Outcome of Tax Cuts Following the 2001 Recession - Noteworthy Facts

Economics / US Economy Jul 23, 2011 - 05:55 AM GMTBy: Asha_Bangalore

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) lowered taxes on personal income, dividends and capital gains. Personal income tax rate for the highest bracket was reduced in steps from 39.6% (tax rate prior to EGTRRA) to 35% (after the JGTRRA legislation). These changes of income tax rates had sunset provisions and were set to expire in 2010; but they were extended under the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (TRUIRJCA).

The Economic Growth and Tax Relief Reconciliation Act of 2001 (EGTRRA) and Jobs and Growth Tax Relief Reconciliation Act of 2003 (JGTRRA) lowered taxes on personal income, dividends and capital gains. Personal income tax rate for the highest bracket was reduced in steps from 39.6% (tax rate prior to EGTRRA) to 35% (after the JGTRRA legislation). These changes of income tax rates had sunset provisions and were set to expire in 2010; but they were extended under the Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 (TRUIRJCA).

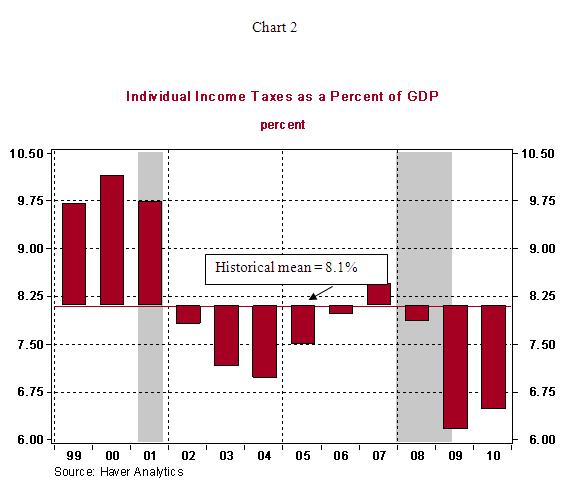

Tax cuts were enacted in 2001 and 2003 to support economic growth. One of the main tenets of supply side economics is that tax revenues would advance, not decline, following a reduction of tax rates. Contrary to these expectations, personal income tax revenues as a percent of GDP following the 2001 recovery came in below the historical mean of 8.1% for each of the years during the recovery/expansion period, with the exception of 2007 (see Chart 2).

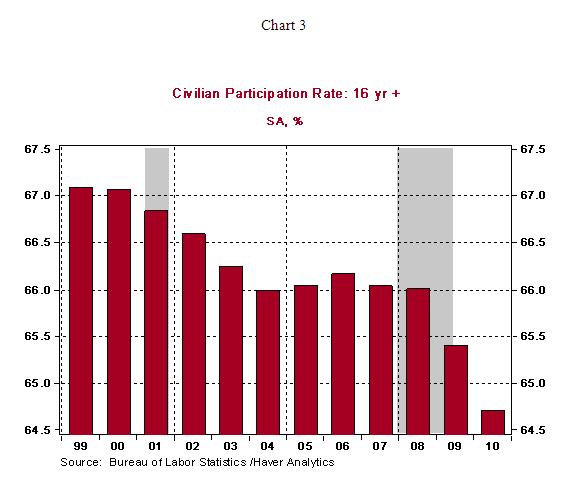

Also, the expected trajectory of economic growth did not materialize. As Chart 1 indicates, economic growth after the 2001 recession is the weakest in the post-war period (Recoveries prior to 1975 are not shown in the interest of keeping the chart reader friendly). Advocates of supply side economics/tax cuts also cite that the participation rate of the labor force increases as income taxes are reduced because work is favored in the work-leisure trade off in the new income tax environment. The participation rate stood at 66.8% in 2001 and fell to 66% by 2007 (see Chart 3), another proposition that failed to occur.

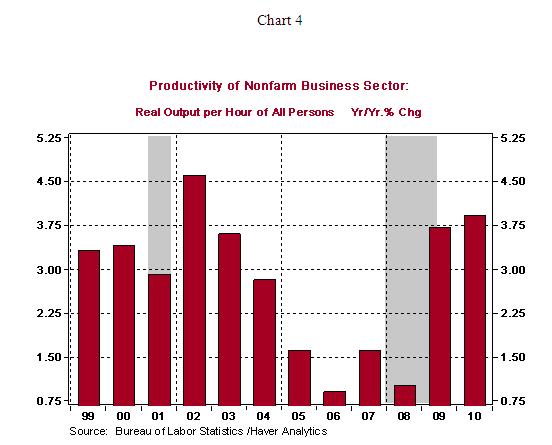

Gain in productivity growth is cited as benefit of a reduction of personal income taxes. Of course, other factors play a role in raising productivity of the economy in addition to a favorable tax environment. However, on this front also, the economic recovery after the 2001 recession falls short of predictions. Productivity of the U.S. economy shows a decelerating trend in the recovery/expansion phase after the 2001 recession (see Chart 4). These metrics suggest that projected benefits of a reduction in personal income tax rates are not visible in economic data.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.