Gold, Silver and Midsummer Madness as Fed Prepares for US Debt Default

Commodities / Gold and Silver 2011 Jul 21, 2011 - 09:37 AM GMTBy: Jesse

"Why, this is very midsummer madness.” - William Shakespeare, Twelfth Night, 3.4.55

"We are developing processes and procedures by which the Treasury communicates to us what we are going to do," Plosser said, adding that the task was manageable. "How the Fed is going to go about clearing government checks. Which ones are going to be good? Which ones are not going to be good?"

Fed Preparing for US Default - Reuters

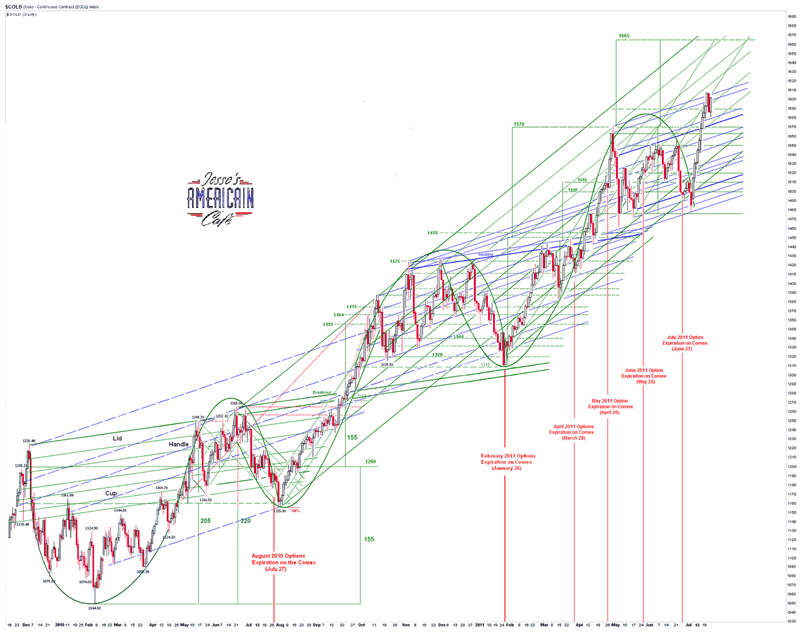

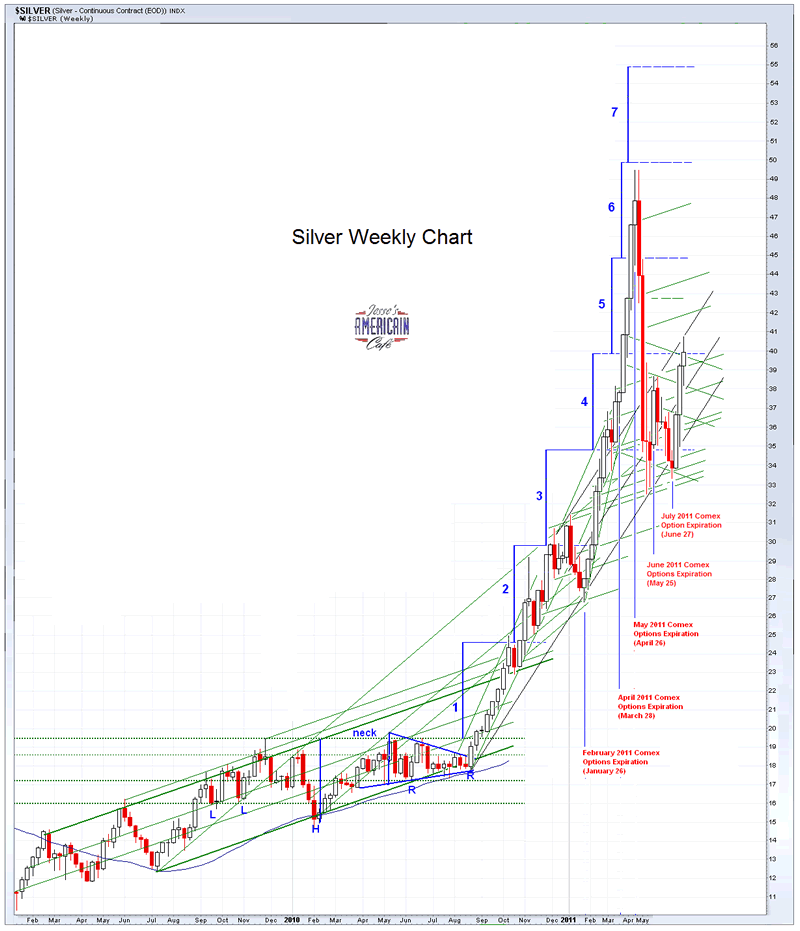

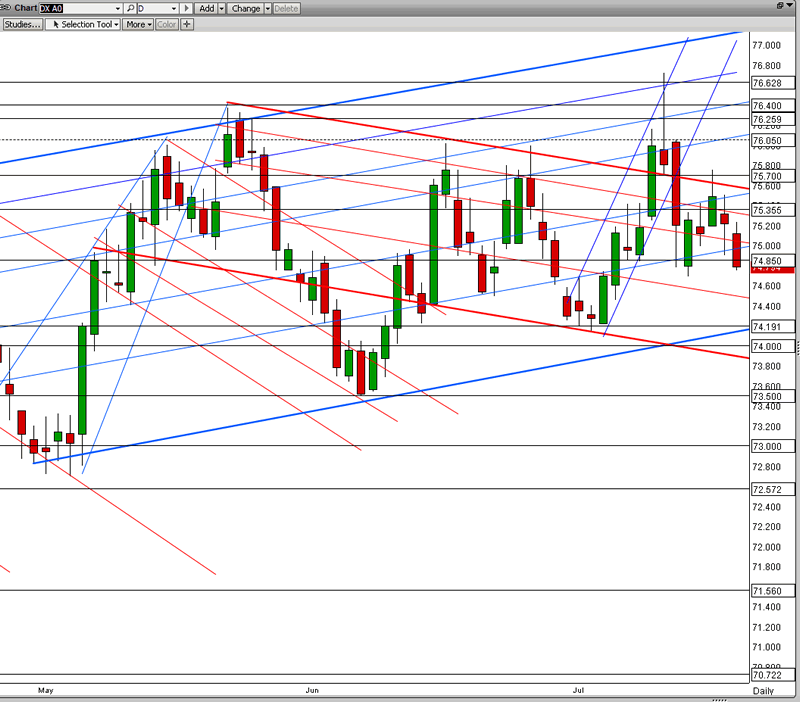

Very bullish reversal in the metals intraday, with closes in gold and silver above the psychological numbers of 1600 and 40 respectively.

If they can move higher and stick a close, and hold it through option expiration next week, you can say goodbye to these levels, the dollar, and quite a bit more.

As an aside, the other day I read an essay in a recent issue of Discover Magazine called, The End of Morality. I also found this commentary on it.

In this article, which promotes the triumph of scientific reason, utilitarianism, over what it contends are mere emotions, holdovers from history, it was put forward that it makes rational economic sense to kill one healthy person and harvest their organs, in order to provide them to five other people who can then live a higher quality of life, as an increase of goodness on the whole. The revulsion that one feels at murder is an unthinking instinct which can be overcome by higher thinking, the power of the will.

And it held this out as the higher 'good' in the new scientific morality, freed of the restraints of the mere instinct to preserve innocent life.

"You have these gut reactions and they feel authoritative, like the voice of God or your conscience. But these instincts are not commands from a higher power. They are just emotions hardwired into the brain as we evolved."

The logical extensions of such reasoning should be perfectly obvious to anyone with a sense of history.

And one does not even have to kill them to put them to the good service of the State, and those predestined for a higher quality of life, the übermenschen. At least, not in the beginning.

Plus ça change, plus c'est la même chose.

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.