Most American's Don't Believe the U.S. Dollar Will Collapse

Currencies / Fiat Currency Jul 27, 2011 - 12:02 PM GMTBy: Jeff_Clark

By Jeff Clark, BIG GOLD : In spite of constant headlines about debts and deficits, most Americans don’t really believe the U.S. dollar will collapse. From knowledgeable investors who study the markets to those seemingly too busy to worry about such things, most dismiss the idea of the dollar actually going to zero.

By Jeff Clark, BIG GOLD : In spite of constant headlines about debts and deficits, most Americans don’t really believe the U.S. dollar will collapse. From knowledgeable investors who study the markets to those seemingly too busy to worry about such things, most dismiss the idea of the dollar actually going to zero.

History has a message for us: No fiat currency has lasted forever. Eventually, they all fail.

BMG BullionBars recently published a poster featuring pictures of numerous currencies that have gone bust. Some got there quickly, while others took a century or more. Regardless of how long it took, though, the seductive temptations allowed under a fiat monetary system eventually caught up with these governments, and their currencies went poof!

You might suspect this happened only to third world countries. You’d be wrong. There was no discrimination as to the size or perceived stability of a nation’s economy; if the leaders abused their currency, the country paid the price.

As you scroll through the currencies below, you’ll see some long-ago casualties. What’s shocking, though, is how many have occurred in our lifetime. You might count how many currencies have failed since you’ve been born.

So what’s the one word for the “thousand pictures” below? Worthless.

Yugoslavia – 10 billion dinar, 1993

Zaire – 5 million zaires, 1992

Venezuela – 10,000 bolívares, 2002

Ukraine – 10,000 karbovantsiv, 1995

Turkey – 5 million lira, 1997

Russia – 10,000 rubles, 1992

Romania – 50,000 lei, 2001

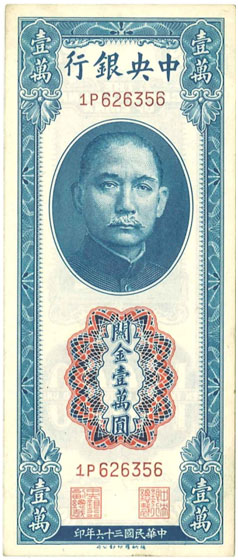

Central Bank of China – 10,000 CGU, 1947

Peru – 100,000 intis, 1989

Nicaragua – 10 million córdobas, 1990

Hungary – 10 million pengo, 1945

Greece – 25,000 drachmas, 1943

Germany – 1 billion mark, 1923

Georgia – 1 million laris, 1994

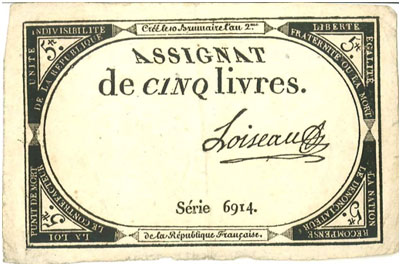

France – 5 livres, 1793

Chile – 10,000 pesos, 1975

Brazil – 500 cruzeiros reais, 1993

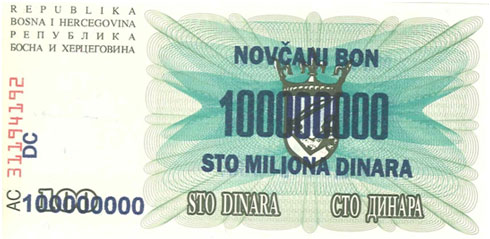

Bosnia – 100 million dinar, 1993

Bolivia – 5 million pesos bolivianos, 1985

Belarus – 100,000 rubles, 1996

Argentina – 10,000 pesos argentinos, 1985

Angola – 500,000 kwanzas reajustados, 1995

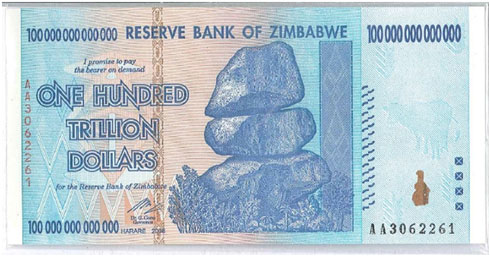

Zimbabwe – 100 trillion dollars, 2006

So, will a similar fate befall the U.S. dollar? The common denominator that led to the downfall of each currency above was the two big Ds: Debts and Deficits.

With that in mind, consider the following:

Morgan Stanley reported in 2009 that there’s “no historical precedent” for an economy that exceeds a 250% debt-to-GDP ratio without experiencing some sort of financial crisis or high inflation. Our total debt now exceeds GDP by roughly 400%.

Investment legend Marc Faber reports that once a country’s payments on debt exceed 30% of tax revenue, the currency is “done for.” On our current path, analyst Michael Murphy projects we’ll hit that figure by October.

Peter Bernholz, the leading expert on hyperinflation, states unequivocally that “hyperinflation is caused by government budget deficits.” This year’s U.S. budget deficit will end up being $1.5 trillion, an amount never before seen in history.

Since the Federal Reserve’s creation in 1913, the dollar has lost 95% of its purchasing power. Our government leaders clearly don’t know how – or don’t wish – to keep the currency strong.

Whether the dollar goes to zero or merely becomes a second-class currency in the global arena, the possibility of the greenback being added to the above list grows every day. And this will lead to serious and painful consequences in our standard of living. While money is only one of many problems we’ll have to deal with, you can protect your assets with the one currency that can’t be debased, devalued, or destroyed by irresponsible leaders.

Don’t be the investor who dismisses this message from history. Use gold (and silver) as your savings vehicle. Any excuse you have now will be meaningless and irrelevant when we enter that fateful period. Make sure you own enough precious metals to make a difference in your portfolio.

Because when it comes to money, worthless is not a fun word.

[Owning physical gold is good protection from the sinking value of the U.S. dollar; investing in the right gold miners can yield even higher returns. BIG GOLD focuses on the larger miners that have strong profit potential, and will help you build your wealth. Give it a ninety-day risk-free trial. Details here.]

© 2011 Copyright Casey Research - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.