How U.S. Debt Downgrade WIll Impact Stock and Bond Market Prices?

Stock-Markets / Financial Markets 2011 Jul 27, 2011 - 11:23 AM GMTBy: Chris_Ciovacco

Since the United States has carried a AAA debt rating since 1917, the term unprecedented has been properly applied to the possibility of a downgrade to AA. The uncertainty associated with a debt downgrade/short-term default was captured by the Wall Street Journal on July 25:

Since the United States has carried a AAA debt rating since 1917, the term unprecedented has been properly applied to the possibility of a downgrade to AA. The uncertainty associated with a debt downgrade/short-term default was captured by the Wall Street Journal on July 25:

In one recent meeting at a major bank, executives were asked to suggest what they would recommend buying the very moment the debt limit wasn’t raised. For each argument made, there was a valid counterargument for why the purchase wouldn’t be wise.

Before we cover the possible impact of what appears to be an almost inevitable downgrade of U.S. debt, let’s discuss one possible way to approach the markets. When confusion creeps into a decision-making process, it is always wise to take a step back and focus on the basics. Do we really need Standard and Poor’s to tell us, via a downgrade, that the long-term fiscal outlook for the United States is on less-than-stable footing? Obviously, the answer is “no”. If that is the case, the financial markets may have already priced in a downgrade based on common knowledge of our nation’s budget woes.

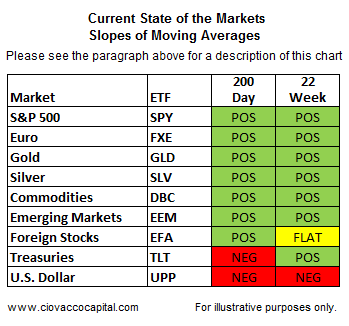

If the financial markets will gain no new knowledge upon the announcement of a downgrade, the current trends in asset prices may remain in place. A market’s 200-day and 22-week moving average often serve as good bull/bear litmus tests. Healthy markets tend to have positive slopes on their moving averages; weaker markets tend to have negative slopes. The table below shows the state of affairs as of July 26. The U.S. dollar has been weak and risk assets have been relatively healthy, which depicts an ongoing bull market in risk assets. If the market has priced in the fiscal state of affairs in the United States, then the table below may continue to serve as a good guide for investors.

A “tipping point” scenario looks at the situation from a more bearish perspective. A debt downgrade may be the fundamental straw that breaks the bull market’s back. Numerous straws are already weighing on the market’s spine - a weak recovery, elevated unemployment, debt problems in Europe, and inflation in Asia. If the “tipping point” scenario plays out following a downgrade of U.S. debt, the table above would migrate to a much more red dominated state as the 200-day and 22-week moving averages begin to roll over in a bearish fashion.

In the “tipping point” scenario, the silver lining for the bulls would be the time it typically takes for markets to shift from a bullish bias (as we have now) to a bearish bias (as we saw in late 2007/early 2008). The transition period should allow for some allocation adjustments to be made over a few weeks, or more likely a few months. You can get a better visual understanding of the bull/bear transition period in this July 2011 stock market outlook by focusing on the slope of the S&P 500’s 200-day moving average.

The impact of a debt downgrade on the markets and the economy is difficult to assess due to the unprecedented nature of the situation. However, we do know the United States Treasury market currently has two major selling points: (1) AAA-rated, and (2) very, very liquid. Following a downgrade, the United States Treasury market will have two major selling points: (1) AA-rated, and (2) very, very liquid. Downgrade-related concerns in the markets would be greater if there was a viable and competitive alternative to a debt market that carries a still-sound AA rating and is very liquid. Japan has problems of its own and its debt carries a lower rating of A1. The common currency in Europe makes it difficult to completely separate German bonds from those issued by Greece, Spain, Italy, and Portugal, especially over an intermediate-to-long-term time horizon.

