Gold Surges in Asian Trading to Record Nominal High on Washington Theatre and Dollar Debasement

Commodities / Gold and Silver 2011 Jul 25, 2011 - 06:12 AM GMTBy: GoldCore

Gold is trading at $1,617.75/oz, €1,126.49/oz and £993.46/oz.

Gold is trading at $1,617.75/oz, €1,126.49/oz and £993.46/oz.

Gold surged 1.4% ($23) from $1,600.90/oz to a new record nominal of $1,624.07/oz within an hour of the open in Asia. Gold reached new highs due to continuing uncertainty and theatre regarding the debt ceiling negotiations in Washington. Gold is higher in all currencies except the Swiss franc as the Swiss currency is also continuing to see flows.

Silver surged 2% on the open from $39.69/oz to $40.48/oz and is higher in all currencies including the Swissie. There was some unusual selling in the electronic market prior to the open which saw prices fall from the close on Friday at $40.05/oz to $39.69/oz prior to the surge on the open.

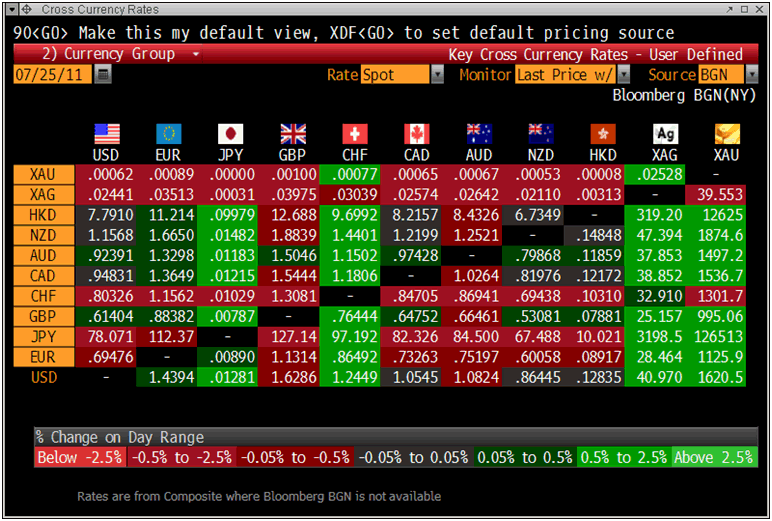

Cross Currency Rates

Asian indices fell with the Chinese indices in particular down sharply (CSI 300 -3.25%) on the U.S. debt impasse concerns.

The high speed train crash may have contributed to the larger losses in China but there are also growing concerns about the Chinese financial system and economy.

European indices have recovered from an initial sell off and peripheral Eurozone debt markets have seen some selling.

The tragic events in Norway may also have markets on edge and police around Europe are on increased alert regarding security threats. Geopolitical risk remains an important reason for maintaining allocations to precious metals.

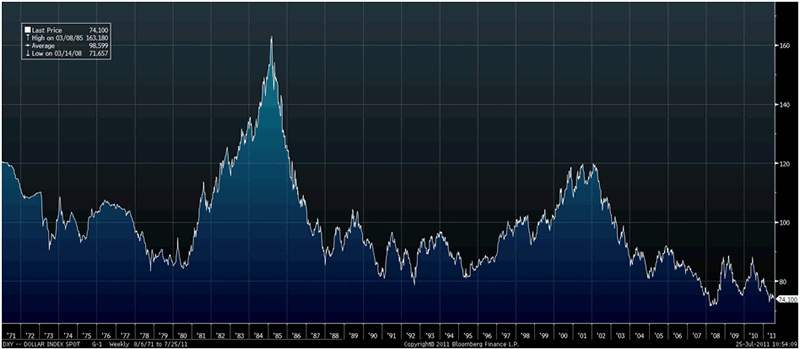

US Dollar Index – 1971-Today (Weekly)

Markets are spooked by the political theatre which continued in Washington over the weekend.

An eleventh-hour solution is expected before next Tuesday’s August 2 deadline when the U.S. Treasury has said that it would not be able to borrow any more funds.

At the same time, investors have cut their exposure to risky assets and the appalling fiscal situation in the U.S. is positive for gold and silver – whether the politicians come to an agreement or not.

