Bailouts, Austerity and Rage: Calm Like A Bomb, Part I - The Greek & The Irish

Politics / Global Debt Crisis Jul 27, 2011 - 07:29 AM GMT "Stroll through the shanties, and the cities remain. Same bodies buried hungry, but with different last names. These vultures rob everything, leave nothing but chains. Pick a point on the globe; yes the picture's the same. There's a bank, a church, a myth and a hearse; a mall and a loan, a child dead at birth. There's a widow pig parrot, a rebel to tame, a whitehooded judge and a syringe and a vein. And the riot be the rhyme of the unheard..." Rage Against the Machine: Calm Like a Bomb

"Stroll through the shanties, and the cities remain. Same bodies buried hungry, but with different last names. These vultures rob everything, leave nothing but chains. Pick a point on the globe; yes the picture's the same. There's a bank, a church, a myth and a hearse; a mall and a loan, a child dead at birth. There's a widow pig parrot, a rebel to tame, a whitehooded judge and a syringe and a vein. And the riot be the rhyme of the unheard..." Rage Against the Machine: Calm Like a Bomb

Rage is deeply-rooted fear and frustration metastasized in the body of a global and institutionalized society; the natural result of economic disenfranchisement. It is one thing to advocate in the name of rage, another to predict that episodes of collective rage will occur and yet another to note that they are already occurring and accept them as a fundamental aspect of our lives. The former should be avoided as much as possible, while the latter two are required of the responsible analyst, in my humble opinion. "RATM" may not be a shining beacon of objective analysis in our world, but, at the same time, they are right. People across the world are once again recording their "rhymes" as history unfolds. The debt-drugs were injected for years on end, so now the only question is how far down the revolutionary river our rage-filled, junkie mentality will carry us? Southern Europe (and Ireland), of course, are back in the cross-hairs right now, to the extent that poorer parts of the world ever escape them. Revolutions were all but manufactured by Western colonial/imperial powers in Latin America, Asia, Africa and the Middle East throughout the 20th century (see The Shock Doctrine and Confessions of an Economic Hitman), but now the chickens are coming home to roost. The last time Greece had a true "revolution" (let's call it "a widespread uprising of the people which displaces or severely threatens the existing political order") was in the 1820s, Spain was in the 1860s, Italy in 1848, Ireland in 1916 and Portugal the most recent in 1974 (no shots were fired in this military coup). [1], [2]. In the case of France, Germany and the UK, the populations have generally suffered their own governments for much longer stretches with fewer internal uprisings. Now, in the span of just over a year, we have witnessed mass protests and/or riots in all of these countries, on multiple different occasions. The trigger for this rage has largely been either the establishment and/or proposal of "austerity measures", as both conditions of EU "bailouts" or independent fiscal policy, or the subsidization of debtor nations by those belonging to Europe's "core". This situation in the EMU has created an extremely tense dynamic both within and between the respective populations of member states. So if we want to know the future of social unrest in Europe, perhaps we should look to the future of bailouts and austerity. To date, the two countries in the developed world that are facing the most severe austerity measures are, without a doubt, Greece and Ireland.

GREECE

"Here is what it [the latest EMU plan] really says: We are going to keep throwing good money after bad and work as hard as we can to transfer the debt that is on the banks to the ECB and European taxpayers as long as the voters will let us. This first tranche will be another €109 billion. That will last a few years, and Greece will only have to pay about 3.5% on that debt and the rollover debt, and people who expected to be repaid in that period will see payment extended to either 15 or 30 years. You can call this what you like, and they call it "selective default,” but it is a default. There will be government guarantees on the debt, so the ECB can take it from the banks. Let’s see what the "voluntary” debt rollovers will look like and what the likely debt destruction will be. This is from Global Macro Monitor. First, notice that the plan claims haircuts will only be 21%. But that assumes you can sell the new bonds at a 9% interest rate. If the interests rate demanded by the market are 15%, which is closer to reality, the haircuts are closer to 67%, after what appears to be an initial 20% cut. Will any institution not immediately try and get those bonds into the hands of the ECB? This is just ugly."

