U.S. Economic Fundamentals Are More Important, Debt-Ceiling Deal is an Induced Necessity

Economics / US Economy Aug 02, 2011 - 03:27 AM GMTBy: Asha_Bangalore

On July 31, President Obama, Senator Reid, and House Speaker Boehner shook hands on a deal that will be voted on later today. The deal negotiated would lead to a total reduction of the budget deficit by $2.1 trillion during the 2012-2021 period. It also includes raising the debt ceiling between $2.1 trillion and $2.4 trillion by the final months of 2012. The timing and magnitude of the spending cuts as indicated in Table 3 of the latest scoring from the Congressional Budget Office (CBO's assessment of new legislation)point to discretionary spending cuts in the entire 2012-2021 period. Lower federal government outlays in 2012 in a fragile economic environment are a setback to economic growth.

On July 31, President Obama, Senator Reid, and House Speaker Boehner shook hands on a deal that will be voted on later today. The deal negotiated would lead to a total reduction of the budget deficit by $2.1 trillion during the 2012-2021 period. It also includes raising the debt ceiling between $2.1 trillion and $2.4 trillion by the final months of 2012. The timing and magnitude of the spending cuts as indicated in Table 3 of the latest scoring from the Congressional Budget Office (CBO's assessment of new legislation)point to discretionary spending cuts in the entire 2012-2021 period. Lower federal government outlays in 2012 in a fragile economic environment are a setback to economic growth.

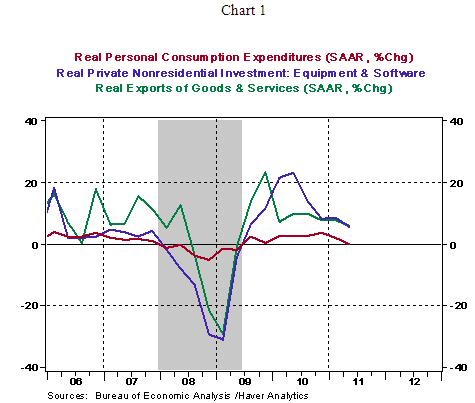

Real GDP grew at a less than 1.0% in the first-half of this year, consumer spending, exports, and equipment and software spending show a significant deceleration in the first six months of the year. Government spending -- federal and state and local government – has turned negative. In this weak environment, additional projected cutbacks in spending are a negative to real GDP growth. The latest ISM manufacturing survey results for July (see discussion below) suggests a weakening factory sector. The poor fiscal status of the United States needs to be addressed with a deft hand such as not to jeopardize the fragile economic recovery in place.

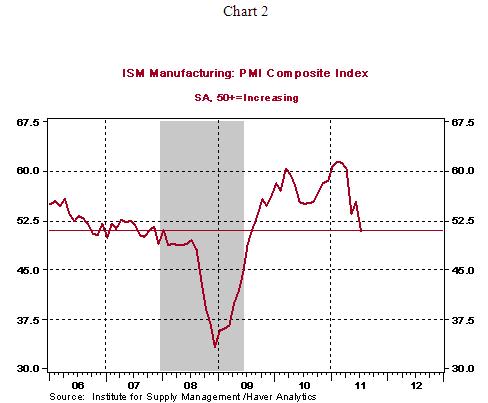

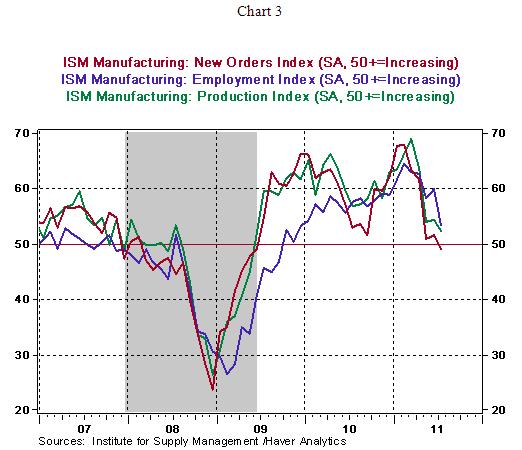

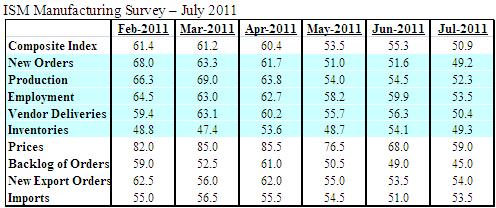

ISM Manufacturing Survey Points to Weakening Factory Sector

The composite index of the ISM manufacturing survey of the United States fell 4.4 points to 50.9 in July. Readings above 50.0 denote an expansion of activity and those below 50.0 signify a contraction. The July reading is the lowest in two years when the economy was pulling out of the recession.

The index tracking new orders declined to 49.2 in July from 51.6 in June, which is the most worrisome aspect of the report. The employment index also fell as did the index measuring production, but these indices are holding above the critical mark of 50.0 which denotes an expansion. The anemic GDP report of the second quarter on July 29 and the July ISM factory survey results this morning paint a picture of significantly weak economic conditions in the United States. Overseas, the Purchasing Managers Indexes (PMI) of China (50.7 vs. 50. In June), the Euro-area (50.4 vs. 52.0 in June), United Kingdom (49.1 from 51.4 from June), and India (53.6 from 55.3 in June) declined and suggest that the global factory sector stalled in July.

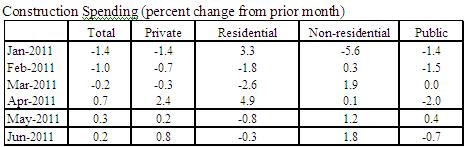

Construction Spending Lifted by Private Non-Residential Expenditures

Construction outlays moved up in June (+0.2%) after gains of 0.7% and 0.3%, respectively in April and May. The June increase was dominated by a 1.8% jump in non-residential construction improvement that was widespread – hotels, office, health care, commercial, educational, and factory. Residential and public sector construction spending posted declines in June.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.