How To Buy Stocks During Corporate Earnings Season

Companies / Company Chart Analysis Jul 21, 2011 - 02:29 PM GMTBy: David_Grandey

IT’S EARNINGS SEASON

IT’S EARNINGS SEASON

True to form with thrills (IBM, AAPL, VMW) and spills (RVBD, FTNT) earnings season is here in all its glory. So how do you go about buying a stock in the volatile climate? Let’s take a look at a couple of examples from the watch list in our newsletter — starting with an example of what not to buy, then an example of what we did buy and a stock that is setting up to be another good buy should conditions hold up.

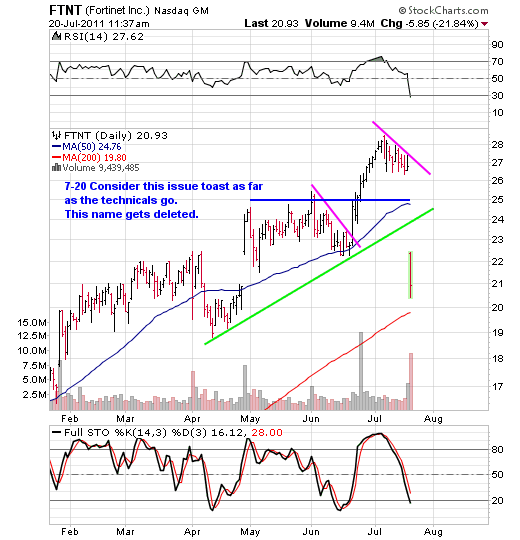

What not to buy:

Here we have FTNT that was setting up nicely before earnings. It was pulling back off of its highs in an orderly manner and was above support and the 50-day. What we wanted to see after earnings was the stock finding support at the 50-day or the blue or green lines. If that occurred, we would have stepped up to the plate to buy it. However, as you can see, the stock crashed through multiple areas of support and therefore is no longer a buy candidate.

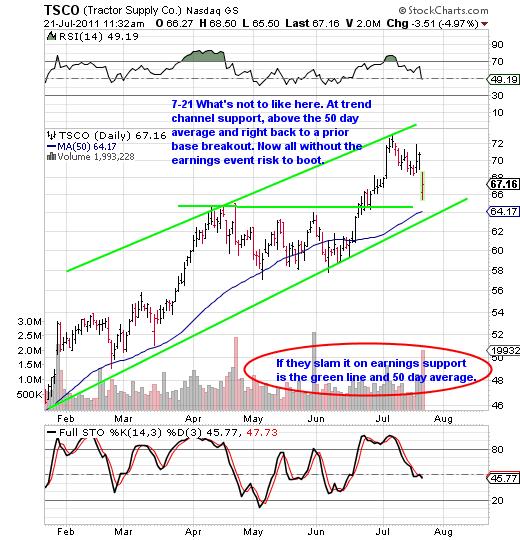

Now let’s take a look at what to buy:

Yesterday TSCO announced earnings and the stock went from 70.67 to the 65-66 range.

Why are we buying it on weakness? Because its uptrend is still intact as defined by the upward slopping green trendline. That’s what we wanted to see happen with FTNT.

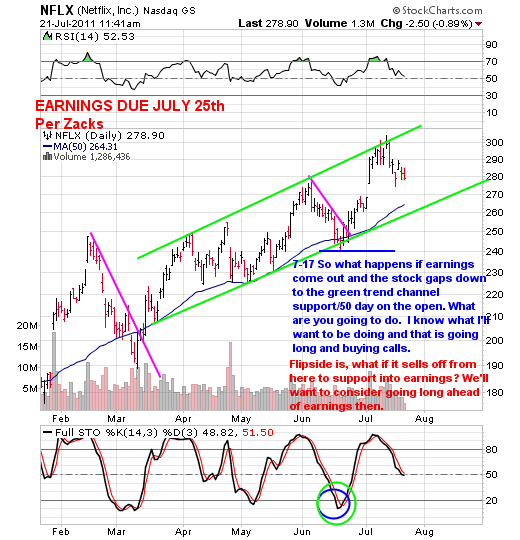

Now let’s take a look at a stock that is setting up nicely:

We want to see NFLX tag the 50-day after earnings. If so, we’ll initiate a long side trade.

“Let your stocks tell you what to do by the action they exhibit”

“We trade what we see, not think, hear or fear”

By David Grandey

www.allabouttrends.net

To learn more, sign up for our free newsletter and receive our free report -- "How To Outperform 90% Of Wall Street With Just $500 A Week."

David Grandey is the founder of All About Trends, an email newsletter service revealing stocks in ideal set-ups offering potential significant short-term gains. A successful canslim-based stock market investor for the past 10 years, he has worked for Meriwest Credit Union Silicon Valley Bank, helping to establish brand awareness and credibility through feature editorial coverage in leading national and local news media.

© 2011 Copyright David Grandey- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.