Gold and Silver Inter-metal Dynamics

Commodities / Gold and Silver 2011 Jul 28, 2011 - 03:53 AM GMTBy: Ashraf_Laidi

As risk currencies become quickly overcrowded and range-bound equity indices remain the territory of traders rather than investors, silver once again appears as the notable gainer, characterised by richly similar fundamentals to gold. The only thing is that silver is trading 20% below its record high.

As risk currencies become quickly overcrowded and range-bound equity indices remain the territory of traders rather than investors, silver once again appears as the notable gainer, characterised by richly similar fundamentals to gold. The only thing is that silver is trading 20% below its record high.

Here are 3 general reasons to our renewed preference for silver...

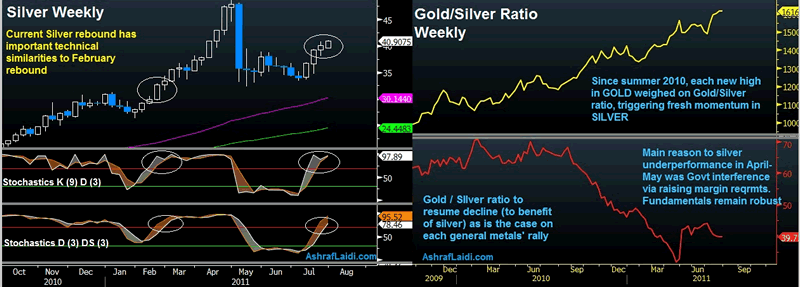

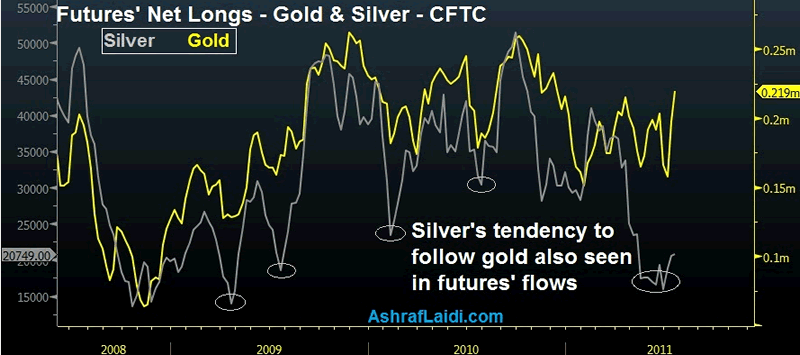

Inter-metal dynamics

Gold has always preceded silver in hitting new record highs (due to liquidity & popularity of investing options to the public), but silvers subsequent catch-up has rendered this pattern an attractive investment reality. This has especially been the case since summer 2010. It is important to remember the main reason to silvers severe underperformance relative to gold in April/May was artificial interference (exchanges quadrupled he margin requirements).

The fact that silver is 20% below its high despite improving metals fundamentals presents a notable opportunity for silver. The chart below (right) shows how the Gold/Silver ratio has resumed its decline, which is the case each time metals rise in concert.

Fundamental

The fundamental arguments to rising metals have changed little since the record-breaking days of March-April 2011. In fact, if anything, they have improved.

i) Regardless of the nature of any solution to the US debt ceiling problem, debt monetization and printing fresh paper by the US Treasury is here to stay. Meanwhile, the probability of a downgrade in the US credit rating has risen from zero, one year ago to 50-50% today according to S&P. This rapidly-changing landscape

ii) Combining the above with the broadening reality that US short term interest rates shall remain at zero until at least end of 2012 and QE3 is an impending likelihood, the substitute nature of metals to interest-rate bearing assets (money) shall continue to prevail in value.

iii) Europe may be free of bipartisan resistance to debt negotiations (as in the case in US partisan politics) but the tripartite lifelines remain short-term in nature as long as sluggish growth is unable to bring down the debt/GDP ratio.

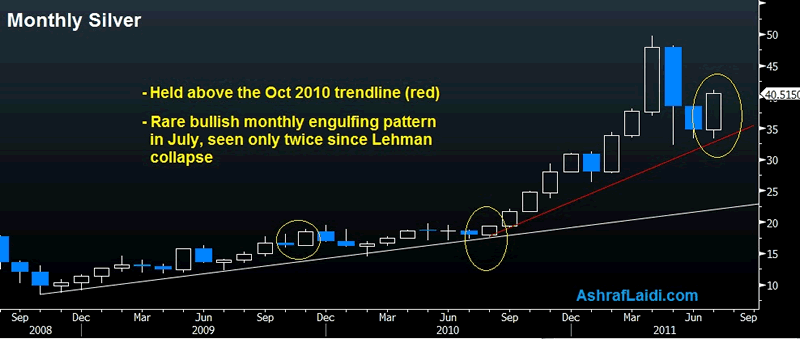

Technical

The most striking technical argument to rising silver is the technical similarity between the current rebound and that of the February rebound (which led to new highs). Looking at weekly stochastics (momentum-related indicator) by using various speeds, we see the patterns are almost identical across different measures. This adds to the argument that the current price rebound carries sufficient follow-up momentum to lift it back towards the high $40s, at which point will draw retail interest back into the spring highs.

The other key technical development is silver's monthly chart, showing a rare bullish engulfing July candle, defined when the bar "wraps" around the prior month's bar, paving the way for prolonged gains. Expecting $47 /oz in August. The $50 record is seen before end of Q3.

Click here to try our Premium service of daily trades & intermarket insights.

For more frequent FX & Commodity calls & analysis, follow me on Twitter Twitter.com/alaidi

By Ashraf Laidi

AshrafLaidi.com

Ashraf Laidi CEO of Intermarket Strategy and is the author of "Currency Trading and Intermarket Analysis: How to Profit from the Shifting Currents in Global Markets" Wiley Trading.

This publication is intended to be used for information purposes only and does not constitute investment advice.

Copyright © 2011 Ashraf Laidi

Ashraf Laidi Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.