U.S. Real GDP Revisions Indicate Economy Still in Recovery Phase

Economics / US Economy Jul 31, 2011 - 03:32 AM GMTBy: Asha_Bangalore

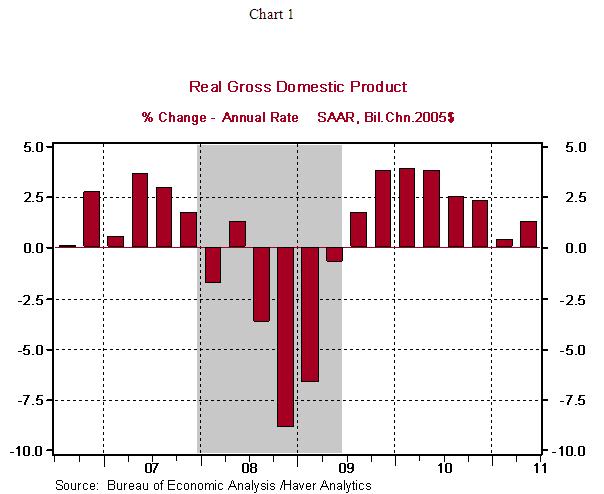

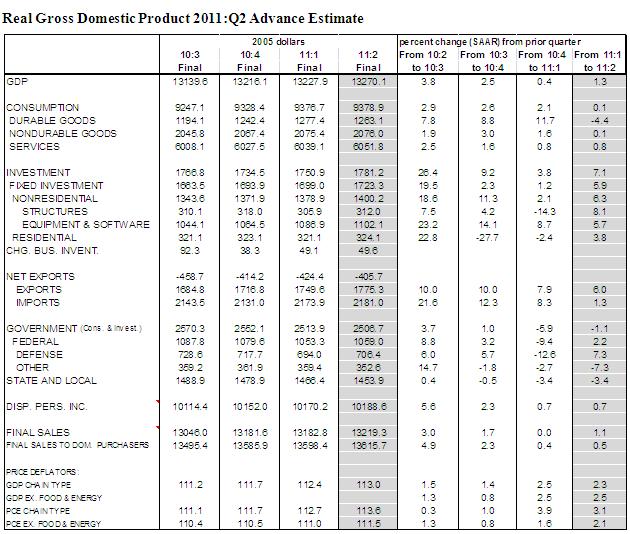

The U.S. economy grew at an annual rate of 1.3% in the second quarter after a downwardly revised 0.4% increase in the first quarter (previously estimated to have increased 1.9%). From a year ago, real GDP advanced only 1.6%, the smallest increase in the current recovery.

The U.S. economy grew at an annual rate of 1.3% in the second quarter after a downwardly revised 0.4% increase in the first quarter (previously estimated to have increased 1.9%). From a year ago, real GDP advanced only 1.6%, the smallest increase in the current recovery.

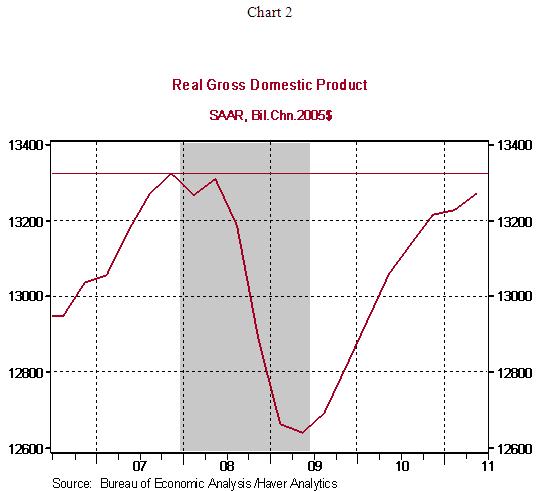

Annual benchmark revisions indicate that the Great Recession has recorded a deeper decline in real GDP (-5.1%) during 2007:Q4 to 2009:Q2 compared with the prior estimate (-4.1%). Revisions also point to the fact that the U.S. economy is still in the recovery phase (see Chart 2). Previous estimates had shown that the economy entered an expansionary phase in the first quarter of 2011.

