Is Congress Fiddling While Rome Burns?

Stock-Markets / Stock Markets 2011 Jul 29, 2011 - 01:54 PM GMTBy: Marty_Chenard

I'm starting to think this is ironic ...

The country is in debt and the Government's revenue cannot cover the current debt. In other words, the cash outflow is greater than the cash inflows, so we have a Liquidity Contraction situation.

What's ironic?

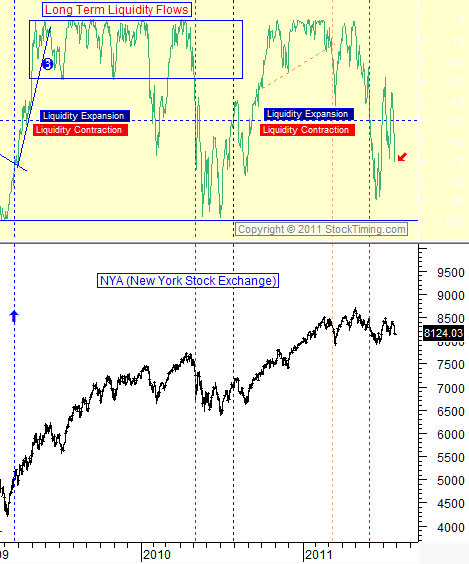

The ironic part is that the Stock Market now has its Long Term Liquidity flows in Contraction territory as you can see on today's chart (this chart is updated every day on our paid subscriber site).

Back in the 20's and 30's, it was Jesse Livermore who commented that the market was all about money ... Money flows in, and the market goes up ... Money flows out, and the market goes down.

So, it is one of the reasons we track money flows ... and Liquidity Levels are now in Mid-Contraction territory which is a dangerous place to be, and a place where Congress will be punished if they don't stop fiddling around.

FYI ... An interesting commentary from Wikipedia: "During his reign, Nero focused much of his attention on diplomacy, trade, and enhancing the cultural life of the empire... He is also infamously known as the emperor who "fiddled while Rome burned". Maybe Congress should stop fiddling around?

By Marty Chenard

http://www.stocktiming.com/

Please Note: We do not issue Buy or Sell timing recommendations on these Free daily update pages . I hope you understand, that in fairness, our Buy/Sell recommendations and advanced market Models are only available to our paid subscribers on a password required basis. Membership information

Marty Chenard is the Author and Teacher of two Seminar Courses on "Advanced Technical Analysis Investing", Mr. Chenard has been investing for over 30 years. In 2001 when the NASDAQ dropped 24.5%, his personal investment performance for the year was a gain of 57.428%. He is an Advanced Stock Market Technical Analyst that has developed his own proprietary analytical tools. As a result, he was out of the market two weeks before the 1987 Crash in the most recent Bear Market he faxed his Members in March 2000 telling them all to SELL. He is an advanced technical analyst and not an investment advisor, nor a securities broker.

Marty Chenard Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.