Debt Issues Put a Ceiling on Stocks and a Floor Under Gold

Stock-Markets / Financial Markets 2011 Aug 04, 2011 - 10:31 AM GMTBy: Joseph_Russo

When politicians, monetary authorities, and other talking-heads refer to dire consequences for "the economy" unless XYZ legislation is passed, I can't help but think that what they are really talking about are dire consequences for stock prices.

When politicians, monetary authorities, and other talking-heads refer to dire consequences for "the economy" unless XYZ legislation is passed, I can't help but think that what they are really talking about are dire consequences for stock prices.

Although their last dance-on-the-ceiling failed in this regard, bailing out an insolvent financial system, QE1, QE2, and perhaps some stealth form of QE3, are all clear efforts to keep stock prices artificially inflated.

It seems to me as though most of these status-quo cheerleaders truly believe that the stock market IS the economy. In my view, there could be nothing further from the truth. In fact, I believe that this egregiously false paradigm is what gives the financial sphere all of the power it needs to usurp-and-affect rather than to mirror-and-reflect what goes on in the real economy.

The intractable debt and deficits created over the past 30-years are finally catching up to the band of academic thieves who have collectively robbed the economy from its citizenry and placed it in the hands of the Wall Street/Government cartel.

You bet Egyptians are both stunned and relieved to see their tyrannical dictator Mubarak on trial just as many Americans would be to see Greenspan, Rubin, Summers, Bernanke, along with half of Wall Street and Washington on trial for crimes against the economy.

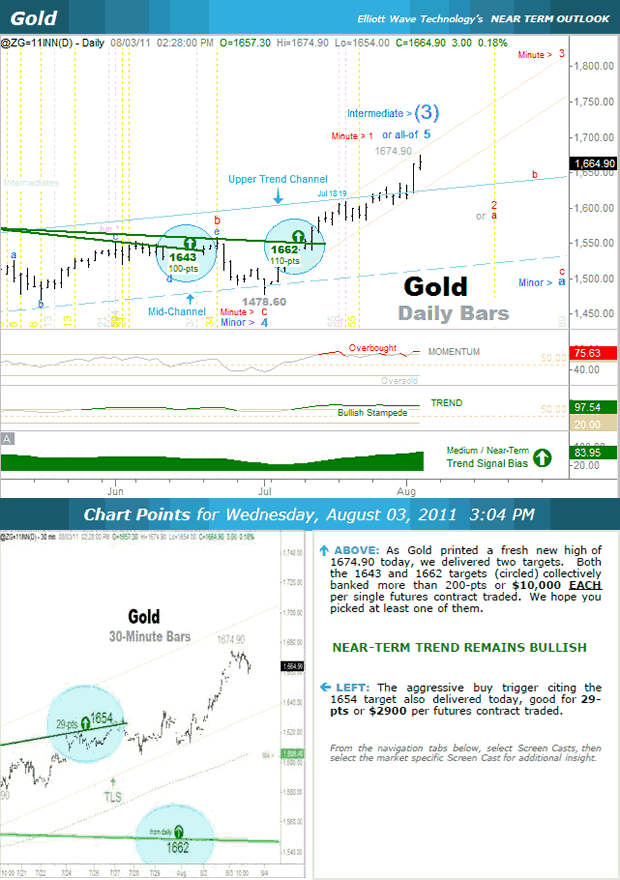

Having said that, it should come as no surprise that the infamous QE1, and QE2 "stock-market-bailout-rally" has bumped into a rather stubborn ceiling. Meanwhile, a one-thousand-mile-deep concrete floor has already cured under the price of Gold.

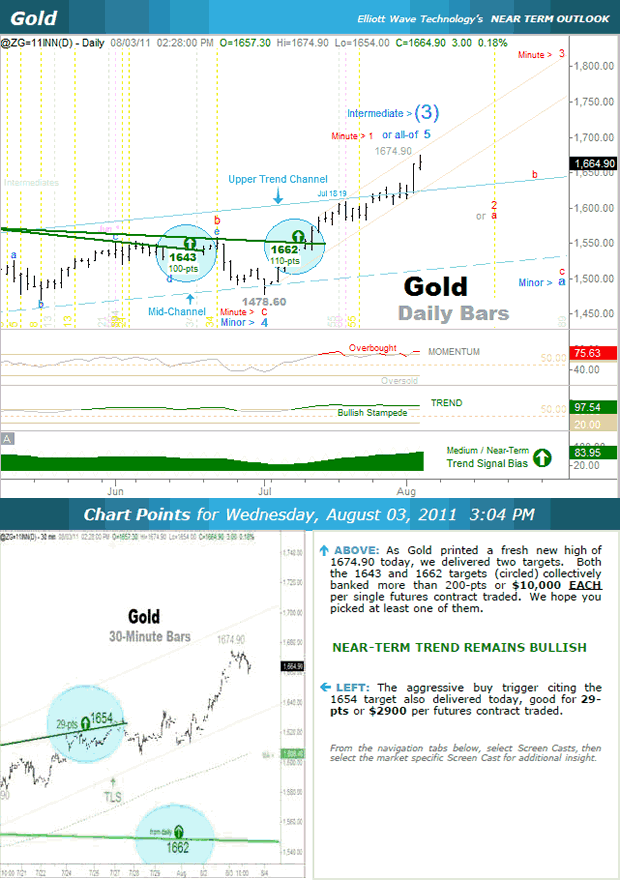

Relative to the recent price action in both Gold and the S&P, today's chart-points speak for themselves.

On days like today, it truly pays handsomely to be able to understand the proper context in which markets trade. Oh, what a feeling, - when we're Dancin'-On-The-Ceiling.

There truly is nothing quite as empowering than to acquire a razor sharp focus on what the charts are saying and then profiting from them.

Unlike the majority of what you see and hear in the mass media, the charts somehow always manage to tell the truth.

Until next time,

Trade Better/Invest Smarter

By Joseph Russo

Chief Publisher and Technical Analyst

Elliott Wave Technology

Email Author

Copyright © 2011 Elliott Wave Technology. All Rights Reserved.

Joseph Russo, presently the Publisher and Chief Market analyst for Elliott Wave Technology, has been studying Elliott Wave Theory, and the Technical Analysis of Financial Markets since 1991 and currently maintains active member status in the "Market Technicians Association." Joe continues to expand his body of knowledge through the MTA's accredited CMT program.

Joseph Russo Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.