Agri-Foods Price Correction Breeds Investor Opportunities

Commodities / Agricultural Commodities Aug 07, 2011 - 06:18 AM GMTBy: Ned_W_Schmidt

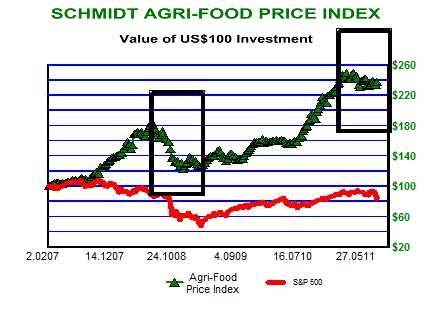

Time is an important component of both healing and financial corrections. Some times, it just takes time. To date, the correction in Agri-Food prices, as shown by the index in the chart below, has been modest. The Agri-Food Price Index has declined less than 7% from the high to the recent low. That would be considered modest by most.

Time is an important component of both healing and financial corrections. Some times, it just takes time. To date, the correction in Agri-Food prices, as shown by the index in the chart below, has been modest. The Agri-Food Price Index has declined less than 7% from the high to the recent low. That would be considered modest by most.

The duration of the current correction is about 26 weeks. The time dimension may be more important than the depth dimension this cycle. The two rectangles in the chart above are identical. For that reason, they envelop the same time range. They have been positioned as best can be at the top in each of the two cycles portrayed. That rather simplistic analysis would suggest that the end of the Agri-Food price consolidation is rather close.

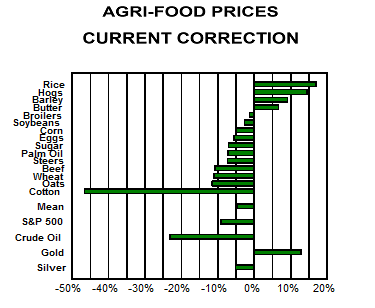

However, like all corrections, or bull markets, considerable divergence can occur between the various sectors of a market. Bottom chart to the right portrays the action during this correction of a good sample of commodity prices, both Agri-Food and others. Rice and hogs continue to be the strongest two Agri-Food prices. At the other end of the spectrum, cotton has crashed and wheat seems far from shortage this year. Interesting to note is that the pound of butter in your refrigerator has been a better investment than Silver. Beef prices are down because ranchers have been liquidating herds due to the drought. Growing grass without rain is tough.

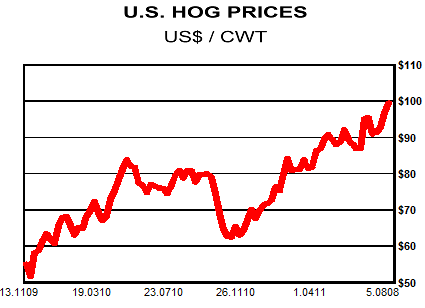

Last we visited on this topic we talked about hogs. Since that time hogs continue to be a hot topic. Demand remains strong, particularly from China. China is apparently importing pork to hold down prices. Some indications they are having success with their approach to constraining Agri-Food prices. We do not suggest that one should sell Silver and buy hogs, though that would have been an excellent idea at one point. Rather, high and rising prices do eventually set up conditions for weaker prices in the future.

In the mean time, hog and pork producers should experience a good environment as the above picture is one of demand pulling prices higher. Consumer demand for pork is pulling that price higher which translates into hog prices being pulled higher. At the same time grain prices are moderating. Pork is not made in a factory, but produced by feeding hogs grain. This combination of developments should benefit hog and pork producers through the remainder of this year and into the next. Agri-Equities to review include, but are not limited to, FEED, SFD, and HOGS.

Consolidations such as now being experienced by Agri-Food prices provide an opportunity for investors due to the longer term nature of the Agri-Food Super Cycle. Often mentioned is that China is attempting to feed 21% of the world's population with 7% of the world's arable land. However, ignored is that India is attempting to feed 17% of the world's population with a mere 2% of the world's arable land. The only chance of success in feeding their populations is by raising incomes so that their consumers can buy the Agri-Foods in world markets. As both are in Asia, the most logical choices for investors are Asian Agri-Equities.

By Ned W Schmidt CFA, CEBS

AGRI-FOOD THOUGHTS is from Ned W. Schmidt,CFA,CEBS, publisher of The Agri-Food Value View, a monthly exploration of the Agri-Food grand cycle being created by China, India, and Eco-energy. To contract Ned or to learn more, use this link: www.agrifoodvalueview.com.

Copyright © 2010 Ned W. Schmidt - All Rights Reserved

Ned W Schmidt Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.