Gold Near Record USD and EUR High – Eurozone Debt and U.S. Default Risks Global Financial Contagion

Commodities / Gold and Silver 2011 Jul 28, 2011 - 09:36 AM GMTBy: GoldCore

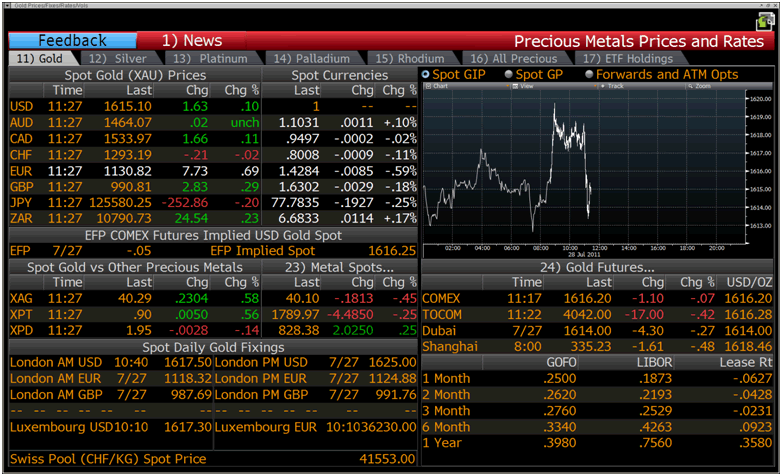

Gold is marginally higher against most currencies today and is trading at USD 1,614.40, EUR 1,130.50, GBP 990.08 and CHF 1,294.50 per ounce. Gold is flat against the dollar but remains just less than 1% from the record nominal high reached yesterday ($1,628.05/oz). The euro is under pressure again today and gold is 0.7% higher against the euro and is just less than 1.5% away from the record euro high of EUR 1,144.80/oz reached last Monday.

Gold is marginally higher against most currencies today and is trading at USD 1,614.40, EUR 1,130.50, GBP 990.08 and CHF 1,294.50 per ounce. Gold is flat against the dollar but remains just less than 1% from the record nominal high reached yesterday ($1,628.05/oz). The euro is under pressure again today and gold is 0.7% higher against the euro and is just less than 1.5% away from the record euro high of EUR 1,144.80/oz reached last Monday.

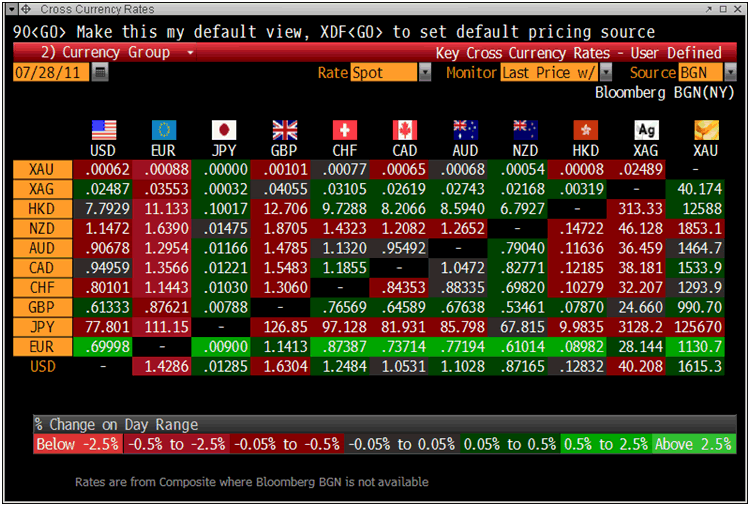

Cross Currency Rates

Early gains in Europe saw gold fix at USD 1617.50/oz in London prior to a bout of selling saw gold fall and then rise again. Volatility has increased but remains low compared to levels seen in the late 1970’s.

European indices followed Asian indices lower (Nikkei -1.45%, Sensex -1.03%, Shanghai -1.01%, Hang Seng +0.3%, STI -0.49%) and the FTSE is down 0.73%. The Italian MIB is down 1.2% and the DAX 1.66%.

Investors were made nervous by comments from chemicals major BASF, which said it saw global economic growth slowing as it posted weaker-than-expected earnings, sending its stock down 4.9%.

Siemens AG, Europe's largest engineering conglomerate, warned that global economic risks were increasing and posted below forecast results. Its shares fell 1.3%.

As per yesterday, Spanish and particularly Italian bonds are under pressure today with the Spanish 10 year rising to 6.06% and the Italian 10 year rising to 5.94%.

One-year CDS (credit default swap) prices on U.S. debt have moved above five-year CDS prices, signaling that the risk of financial contagion remains real.

Europe's STOXX bank index has lost about 25 percent since mid-February suggesting jitters regarding the possibility of a second phase to the banking crisis.

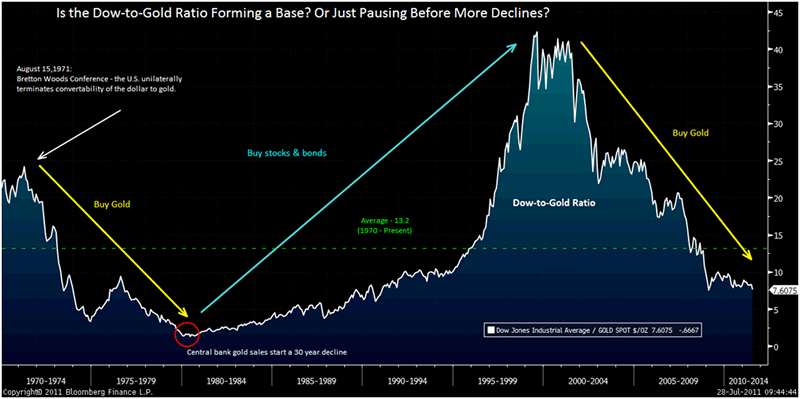

The Dow to Gold Ratio has again turned down suggesting gold may continue to outperform U.S. stocks and the DJIA, in particular, in the coming weeks. The long term target of below 2:1 remains viable.

Dow-to-Gold Ratio: Financial Assets vs. Hard Assets

Separately, JP Morgan (JPM) have forecast gold to rise to $1,800/oz by year end on continued strong retail and official demand. and lower scrap supply.

For the latest news, commentary, infographics and videos on gold and financial markets follow us on Twitter.

SILVER

Silver is trading at $40.24/oz, €28.15/oz and £24.68/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,782.75/oz, palladium at $825/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.