Ashvin Pandurangi: So how much will major bondholders really have to share in the losses on risky debt-instruments that they generated in the past, and how much of those losses will be immediately pawned off to the ECB under the new plan? Many of the details of this new "fiscal consolidation" of the EMU have yet to be ironed out, and it is still not clear whether it will be accepted as drafted by the relevant Parliaments. Ambrose Evans-Pritchard writes on this issue in The Telegraph:"The terms overstep a resolution passed by the Bundestag limiting how far she [Merkel] could go in committing Germany to any form of transfer union or pooling of debts. The use of the EFSF as a fiscal fund without treaty authority further complicates a ruling by the German constitutional court on the legality of the bail-outs expected in September. Such changes to the EFSF will require ratification by each of the national parliaments. It may require an amendment to the Treaties, greatly raising the bar in Germany. EU officials hope that a debt rollover plan for Greece can be limited to a short technical default. The ECB has backed down on its threat to reject Greek bonds as collateral. The formula will not be extended to Portugal and Ireland. It is understood that rating agencies will hold fire for the sake of global stability. However, there is no disguising that a major taboo has been broken, even if French leader Nicolas Sarkozy continued to insist that Greece would pay "all its debts"."

Ashvin Pandurangi: So, it is still unclear to what extent the new "stability" mechanisms will be implemented across the EMU, but Evans-Pritchard is right to say that a major line has been crossed, regardless of the final details. There is no doubt that the Emergent Union, through its latest plan, has now decided to stick together until the bitter end, when death finally does them apart. We are talking about the unilateral decisions of political and financial officials, though, which are not even close to being reflective of what their populations want. Nowhere is that fact more true right now than in Greece. At least 95% of the Greek people are suffering immensely to remain in a Union that fails to benefit anyone outside of the top 5%. The authorized plans for austerity and privatization of the citizens' assets continues unabated, and more ominous than ever. Any backstops of Greek debt in the future will still be accompanied by austerity measures approved by the Greek government earlier this month. Meanwhile, the government is still in the process of finding new "advisers" (investment banks) to pay hefty fees in return for advice on how to reduce their deficit via asset sales. [4]. Jeremy Warner from The Telegraph reports:"Agreement on the package is one thing, deliverability is quite another. Once Germans realise that what is being proposed is a transfer union by stealth, you have to wonder what political future there is for the leaders who agreed it. Angela Merkel is staring election defeat in the face, rather in the way that agreeing to German participation in the euro was arguably what did for Chancellor Helmut Kohl back in the late 1990s. The same might be said of the recipient nations. What future for political and social stability among the newly enslaved once it is realised the price that has to be paid is loss of fiscal sovereignty together with years of externally imposed austerity; The agreement refers to a "European Marshall Plan” to restore competitiveness to Greece. This doesn’t appear to mean money. Instead it seems to refer to the provision of "exceptional technical assistance to help Greece implement its reforms”. In other words, someone else will be running Greece’s affairs."

Ashvin Pandurangi: How will this hypocritically harsh plan of austerity and privatization sit with the people of Greece? The proposed austerity measures adopted by the Greek government foresee tax increases of about $9B over the next four years, with almost $8B (~90%) front-loaded in the next two. This includes a measure to reduce the income tax threshold 30% (from 12,000 euros to 8,000) and place a "solidarity levy" on households for 1-5% of income this year. What that really means is the average Greek worker will be paying substantially more taxes, while the wealthiest brackets continue to evade them with relative ease. Der Spiegel:"Two-thirds of Greeks regularly pay their taxes as well. Indeed, "contrary to widespread views," as the Friedrich Ebert Stiftung study put it, these taxes are automatically deducted along with social contributions from the paychecks of Greeks employed in both the private and public sectors. It is mainly the small wealthy class that manages to cheat the authorities out of €40 billion in tax each year. That is the OECD's estimated volume of annual tax evasion. The Greek central bank puts the losses at somewhere between €15 billion and €20 billion. These tax cheats have little to fear. As Panos Kazakos, an Athens-based professor of politics, puts it: "I have never seen a single person put in jail for tax evasion." Robolis adds that the government, which supposedly has no money available for social services, just published a list of companies that owe the state a total of €9 billion in social contributions -- but it does nothing to get that money. This injustice is what is making people in Greece so angry..."

