A U.S. Sovereign Debt Downgrade Is No Laughing Matter for China or Anybody Else

Interest-Rates / Global Debt Crisis Jul 31, 2011 - 08:27 AM GMTBy: EconMatters

With a stalemate heading into the weekend, the debt drama of the United States is going down to the wire, and when the clock strikes twelve midnight on August 2 (countdown clock at our homepage), the world's largest economy could be looking at an unprecedented technical default. The current consensus suggests that although a total default is nothing but a remote possibility, the damage is already done to the dollar, and a sovereign debt downgrade could be inevitable even after the debt ceiling deadlock is resolved.

With a stalemate heading into the weekend, the debt drama of the United States is going down to the wire, and when the clock strikes twelve midnight on August 2 (countdown clock at our homepage), the world's largest economy could be looking at an unprecedented technical default. The current consensus suggests that although a total default is nothing but a remote possibility, the damage is already done to the dollar, and a sovereign debt downgrade could be inevitable even after the debt ceiling deadlock is resolved.

China, as the largest foreign holder of the U.S. debt, is totally freaking out. NPR reported that

"State Department officials now admit that China has been using diplomatic channels to express its concern. It has sent several official demarches urging Washington to abide by its financial commitments."

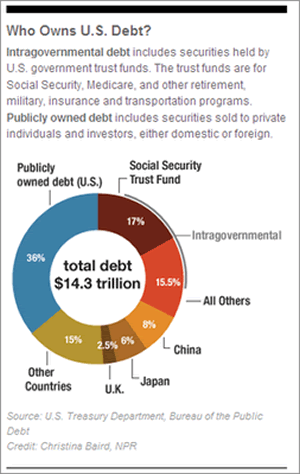

The Middle Kingdom has the world's largest foreign exchange reserve at about $3.2 trillion, which is mostly in US dollar holdings, and holds $1.16 trillion in U.S. debt, followed by Japan with $912.4 billion and the United Kingdom with $346.5 billion (See Chart)

|

| Chart Source: NPR.org |

Beijing has been trying to diversify away from the dollar in recent years; however, with its huge reserve size, the effort has not made much of a dent. So needless to say, the prospect of a U.S. default, and/or a sovereign credit downgrade has put China’s own wealth in a dire predicament.

On that note, I’m having a hard time making sense of the comment made by Sen. John Kerry, as reported by the Huffington post,

"The Chinese are laughing all the way to the bank,” said the former Democratic presidential nominee, because a downgrading of US Treasury securities will mean enormous and completely unnecessary increases in our interest payments to the nation’s largest creditor — and our most important competitor in the international arena."

The dollar (and the U.S. Treasurys), despite the long standingweak-dollar policy of the U.S., is nevertheless the world's top reserve currency on U.S. bond's deep market liquidity, and amid the ongoing euro debt crisis. Many U.S. debt holders and central banks, including China, basically have no choice but to keep buying Treasurys supporting the dollar, or they will see their own wealth dwindling along for the 'Dollar Dipping Ride'. In other words, most of the U.S. debt holders are in essence the "enablers" of the U.S. debt and spending binges.

For now, I’d give Sen. Kerry benefit of the doubt that his remark was meant to

1) Mock China knowing Beijing has very few alternatives. Actually, Chinese wealth only buys 8% of the total U.S. debt, whereas over 50% of Uncle Sam's debt is owed to the private investors, American as well as international. (See Chart). So if Sen. Kerry is mocking China, he is also mocking the American taxpayers, and many of the nation's trading partners, not to mention the loss of purchasing power, the inflationary effect, and higher interest rates that a weak dollar and a sovereign credit downgrade would bring.

2) Divert and downplay this self-inflicted crisis and the incompetency of this government. Spin-control seems a bit late at this hour.

And there's always the call-it-as-you-see it 3) Kerry does not understand the cause and effect of global credit and currency markets. This would be far more dangerous considering his current position as the head of the Senate Foreign Relations Committee, and once a Democratic presidential nominee.

Regardless, if the United States really goes into a technical default, and/or receive a sovereign credit downgrade, expect serious sell-off's in commodities such as crude oil, copper, agriculture, and equities tripping multiple exchanges' circuit breakers. Gold, more so than silver, would benefit on the flight to safety. But Treasury would also get a boost (No, this is not one of my typo's.)

As I noted before, fundamentally the U.S. has no immediate liquidity issue, and on the fact that this 'crisis' is self-induced, when a near world-ending event such as a U.S. credit downgrade occurs, people would still go into U.S. Treasury as the safe haven ('the dog' with less fleas).

So a dollar rout is unlikely whereas a rew round of Euro rout could be in the cards if some more bad news erupt in the Euro Zone. And unfortunately, PIMCO's Bill Gross would have to wait just a little longer to be the Roubini of the Bond Market.

However, if the U.S. Congress is short-sighted enough (which seems more and more likely), things could really hit the fan, then nothing would be immune to the rush to exit en masse. Cash is king while the big boys duke it out.

More importantly, I think this debt ceiling 'crisis' really has shed a spotlight on the nation's government and its leadership. That seems to be the more imminent clear and present danger than any fiscal or debt problems the U.S. has right now.

By EconMatters

The theory of quantum mechanics and Einstein’s theory of relativity (E=mc2) have taught us that matter (yin) and energy (yang) are inter-related and interdependent. This interconnectness of all things is the essense of the concept “yin-yang”, and Einstein’s fundamental equation: matter equals energy. The same theories may be applied to equities and commodity markets.

All things within the markets and macro-economy undergo constant change and transformation, and everything is interconnected. That’s why here at Economic Forecasts & Opinions, we focus on identifying the fundamental theories of cause and effect in the markets to help you achieve a great continuum of portfolio yin-yang equilibrium.

That's why, with a team of analysts, we at EconMatters focus on identifying the fundamental theories of cause and effect in the financial markets that matters to your portfolio.

© 2011 Copyright EconMatters - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.