Bayonets and Gold

Commodities / Gold and Silver 2011 Jul 29, 2011 - 02:40 AM GMTBy: Richard_Mills

The history of fiat money has always been one of failure - every fiat currency since the Romans started diluting the silver content of their denarius has ended in devaluation and eventual collapse of both the currency and of that particular economy. Most paper money economies downfall can be linked to the costs of financing out of control military growth and its wars.

The history of fiat money has always been one of failure - every fiat currency since the Romans started diluting the silver content of their denarius has ended in devaluation and eventual collapse of both the currency and of that particular economy. Most paper money economies downfall can be linked to the costs of financing out of control military growth and its wars.

For the very first time in our history, all money, all currencies, are now fiat - the US dollar use to be gold backed and it was the rock all the worlds currencies were anchored to - when the US dollar became fiat, all the worlds currencies became fiat.

According to House Speaker John Boehner and Senate majority leader Harry Reid the budget compromise reached between the White House and Congress in April of this year included an "historic amount of cuts". President Obama gushed it was "the largest annual spending cut in our history".

Mainstream media called the cuts sweeping and across-the-board.

Unfortunately not a single penny of the spending cuts will come from the Pentagon's coffers.

Defense spending in 2011 is actually going to increase, by a reported $5 billion over 2010 levels to $513 billion. The $513B doesn't actually include the cost of ongoing overseas contingency operations, these would be the wars in Iraq and Afghanistan (the Fiscal Year budget requests for US military spending do not include combat figures which are supplemental requests that Congress approves separately) - if those costs were included U.S. military spending in 2011 will exceed $700 billion.

Also not included, even in the $700B, are nuclear weapons spending, black ops, interest on the defense portion of the debt and ongoing military obligations to veterans. The budget for nuclear weapons falls under the Department of Energy, other military expenses - care for veterans, health care, military training, aid and secret operations - are put under other departments or are accounted for separately.

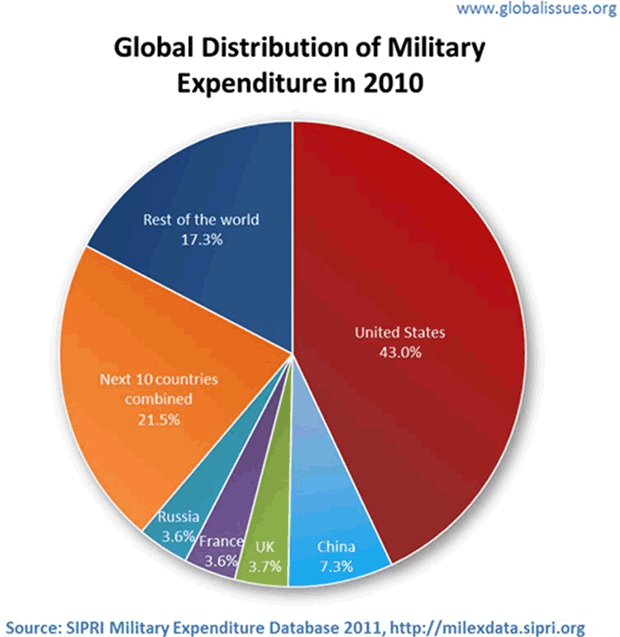

The US numbers are eye opening - they amount to more than half of all government discretionary spending and represent, at the very least, an astounding 43% of total military spending on the planet.

Neither Obama's 2012 budget proposal nor Representative Paul Ryan's "Path to Prosperity" signal a major decrease in military spending - Ryan's budget projection calls for nearly $8 trillion in military spending over the next decade.

"Of all the enemies to public liberty war is, perhaps, the most to be dreaded because it comprises and develops the germ of every other. War is the parent of armies; from these proceed debts and taxes ... known instruments for bringing the many under the domination of the few.... No nation could preserve its freedom in the midst of continual warfare." James Madison, Political Observations, 1795

The Chinese love their gold...