Ashvin Pandurangi: The plan also calls for about a $31B reduction in spending over the same four-year time frame, with a majority coming from a reduction in public salaries, social programs and health care spending. Taken together, these measures amount to more than 10% of Greece's GDP. Such cuts represent a systematic gutting of safety nets that the average Greek has become reliant on for any chance of solvency, and, even survival in some cases. Finally, the proposed plan aims to generate about $70B+ from sales of public assets, including the citizens' stake in sea ports, airports, highways, mining operations and various other property (such as land on the island of Mykonos [6]) until 2015. [7]. UN News Centre:"The implementation of the second package of austerity measures and structural reforms, which includes a wholesale privatization of state-owned enterprises and assets, is likely to have a serious impact on basic social services and therefore the enjoyment of human rights by the Greek people, particularly the most vulnerable sectors of the population such as the poor, elderly, unemployed and persons with disabilities,” said Cephas Lumina, who reports to the UN Human Rights Council in Geneva.

Ashvin Pandurangi: The UN is generally known for having a lot of opinions on "human rights" issues without ever really backing them up with concrete action, but the statement above still touches on a very important dynamic for the Greek people. More and more of them are entering the "most vulnerable" classification of neo-feudal society, as they are forced to join the ranks of the impoverished and/or the unemployed. Der Spiegel:"This time, the fight for survival last exactly 29 minutes. At precisely 3 p.m., Father Andreas, a 37-year-old Greek Orthodox priest, opens the doors of the food bank in downtown Athens. At this hour, the line of hungry people stretches all the way across the large square outside and into the street. Needy people of all ages are waiting patiently -- pensioners, unemployed people, mothers with children, immigrants, asylum seekers. "We can't let these people starve," the priest says. "They are already suffering so much. They should at least not go without food. [..] In recent weeks, the needs of such people have been keeping Father Andreas and his colleagues very busy. Almost all of the 400 parishes in the Archdiocese of Athens have opened food banks like the one he runs. City officials have opened some as well. His food bank distributes meals three times at day. Up to 2,000 come at noon, another 1,200 in the afternoon, and about another 1,000 in the evening. The workers try to make sure that they don't always supply the same people. Such vigilance is necessary because "the number of needy is skyrocketing," says one volunteer who estimates that the figure has increased by 30 percent in recent months. "But we can't be sure it will stay there," she says."

Ashvin Pandurangi: It now becomes clear that one cannot and should not under-estimate the revolutionary spirit of an extremely vulnerable population; one which has increasingly less to lose with every iteration of bailouts, austerity and privatization, as was clearly demonstrated by the Greek people at the end of June. Der Spiegel:"On Wednesday [June 29] afternoon, tear-gas fumes drifted through the city center. More than 200 demonstrators were reported to have been injured, most of them with eye and respiratory problems. The police union said at least 40 policemen had been injured, one of them seriously. A total of 30 people were arrested. [..] On Wednesday, one protester, his face covered up, warned that the conflict would continue. "This is just the beginning," he said."

Ashvin Pandurangi: The anonymous protester was absolutely right - those events were only just the beginning of a fundamental and deepening trend for the people of Greece under their new regime of oppressive austerity. Der Spiegel:"For weeks, thousands of enraged Greeks have been holding anti-government demonstrations outside Greece's parliament building. They come with bullhorns and banners, and a couple hundred also bring stones and Molotov cocktails. Camera crews from around the world are always there to film them, but they never turn their lenses toward those in the dark back alleys of central Athens."

