Gold Seen as Less Risky Currency, Return to Gold Standard Advocated in Print and Video

Commodities / Gold and Silver 2011 Jul 26, 2011 - 08:32 AM GMTBy: GoldCore

Gold is marginally lower in all currencies today (USD 1,611, EUR 1,113 and GBP 983 per ounce) but remains close to record nominal highs in major currencies on U.S. and Eurozone debt concerns. With the risk free rate of return of U.S. Treasuries (Treasury bills, Treasury notes and Treasury bonds) coming into question, gold is increasingly being seen by many as a less risky asset and as a less risky currency.

Gold is marginally lower in all currencies today (USD 1,611, EUR 1,113 and GBP 983 per ounce) but remains close to record nominal highs in major currencies on U.S. and Eurozone debt concerns. With the risk free rate of return of U.S. Treasuries (Treasury bills, Treasury notes and Treasury bonds) coming into question, gold is increasingly being seen by many as a less risky asset and as a less risky currency.

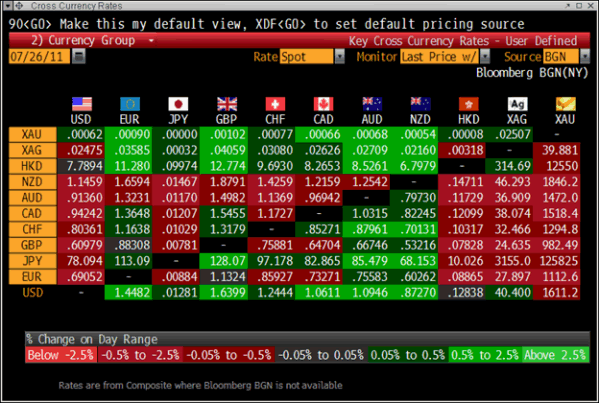

Cross Currency Rates

While the focus shifted from the Eurozone debt issues to U.S. debt issues this week, gold is also being supported by currency debasement and rising inflation internationally and the now very real risk of a recession in the U.S. and a global economic recession.

This comes at a time of continued geopolitical risk from social unrest in the Middle East and Africa and from the continued risk of conflict in the Middle East.

Video: ‘Gold – Independent Money’

Asian indices were higher except for stocks in India which fell after the surprise 50 basis point interest rate rise – a sign of risk markets sensitivity to rising interest rates.

European indices are mostly lower and the FTSE is 0.1% lower after UK GDP data showed the UK may be entering a recession. UK GDP rose just 0.2 percent in the second quarter, slowing from the first quarter’s feeble 0.5 percent growth despite historically low interest rates at 0.5%.

Calls for a return to some form of gold standard become louder by the day.

Once the preserve of fringe libertarians and hard money advocates, there are an increasing number of more “respectable voices” calling for a debate on the merits of sound money in order to protect taxpayers and economies from the vagaries of fiat currencies and the modern money printing and digital creation experiment.

In recent months, joining Ron Paul, the presidential candidate, have been the President of the World Bank, Robert Zoellick, the ‘Father of the Euro’, Professor Robert Mundell and publishing magnate Steve Forbes.

World Bank chief Robert Zoellick said it was time to "consider employing gold as an international reference point."

“Gold is nobody’s liability and it can’t be printed,” Mundell told Bloomberg. “So it has a strength and confidence that people trust.”

Mundell has suggested that an improved global monetary system could be achieved by tying together the US dollar, euro and gold (see article by Judy Shelton in Commentary section).

The Swiss parliament is soon to hold hearings on a parallel Swiss "gold franc".

Utah has already passed a state law that recognizes gold and silver coins as legal tender in Utah. A dozen other states are considering similar laws.

As the world monetary system and the twin pillars upon which it rests, the dollar and euro, risk unraveling, gold’s time tested attributes as a foundation of stability is being increasingly accepted.

Contributing editor to Money Week, Dominic Frisby, (who we had the pleasure of meeting with last week) has just released an excellent video - ‘Gold: Independent Money’.

A picture paints a thousand words and a video hundreds of thousands of words and this is a very informative video about our modern monetary system, fiat currencies and gold.

It shows how fiat money has led to wars, massive debt, social inequality, economic bubbles, rampant consumerism, and environmental destruction. It shows that a return to a gold standard would help ameliorate today’s monetary, financial and economic ills.

“A gold standard will not cure every social ill in the world, nor will it stop all senseless wars. Nothing will.

However, by now it should be clear to everyone that the current fiat system is good only for bankers, brokers, politicians, war mongers, and the already wealthy. Everyone else loses as inflation eventually eats away at what's left of the rapidly shrinking 'middle class'.

All fiat currencies including the US dollar are doomed. The only debate is the path it takes to get there.”

‘Gold: Independent Money’ can be seen here or see Commentary section below.

SILVER

Silver is trading at $40.33/oz, €27.85/oz and £24.58/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,780.50/oz, palladium at $808/oz and rhodium at $1,900/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.