Trouble Brewing In Credit Markets

Interest-Rates / Credit Crisis 2011 Jul 23, 2011 - 02:26 AM GMTBy: Tony_Pallotta

Credit markets continue to signal either a weakening economy or outright recession yet equities refuse to pay attention. With daily market volume dominated by intraday traders with no concern about macro data this comes as no surprise. The danger becomes that equity markets have no ability at forecasting any longer. The Great Recession saw equities peak just two months before contraction began. We may in fact be watching the same horrific forecasting ability play out if the credit markets are accurate.

Credit markets continue to signal either a weakening economy or outright recession yet equities refuse to pay attention. With daily market volume dominated by intraday traders with no concern about macro data this comes as no surprise. The danger becomes that equity markets have no ability at forecasting any longer. The Great Recession saw equities peak just two months before contraction began. We may in fact be watching the same horrific forecasting ability play out if the credit markets are accurate.

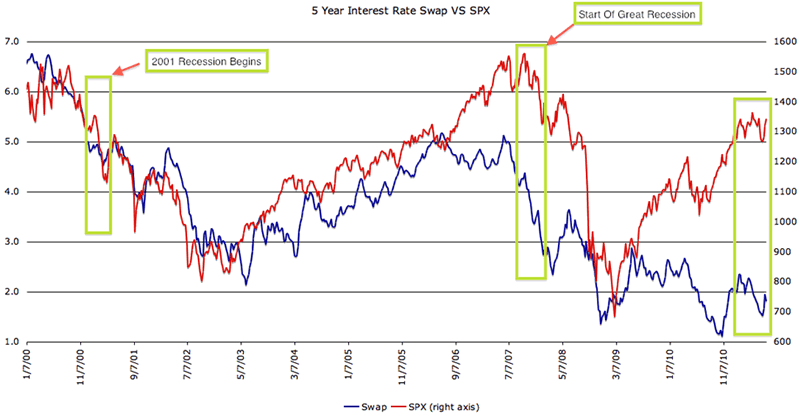

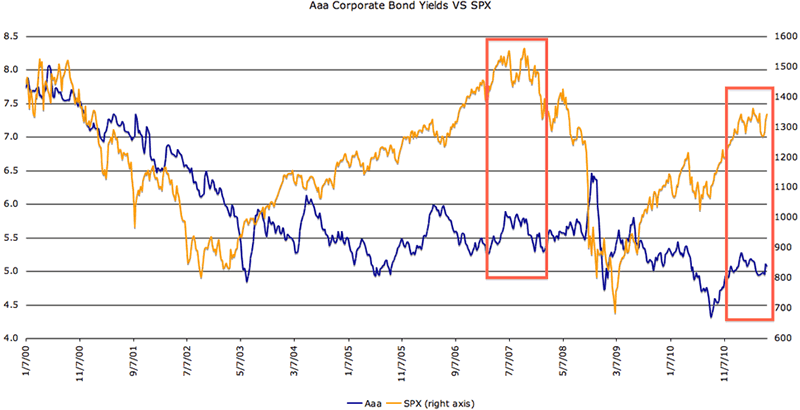

Below are three charts signaling trouble ahead for both the economy and the equity market. Equities have diverged from almost any correlation that existed for years. With a divergence you never know who is wrong. When countless relationships breakdown though and equities are always involved it becomes easier to say truly that "it's not you it's me."

5 Year Interest Rate Swap Spread

Corporate Bonds

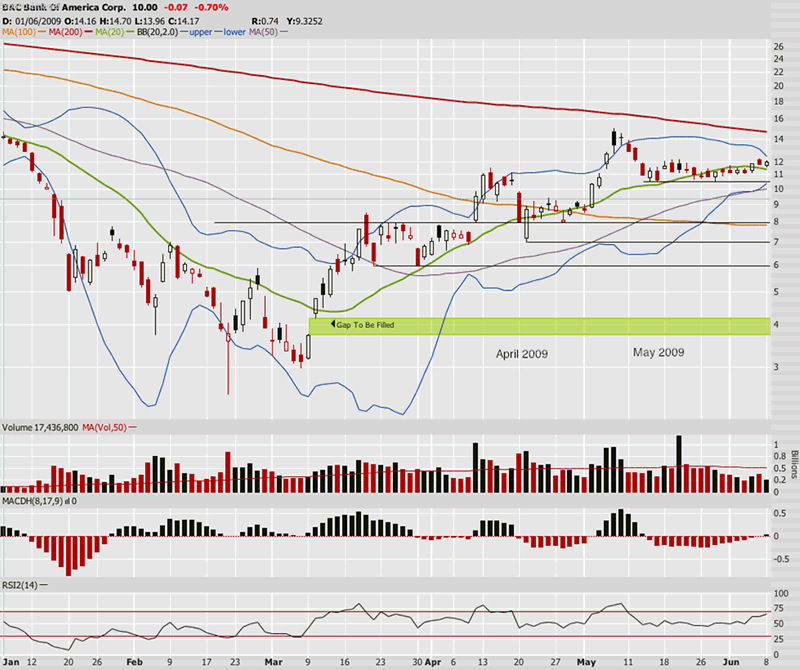

Bank Of America

And of course the real elephant in the room is BAC precarious close to completely breaking down. Below is a chart of March through May 2009. Yes you need to go that far back to find support levels and there are few remaining. Once 9.50 is breached the next stop is $8. At what point do the credit markets shut them out of any capital raises. At what point does contagion in the US banking sector bring this charade call the US Equity market down. If history is a guide we are in fact a lot closer than group think suspects.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.