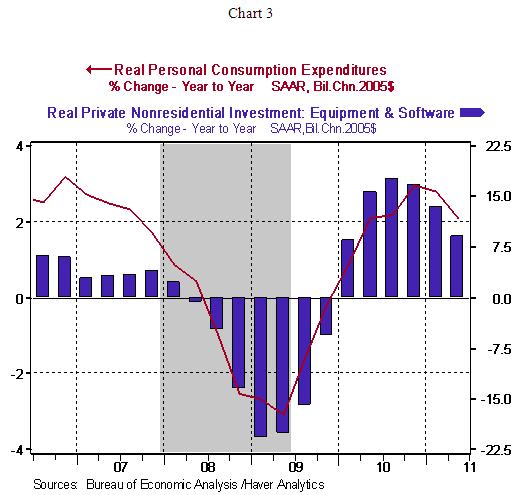

Consumer spending held nearly steady in the second quarter, equipment and software spending rose 5.7% in the same period. But, both of these components of real GDP show a slowing trend (see Chart 3).

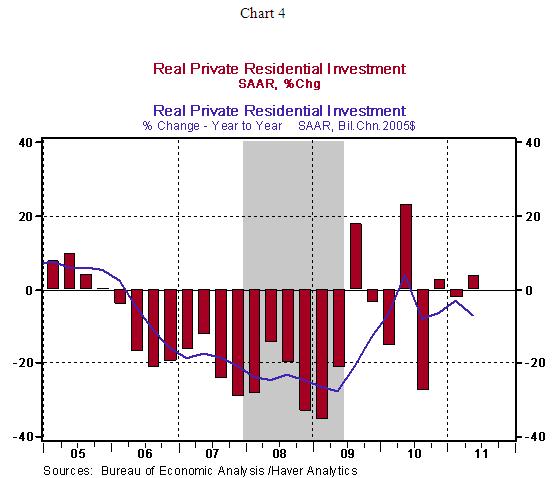

The 3.8% increase in residential investment expenditures was a surprise; however, on a year-to-year basis, residential investment outlays remain negative.

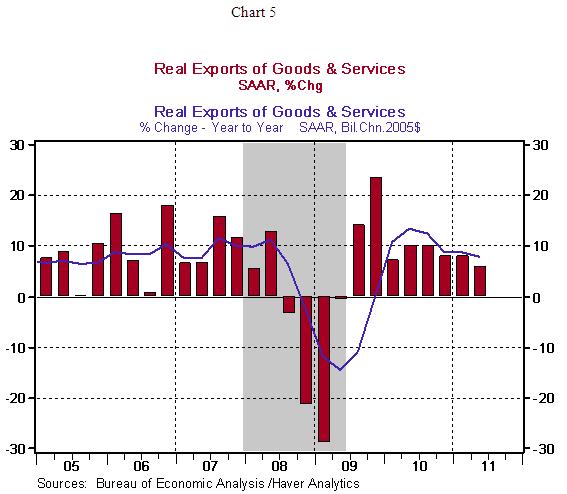

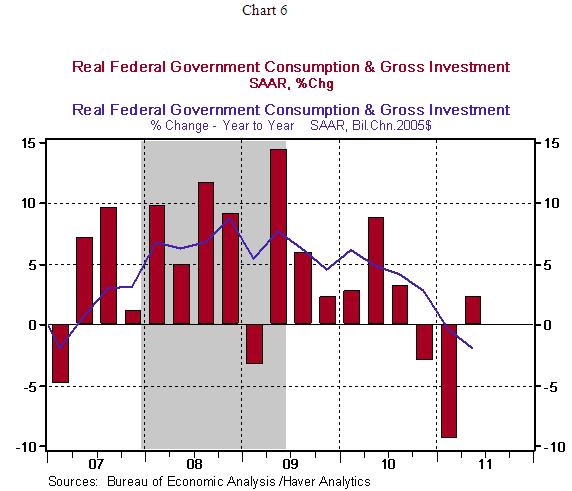

Exports rose at an annual rate of 6.0% in the first quarter, representing a slowing trend on a year ago basis. Federal government spending shows a sharp deceleration on a year basis (see Chart 6). Further cutbacks in federal government spending should translate into trimming headline real GDP growth in the quarters ahead after a soft patch in the first-half of 2011.