"Chinese appetite for gold has increased rapidly over the past few years. In March 2010, we predicted that gold demand in China would double by 2020, however, we believe that this doubling may in fact be achieved sooner. Increasing prosperity in the world's most populous country coupled with their high affinity for gold will serve to drive demand in the long-term. Near term inflationary expectations are likely to support the investment case for gold." Albert Cheng, Managing Director, Far East at the World Gold Council

So too do Indians...

"Gold demand in India, the world's largest user of the bullion, may increase to more than 1,200 metric tons by 2020 as economic growth boosts incomes and household savings. Indian households hold more than 18,000 tons of gold, the largest stockpile of bullion in the world. Gold purchases by India accounted for 32 percent of total global sales in 2010." World Gold Council

India's total demand exceeded China's by 383.5 tons in 2011. GFMS Ltd. and INTL FCStone said in March that Chinese consumption of gold may soon climb to rival that of India. Could it be that the Chinese, and Indians, long ago caught onto something we here in the west are just now slowly figuring out?

According to the World Gold Council investor demand for gold ownership - in the form of bars, coins and jewelry - is climbing, while at the same time production at existing mines is grinding down, re-cycled gold sales are dropping and central banks are increasingly gold buyers not sellers:

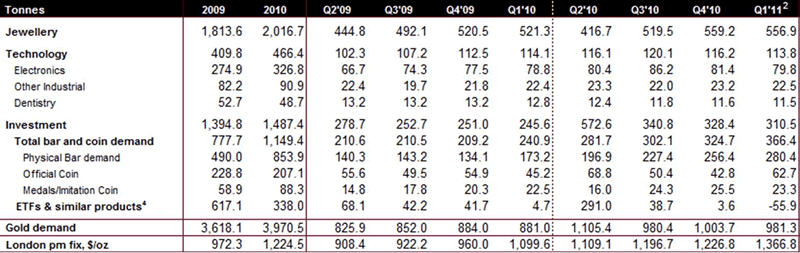

- Global gold demand in the first quarter of 2011 totaled 981.3 tonnes (US$43.7bn), up 11% year-on-year from 881.0 tonnes (US$31.4bn) in the first quarter of 2010. The increase was largely attributed to a widespread rise in demand for bars and coins and increased jewelry demand - demand for physical bars and coins was up 52% at 366.4 tonnes while jewelry demand in the first quarter of 2011 registered a gain of 7% year-on-year to reach 556.9 tonnes. India and China are the two largest markets for gold jewelry and together accounted for 349.1 tonnes of gold jewelry demand or 63% of the total - US$16bn. China's jewelry demand reached a new quarterly record of 142.9 tonnes, up 21%, from 118.2 tonnes

- In the first quarter of 2011 investment demand grew by 26% to 310.5 tonnes

- ETFs and other similar products witnessed net outflows of 56 tonnes (mostly concentrated in January). The collective volume of gold held by these products at the end of the quarter was still over 2,100 tonnes

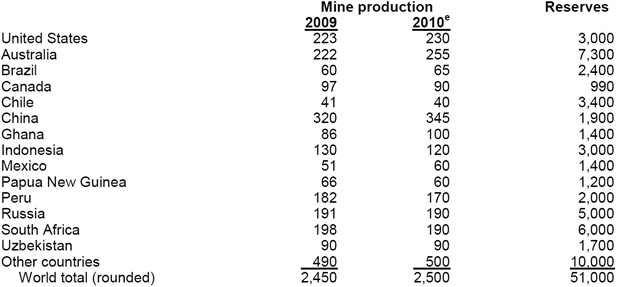

- In Q1 2011, gold supply declined by 4% year-on-year to 872.2 tonnes from 912.1 tonnes in the first quarter of 2010 - this against an increase in mine production of 44 tonnes (a growth rate of 7%)

- The decline in total supply was because of two reasons: firstly recycled gold was down 6% on year earlier levels to 347.5 tonnes from 369.3 tonnes and secondly a sharp increase in net purchasing by the official sector - central bank purchases jumped to 129 tonnes in the quarter, exceeding the combined total of net purchases during the first three quarters of 2010

ABN Amro Bank, VM Group and Haliburton Mineral Services recently published a report providing details on rising gold mining production costs. Cash costs include:

- Direct mining and processing expenses

- Other onsite charges

- Third party smelting and refining charges

- Royalties and taxes net of by-product credits

In the first quarter of 2011, the average cash cost of production rose from $609 oz to $620 oz.