Ashvin Pandurangi: It is very difficult to look at the proposed austerity measures, in the context of the above developments, and conclude that the rage and riots in Greece will not get much worse. Last year saw its fair share of violence in Athens, and June 29, 2011 did as well, but there is also every reason to think Greece's economic/financial situation will continue to deteriorate as renewed austerity and privatization plans takes their toll. As reported above, that toll is especially pronounced in the "back alleys" of Athens where no one is looking. Instead, they choose to focus on sound bites from international institutions and national politicians who claim to be "saving" the country. Der Spiegel again:"Last week, Prime Minister Georgios Papandreou once again succeeded in getting a majority of Greek lawmakers to push through an austerity and privatization package worth €78 billion ($111 billion). In doing so, he was responding to pressure from the International Monetary Fund (IMF), the European Central Bank (ECB) and the European Commission. Indeed, many economic experts see the package's measures as the only way to fend off an imminent national bankruptcy at the last minute -- and the only way to save the euro from an even worse fate. But is Papandreou saving his country to death? Savas Robolis thinks he is. "People are afraid," the 65-year-old says -- they're afraid of an uncertain future."

Ashvin Pandurangi: This fear of the future will continue to strengthen the sociopolitical backlash against a political and banking system that has unequivocally expressed its disdain for the people of Greece. An increasing number of Greek people are protesting for their right to eat a decent meal every day, but the plans for severe spending cuts, tax increases and public asset sales continue on as if those protesters didn't even exist. In the meantime, European leaders meet with each other and figure out "clever" ways of tying themselves into a tight, inseparable knot of fiscal abandon. And for those two reasons alone, the modern world has yet to see the largest uprising that the Greek populace can produce.IRELAND

"Dublin-based novelist Ed O'Loughlin says that perhaps one reason why the Irish are proving so docile is that for the first time in centuries the British can by no stretch of the imagination be blamed for their problems. The author of the political satire Toploader adds: "The lack of clearly stratified classes – as they have in England – breeds insecurity, a fear of losing caste, of being pushed outward. To protest at the rules of this game would be an admission that you no longer have a hand to play in it; that you are a loser and a sucker." At times of mass emigration, just staying in the country was felt to be a victory in itself, although often a pretty hollow one. "The fact that everyone's class system is centred exactly on themselves tends to make people, naturally, very self-centred. The Irish term for this is 'mé féin-ism', or 'myself-ism', a play on Sinn Féin, or 'we ourselves'. Mé féiners do not stand together for the common good. They are not good citizens."

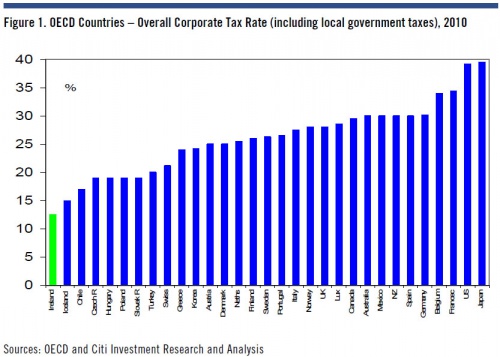

Ashvin Pandurangi: It's an interesting theory that may demonstrate the power of a nation's political and cultural history to restrain the socioeconomic frustration of its people, but how long will this dynamic last for the Irish? Before getting to that question, let's first summarize what the people of Ireland are facing in the way of austerity measures. The current budget for Ireland includes spending cuts and tax increases, valued at about $8B, over the next year alone, or 4% of GDP. Most of the reduction in spending will come from cuts to welfare programs and public sector salaries/benefits. The budget will reduce 4% of public pension expenditures by cutting benefits to retirees who are already being paid out. The tax increases will mostly come from income and value-added tax reform (lowering the income tax threshold and increasing VAT to 23% from 21%), although the top marginal income tax rate will be kept at 52%. The Irish government may also sell "non-strategic" public assets valued up to $3B over time, on recommendations of the "McCarthy Group". [8]. Meanwhile, the corporate tax rate will continue to be held at 12.5% (the lowest rate in OECD countries), which effectively serves to deflect the austerity burden from corporations generating massive profits within the country. [9], [10].

"In a statement, the bank [BoI] said it had raised the funds through two "bilateral secured term funding" trades; one yesterday and one at the end of June. The latest trade is believed to have been done with RBS -- itself nationalised by the British government in 2009. The funding, which is not covered by the banking guarantee, has an average duration of some 2.2 years.Although the lender would not comment on all the specifics of the fundraising, they did reveal that under the funding agreement's terms, they will pay 2.65pc above the three-month Euribor rate. [..] BoI is facing a race against time to avoid joining the rest of the Irish banking sector under state ownership. After the results of the stress tests in April, it was told it had until the end of June to raise €5.2bn if it wanted to remain under private ownership. That deadline was pushed back to the end of this month with the firm trying desperately to raise the required funds."