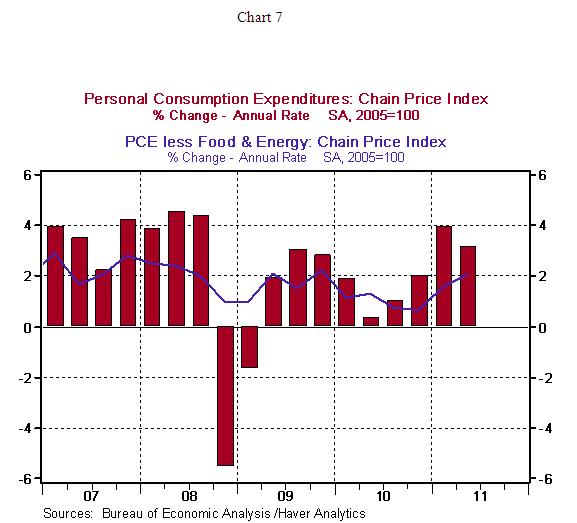

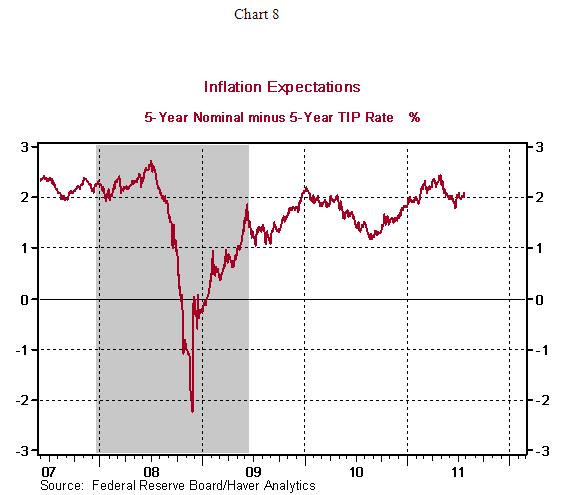

The overall GDP price index moved up at an annual rate of 2.3% in the second quarter vs. a 2.5% gain in the first three months of the year. The personal consumption price index, which the Fed tracks closely, increased 3.1% in the second quarter vs. 3.9% in the first quarter, reflecting the moderation in energy prices. The core personal consumption expenditure price index, which excludes food and energy, rose 2.1% in the second quarter vs. a 1.6% reading in the first quarter. This price measure is at the top of the Fed’s threshold of tolerance. Given projections of economic growth that are below potential in the second-half of 2011, inflation measures are predicted to show a moderating trend. Inflation expectations have moved up slightly in recent days (2.11% as of July 28, 2011, see Chart 8) but the level is still noticeably below the recent high of 2.45%. Inflation expectations are not indicative of impending inflationary pressures; thus, allowing the Fed to watch and wait.

The Fed is on hold in the near term, given that QE2 (quantitative easing) has been completed as of June 2011. Today’s second quarter GDP report and downward revisions of the prior quarters suggest that the economic recovery is fragile and the sub-par performance could require additional monetary policy support in the near term. Another round of quantitative easing by year-end is entirely conceivable if economic growth remains soft.

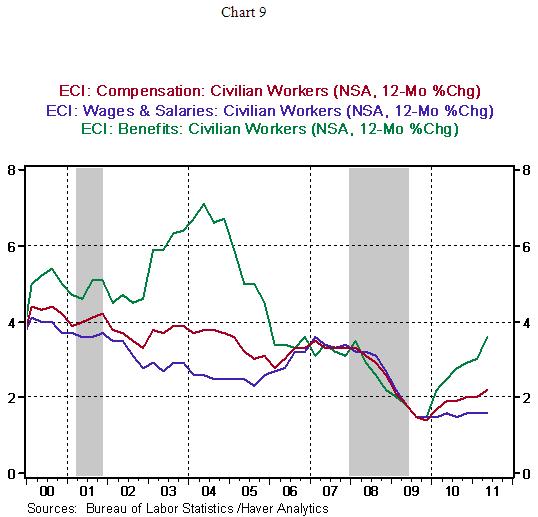

In In related news, the Employment Cost Index (ECI) rose 0.7% during the second quarter, matching the increase seen in the prior quarter. Benefit costs advanced 1.3% in the second quarter, after a 1.1% gain in the first quarter. Benefit costs have accelerated from a 2.5% increase in the second quarter of 2010 to a 3.6% jump in second quarter of 2011 (see Chart 9). Wages and salaries have held in the 1.5% - 1.6% range for almost two years (see Chart 9). Total employment costs have risen gradually over the past year to record a 2.2% year-to-year gain in the second quarter of 2011 compared with a 1.9% gain in the second quarter of 2010 (see Chart 9). The bottom line is that employment costs are not threatening inflationary pressures, for now. If the economy were to gather strong momentum during the second-half of the year, this contained employee cost scenario could change.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.