Commodities Price Growth to Slow in 2008

Commodities / CRB Index Dec 02, 2007 - 08:42 AM GMTBy: Donald_W_Dony

KEY POINTS:

KEY POINTS:

• CRB Index expected to advance to new highs in 2008, but with slower growth

• Light crude oil finds solid support at $89; no weakness anticipated – target is $108

• Fed rate cut meeting on December 11 will send gold higher and drop the USD; target is US$875

• Weaker copper prices point to stalling economies; $3.80 is solid resistance

• Natural gas pinned under $8.50 resistance; little chance of growth until second half of 2008. Steady LNG supply should keep prices low.

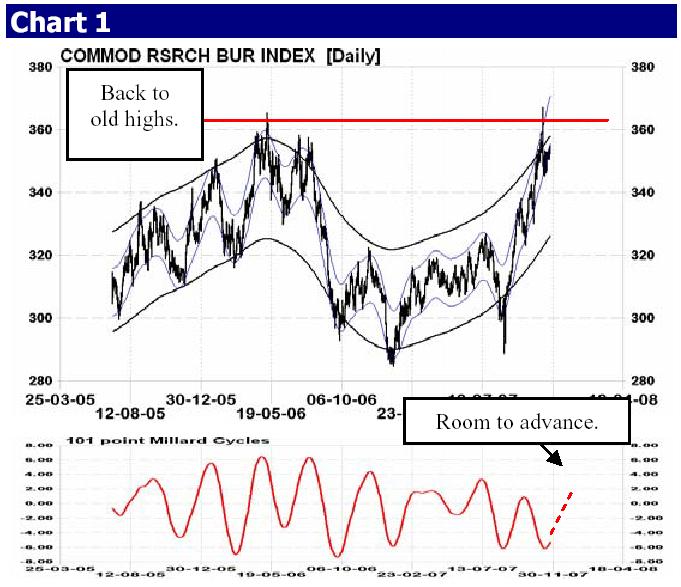

November was been quite a month for commodities. The Commodities Research Bureau (CRB) Index hit the old 2006 high of 360, oil flirted with $100 a barrel, gold smashed above $800 for the first time in more than 20 years, and silver soared to $15. But not all commodities are reaching stratospheric levels. Industrial metals (e.g., copper, tin, nickel, lead, etc.) have all levelled off in 2007 and show no signs of advancing. As these raw materials are more of a barometer of global economic growth, some concerns are starting to surface. But I will address this issue later in this newsletter.

Back to the past

And they said the commodities bull market was over in 2006. Ha! The CRB Index jumped back to the all-time high of 360 again in late November. This lofty price was the peak in the last four-year business cycle (2002 to 2006).

Technical models (see Chart 1) indicate that new highs are probable by year-end, as the current uptrend unfolds. The CRB has reached our target of 360 (see the November issue), and I am raising this now to 370 by late January. In business cycles, commodities are normally one of the last groups to weaken (see the “Business Cycle” tab on the Technical Speculator home page). Since the anticipated end of the current cycle is 2010, additional growth is expected.

TS Model Growth Portfolios update

Oil: Staying high

One thing I think most investors will agree with is that the days of cheap, easy-to-find oil are over. The last big find was the North Sea field in the 1970s. Everything else is deep and/or costly.

This is the first page of the December issue. Go to www.technicalspeculator.com and click on member login to download the full 14 page newsletter.

By Donald W. Dony, FCSI, MFTA

www.technicalspeculator.com

COPYRIGHT © 2007 Donald W. Dony

Donald W. Dony, FCSI, MFTA has been in the investment profession for over 20 years, first as a stock broker in the mid 1980's and then as the principal of D. W. Dony and Associates Inc., a financial consulting firm to present. He is the editor and publisher of the Technical Speculator, a monthly international investment newsletter, which specializes in major world equity markets, currencies, bonds and interest rates as well as the precious metals markets.

Donald is also an instructor for the Canadian Securities Institute (CSI). He is often called upon to design technical analysis training programs and to provide teaching to industry professionals on technical analysis at many of Canada's leading brokerage firms. He is a respected specialist in the area of intermarket and cycle analysis and a frequent speaker at investment conferences.

Mr. Dony is a member of the Canadian Society of Technical Analysts (CSTA) and the International Federation of Technical Analysts (IFTA).

Donald W. Dony Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.