Gold New Record Nominal Highs ($1,625.70) as CDS Traders Start Positioning for U.S. Downgrades

Commodities / Gold and Silver 2011 Jul 27, 2011 - 07:52 AM GMTBy: GoldCore

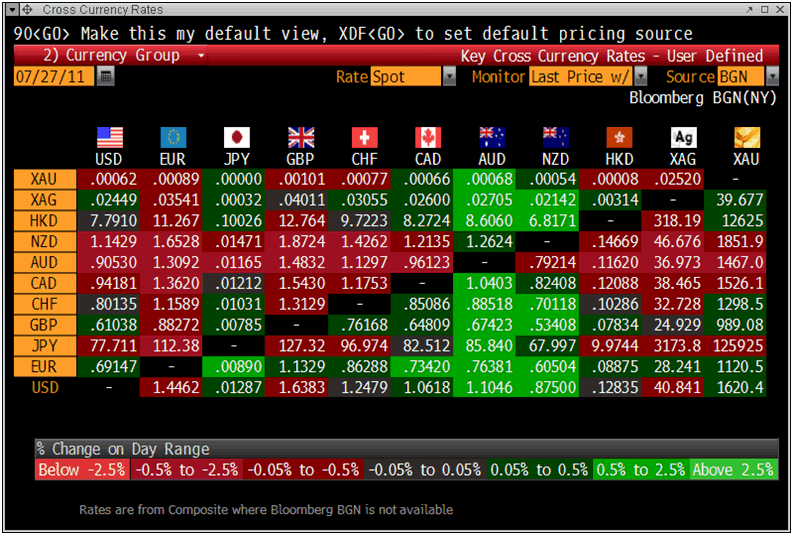

Gold is trading at USD 1,620.40, EUR 1,120.50 and GBP 989.08 and CHF 1,298.50 per ounce. Both the dollar and the euro are under pressure again today and gold has reached another new record nominal high of $1,625.70/oz in early European trading.

Gold is trading at USD 1,620.40, EUR 1,120.50 and GBP 989.08 and CHF 1,298.50 per ounce. Both the dollar and the euro are under pressure again today and gold has reached another new record nominal high of $1,625.70/oz in early European trading.

Cross Currency Rates

European indices are marginally lower after a mixed performance in Asia (Asian indices: Nikkei -0.48%, Sensex -0.52%, Shanghai +0.51%, Hang Seng +0.18, STI -0.13%).

The Italian MIB is down 1.5% with UniCredit down over 4% and Intesa Sanpaolo down more than 5%.

Spanish and particularly Italian bonds are under pressure today with the Spanish 10 year back above 6% and the Italian 10 year rising to 5.79%.

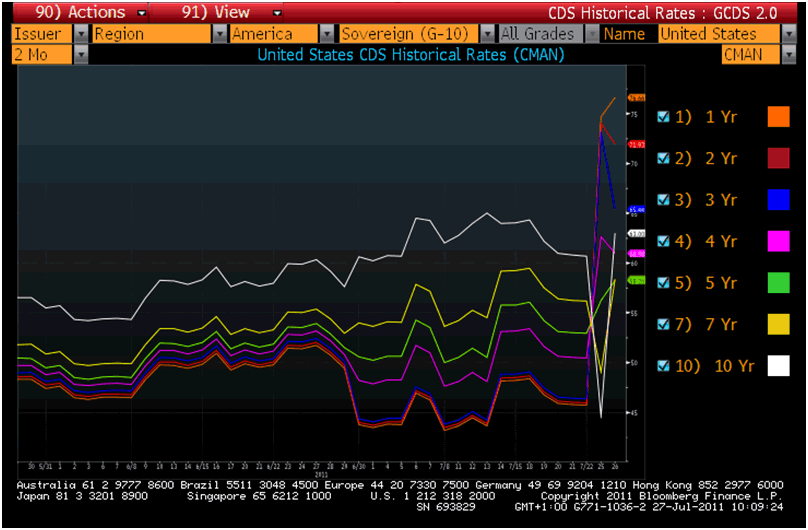

United States CDS Historical Rates (CMAN)

Five-year credit default swaps (CDS) on Italian government debt rose 22 basis points on the day to 295 bps, according to data monitor Markit. This means it costs 295,000 euros to protect 10 million euros of exposure to Italian bonds. Spanish and the rest of the peripheral euro zone CDS also rose.