If following a downgrade, with no highly-liquid substitutes for U.S. Treasuries, the question becomes one of repricing. Investors will be willing to pay less for a bond that carries a lower rating and more risk. How much less? According to a New American article:

Tom Porcelli, chief economist at RBC Capital Markets, looked at the price performance of sovereign debt of four countries that lost their AAA rating and said the yields (which move inversely to bond prices) fell just six basis points — six one-hundredths of a percentage point — translating to a decline in bond prices scarcely worth mentioning.

A Bloomberg story pegs the impact as being a little more significant, but not earth shattering:

A cut of the U.S.’s AAA credit rating would likely raise the nation’s borrowing costs by increasing Treasury yields by 60 to 70 basis points over the “medium term,” JPMorgan Chase & Co.’s Terry Belton said on a conference call hosted by the Securities Industry and Financial Markets Association.

Bloomberg reported the results of a debt survey in early July:

Ten-year Treasury yields may rise about 37 basis points if the U.S. government temporarily misses a debt payment while promising to make bondholders whole as soon as the debt limit was raised, according to a mean estimate of 45 JPMorgan clients that were surveyed by the firm. Foreign investors forecast yields would rise 55 basis points.

Note the JPMorgan survey above assumes the U.S. goes into a short-term form of default, rather than just being hit with a downgrade by one of the rating agencies. The ramifications of a default scenario would be more significant than a downgrade alone.

How significant is a 60 basis point move (or 0.6%) in interest rates? Significant, but not all that unusual, and taken alone it is not a reason to move to a portfolio that incorporates your mattress as the primary investment vehicle. On November 30, 2009 the yield on 10-year Treasuries was 3.20%. On December 31, 2009 the yield had climbed all the way to 3.84%, which is a move of 0.64% or 64 basis points. Did the 64 basis point move kill the bull market in risk assets? The S&P 500 closed at 1,095 on November 30, 2009, prior to the 64 basis point move in the 10-year Treasury. Over the next eighteen months the S&P 500 moved from 1,095 to 1,370, despite the 0.64% rise in interest rates.

The current situation is serious, but as we noted on July 25, the bond market has thus far remained stable. Our ongoing concern relative to the markets centers around the “tipping point” scenario rather than the cataclysmic-event scenario. Our portfolios are currently aligned with the table above, which is based on observable facts. If the facts change, we are ready, willing, and able to make adjustments.

By Chris Ciovacco

Ciovacco Capital Management

-

Copyright (C) 2011 Ciovacco Capital Management, LLC All Rights Reserved.

Chris Ciovacco is the Chief Investment Officer for Ciovacco Capital Management, LLC. More on the web at www.ciovaccocapital.com

Ciovacco Capital Management, LLC is an independent money management firm based in Atlanta, Georgia. As a registered investment advisor, CCM helps individual investors, large & small; achieve improved investment results via independent research and globally diversified investment portfolios. Since we are a fee-based firm, our only objective is to help you protect and grow your assets. Our long-term, theme-oriented, buy-and-hold approach allows for portfolio rebalancing from time to time to adjust to new opportunities or changing market conditions. When looking at money managers in Atlanta, take a hard look at CCM.

All material presented herein is believed to be reliable but we cannot attest to its accuracy. Investment recommendations may change and readers are urged to check with their investment counselors and tax advisors before making any investment decisions. Opinions expressed in these reports may change without prior notice. This memorandum is based on information available to the public. No representation is made that it is accurate or complete. This memorandum is not an offer to buy or sell or a solicitation of an offer to buy or sell the securities mentioned. The investments discussed or recommended in this report may be unsuitable for investors depending on their specific investment objectives and financial position. Past performance is not necessarily a guide to future performance. The price or value of the investments to which this report relates, either directly or indirectly, may fall or rise against the interest of investors. All prices and yields contained in this report are subject to change without notice. This information is based on hypothetical assumptions and is intended for illustrative purposes only. THERE ARE NO WARRANTIES, EXPRESSED OR IMPLIED, AS TO ACCURACY, COMPLETENESS, OR RESULTS OBTAINED FROM ANY INFORMATION CONTAINED IN THIS ARTICLE. PAST PERFORMANCE DOES NOT GUARANTEE FUTURE RESULTS.

Chris Ciovacco Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.