While production costs were rising, so too were margins - from $758 oz to $767oz.

The Gold Demand Trends report for Q1 2011 states demand for gold will be driven by a number of key factors:

- Continued uncertainty over the US economy and the dollar

- Ongoing European sovereign debt concerns

- Global inflationary pressures

- Continued tensions in the Middle East and North Africa

- Chinese and Indian jewelry demand

- Net purchasing by central banks

Conclusion

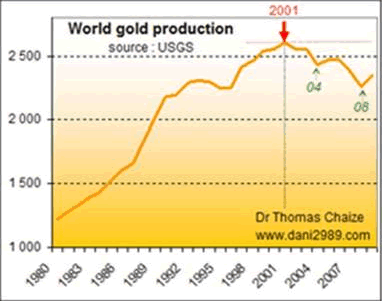

www.dani2989.com 2001 Gold Production Peak

If I was looking for superior investment vehicles to take advantage of what I think I know regarding the future for precious metals I'd be looking at junior producers, near term producers and companies that are in the post discovery resource definition stage with the occasional green field exploration play thrown into the mix.

I believe junior resource companies offer the greatest leverage to increased demand and rising prices for commodities. There is also a very real and increasing trend for Mergers and Acquisitions (M&A) in one of the few bright spots available for investors - resources.

Juniors, not majors, own the worlds future mines and juniors are the ones most adept at finding these future mines. They already own, and find, what the world's larger mining companies need to replace reserves and grow their asset base.

The following factors will drive the growing M&A trend:

- Consolidation to achieve economies of scale and pricing power

- Scarcity of large producing assets

- High demand in industrialized nations for metals and minerals

- V shaped recoveries in developing countries

- Expansion into new geographies

- Diversification of resource bases

- Looser bank lending

- Higher commodity prices and better company cost management = larger operating cash flow

Using history as our guide we know that the greatest leverage to precious metals, the most profitable rewarding way to get involved in precious metals, is to own the shares of junior precious metal companies - our gold junior resource companies, the same ones who today are so oversold and undervalued, are the present owners of the world's future gold supply.

Gold miners are showing some pretty healthy profits and their coffers are overflowing with cash. Investors are starting to pay attention. Ahead of the herd investors realize the attention being paid to the world's major and few remaining mid-tier miners will soon trickle down to the juniors developing precious metal projects.

Junior gold stocks should be on every investors radar screen. Are they on yours?

If not maybe it should be.

By Richard (Rick) Mills

If you're interested in learning more about specific lithium juniors and the junior resource market in general please come and visit us at www.aheadoftheherd.com. Membership is free, no credit card or personal information is asked for.

Copyright © 2011 Richard (Rick) Mills - All Rights Reserved

Legal Notice / Disclaimer: This document is not and should not be construed as an offer to sell or the solicitation of an offer to purchase or subscribe for any investment. Richard Mills has based this document on information obtained from sources he believes to be reliable but which has not been independently verified; Richard Mills makes no guarantee, representation or warranty and accepts no responsibility or liability as to its accuracy or completeness. Expressions of opinion are those of Richard Mills only and are subject to change without notice. Richard Mills assumes no warranty, liability or guarantee for the current relevance, correctness or completeness of any information provided within this Report and will not be held liable for the consequence of reliance upon any opinion or statement contained herein or any omission. Furthermore, I, Richard Mills, assume no liability for any direct or indirect loss or damage or, in particular, for lost profit, which you may incur as a result of the use and existence of the information provided within this Report.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.