Five-year credit default swaps (CDS) on U.S. government debt have risen 3 basis points to 63 bps, according to data monitor Markit. This means it costs $63,000 to protect 10 million euros of exposure to U.S. bonds.

The cost of insuring U.S. government debt against default has edged up again today due to the dawning realization that the world's largest economy will not maintain its AAA credit rating. Indeed, as the chart above shows the cost to insure U.S. debt over all durations is rising.

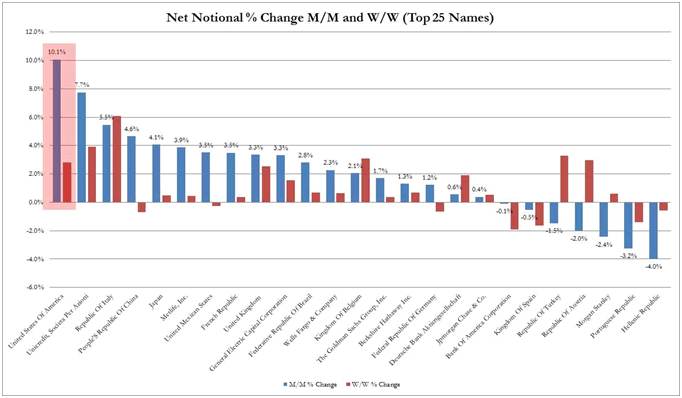

Notional Change in Net Outstanding CDS (Zero Hedge)

Economists in the U.S. believe that the U.S. will lose its vanguard AAA credit rating according to a recent poll conducted by Reuters. A survey of 53 economists showed 30 believed that one of the three leading credit rating agencies will downgrade US debt. The economists do not believe that the U.S. will default.

A downgrading of the U.S. is inevitable given its very poor fiscal position – the question is by how much the U.S. is downgraded and AA looks possible in the coming months.

The widening in U.S. CDS has so far been modest but the bond vigilantes may be awakening from their slumber as net notional CDS on US debt has risen above that of Greece and Italy.

Financial players have positioned themselves by buying some $4.8 billion of credit default swaps on U.S. government debt, according to figures from the Depository Trust and Clearing Corporation.

They either believe that the U.S. government will default on its debt or are taking out insurance against of this happening.

Investors internationally -- including everyone from individual consumers in their pension funds, to hedge funds, to the Chinese government -- currently hold $9.3 trillion (with a T!) in Treasury bonds, and they're counting on Uncle Sam paying up when those contracts mature.

The U.S. government will have a three-business-day grace period to make good on any default before credit default swaps are triggered, the International Swaps and Derivatives Association said Tuesday.

ISDA General Counsel David Green, in a Bloomberg TV interview Tuesday, said that ratings agency actions on U.S. debt and CDS triggers are completely unrelated. "If the ratings agencies come and say there's a default or there's downgrade...that doesn't itself trigger CDS. We would look at whether a payment is due and whether it was made or not.”

There are concerns that a U.S. debt default could send the derivatives market into turmoil because a missed Treasury payment may have been deemed too unlikely to be fully planned for in the contracts.

We are all exposed to Uncle Sam’s profligate ways and this makes a diversification into gold by investors internationally (individual, pension funds, institutions) more important than ever.

A tiny minority realize this and are diversifying into gold, whereas the majority remain unaware of the risks and have no allocation in their portfolios to gold whatsoever.

This is changing but gold remains a very under owned asset and the preserve of the more risk aware and risk averse.

For the latest news, commentary, infographics and videos on gold and financial markets follow us on www.twitter.com/goldcore

SILVER

Silver is trading at $40.75/oz, €28.17/oz and £24.87/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,803.75/oz, palladium at $838/oz and rhodium at $1,900/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.