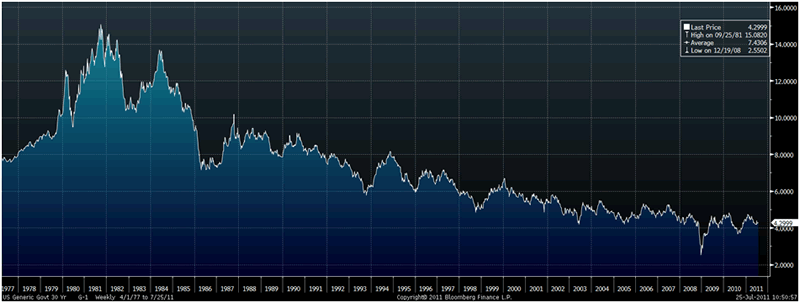

The dollar and US treasuries look set to come under pressure in the coming weeks – especially treasuries which remains close to record historical highs (record low yields) after a historic 30 year bull run.

US Generic Govt 30 Year Yield – 1977 to Today (Weekly)

Political posturing and alarmist rhetoric about ‘catastrophe’ and ‘Armageddon’ has been used by many, including President Obama and Treasury Secretary Geitner, but a default is quite unlikely as ratings agencies may be unlikely to downgrade the U.S. with the global financial system already in such a precarious state.

Regardless of whether the debt ceiling is raised, the Federal Reserve will continue to purchase the Treasury’s debt and Uncle Sam can continue to print an endless stream of money in order to redeem its bonds.

Also, in a worst case scenario, President Obama has the power to ignore the debt ceiling limit and could declare a national emergency due to the threat of “financial Armageddon’, thereby making redundant the divided Congress.

The debt ceiling will almost certainly be increased by next Tuesday which is bullish for gold and silver in the long term as it means that the dollar will continue to be printed en masse and the embattled world reserve currency will continue to be debased.

Throughout history, inflation, currency devaluation and currency debasement have never ended well.

Indeed, without exception currency debasement has ended in economic hardship for ordinary citizens.

World’s Top 15 Largest Gold Producers by 2010 Output and ‘Peak Gold’

Bloomberg published last week a table of the world’s largest gold producers, ranked by 2010 production and based on data from London-based researcher GFMS Ltd (all figures are in metric tons).

Rank |

Company |

2009 |

2010 |

1 |

Barrick Gold Corp. |

230.1 |

241.5 |

2 |

Newmont Mining Corp. |

162.9 |

167.7 |

3 |

AngloGold Ashanti Ltd |

143 |

140.4 |

4 |

Gold Fields Ltd |

106.6 |

102.4 |

5 |

Goldcorp Inc. |

75.3 |

78.4 |

6 |

Newcrest Mining Ltd |

49.2 |

72.8 |

7 |

Kinross Gold Corp. |

64.5 |

68 |

8 |

Navoi MMC |

62 |

62.5 |

9 |

Freeport-McMoRan |

74.8 |

52.9 |

10 |

Polyus Gold |

39.2 |

43.1 |

11 |

Harmony Gold Mining Co. |

45.2 |

41.7 |

12 |

Cia de Minas Buenaventura |

41.2 |

34.1 |

13 |

Agnico-Eagle Mines Ltd |

15.3 |

30.7 |

14 |

Zijin Mining Group Ltd |

30.7 |

30.1 |

15 |

Iamgold Corp. |

29.2 |

30.1 |

The figures are interesting as they show an increase in production is most of the major gold producers between 2009 and 2010.

However, the exception is with the African and South African producers where production fell quite sharply. The trend of falling gold production in Africa continues.

Annual gold production in South Africa has plummeted to 220 tonnes - levels last seen in 1922.

South African gold output has been falling since 1970 when annual production was over 1,000 tonnes. Gold production peaked at this time and has been falling steadily. It has fallen by an incredible nearly 80% since 1970.

The phenomenon of “peak oil” is widely known of and debated however “peak gold” may be of as great import and may be a more realistic threat as a U.S. or global Depression would see demand for oil drop sharply.

This would not be the case with gold and indeed demand for gold should increase in that event – due to safe haven and monetary demand.

SILVER

Silver is trading at $40.73/oz, €28.36/oz and £25.01/oz.

PLATINUM GROUP METALS

platinum is trading at $1,788.00/oz, palladium at $802/oz and rhodium at $1,900/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.