Ashvin Pandurangi: If and when the BoI loses its race to stay private, it's the Irish taxpayers who will pick up the tab for an extra 2.65% interest on loans from RBS, along with any other obligations passed on by the private banking sector. Considering these developments and the ongoing effects of current austerity measures, it is difficult to see the Irish people remaining "docile" for much longer. There is only a certain amount of restraint that can be imposed by cultural perceptions before the reality of economic desperation sets in. They are now merely remaining "calm like a bomb", and the fuse on that device has been lit. The Guardian article referenced earlier also includes the following assessment by John Kearns of the Irish Writers Centre:"John Kearns, who went abroad in previous recessions and now works in Dublin's Irish Writers Centre, says it is too early to rule out social unrest. 'It's quite possible there will be Greek-style riots. The cuts are affecting people now. People are having their utilities cut off. I know of families, a mother of two, who had their electricity cut off. People can't take that lying down. And there is still a mortgage crisis coming down the track with increasing interest rates that are coming later this year. I can certainly see social unrest ahead, although I don't see what can be achieved by it. It's strange that the main demonstrators so far have been pensioners and students rather than industrial workers. The workers so far have been far quieter,' Kearns said."

Ashvin Pandurangi: Indeed, there are strict limits to the amount of economic hardship a population can take before its "restraint" comes to be perceived by it as an exercise in futile despair. It appears that there is now very little standing in the way of fear and rage taking over the reigns of the Irish sociopolitical system. A recent survey found that the Irish people are beginning to agree with Kearns in massive numbers, whether they are truly aware of it yet or not. Irish Examiner:"In the last survey, 36%, or 428,000 people, did not see a future for themselves or their family in this country. However, this has now risen to 45% or 585,000. The iReach survey for the Irish League of Credit Unions (ILCU) found that 82%, or one million adults, fear about coping if further changes to income tax or welfare are introduced. The survey found that 806,000 people feel they are living to work as opposed to working to live. However, the latest results have not factored in the July interest rate hike and in March one-in-five people said that a hike would have a serious effect on their ability to pay bills."

Ashvin Pandurangi: Well over half a million Irish people and families see "no future" living in their own country, and a solid million adults fear for their ability to make ends meet in the current climate of unaffordable private debt and public bailouts conditioned with severe austerity. That is quite simply a recipe for wide-scale protests, riots and uprisings in the near future. It is fundamentally impossible to predict exactly when such fervor will materialize, or what intervening factors will delay its development, such as Irish politics and culture, political/legal maneuvers by EU governments, financial maneuvers by the IMF/ECB, etc. However, at the end of the day, these factors are only strengthening the population's future resolve. They are merely extending Ireland's exposure to the bailout structure of the EMU, and the numerous conditions that naturally accompany those bailouts. The fact that EU leaders are now planning to consolidate that structure under the modified ESFS, abandoning the haphazard process they had earlier, changes nothing for the Irish people. Eventually, they will need to write off a portion of the bad debts taken on by their government, just like the Greeks, and they will be forced to pay the price through further austerity and privatization. I have noted before, in The Short Story of How We Lose, that the pain of losing is disproportionately more severe than the pleasure of winning. Similarly, the relatively abstract prospect of losing in the future is not nearly as painful as the act of losing itself. As the proposed austerity measures targeting the Greek and the Irish transform into implemented measures and real losses for their pocketbooks, we can expect the fear and rage to follow closely behind. Many of the remaining chords tying the people to their political structures will be severed. And, lest anyone tell you different, collective rage is largely a function of deeper socioeconomic trends; ones that are now common to the entirety of Europe and the developed world.

Ashvin Pandurangi, third year law student at George Mason University

Website: http://theautomaticearth.blogspot.com (provides unique analysis of economics, finance, politics and social dynamics in the context of Complexity Theory)

© 2011 Copyright Ashvin Pandurangi to - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.