of or a full blown here we go to the upside doesn’t matter as both counts say up soon. Hang on to your hats as this is going to be fun over the next few months and all filled with big opportunities to make money especially if your name is Jack and you can be nimble and quick.

In Summary:

1. Let the opening dust settle Monday a.m., pray we get capitulation

2. Look to buy common stock and calls on two market kingpin stocks presuming they open at or near their 50-days or some other area of support, or just plain get slammed at the open.

3. Look for a snap back rally in the markets up to the new areas of resistance we’ve outlined and AT THAT POINT, we’ll begin to initiate short-sell positions in stocks on the short-sell watch list for our paying subscribers.

For us — it’s all about taking advantage of the early selling Monday to secure gains in two leading stocks. What we aren’t going to do is break down and sell into fear. Especially AFTER the market has already been pummelled and the inverse ETF’s are in chasing a bus mode here. If we gap down you already know your in for more emotional pain (For those stuck living in the moment of FEAR and can’t see past they’re fears) so why look at it, you need to move your mindset to where to from here and we just gave you the road map. Remember Wall Street buys fear. If we get sold off at the open think “Now that we got that out of the way” Folks you gotta think forward and positive

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2011 Copyright David Grandey- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.