Crowd Behavior Moves Gold, Silver and the SP 500…not the news!

Commodities / Gold and Silver 2011 Jul 20, 2011 - 12:36 PM GMTBy: David_Banister

How many times have you scratched your trading head wondering why gold or silver were either rallying hard or dropping hard on seemingly bearish or bullish news? How about the general stock market represented by the SP500 Index? Has it ever rallied when the headlines were horrible or tanked when the news seemed good? Well, welcome to crowd behavioral dynamics and investing!

How many times have you scratched your trading head wondering why gold or silver were either rallying hard or dropping hard on seemingly bearish or bullish news? How about the general stock market represented by the SP500 Index? Has it ever rallied when the headlines were horrible or tanked when the news seemed good? Well, welcome to crowd behavioral dynamics and investing!

At my TMTF service, I use Elliott Wave Theory combined with a few other indicators like sentiment gauges and Fibonacci relationships to forecast the coming bottom and top pivots in Gold, Silver, and the SP 500 indexes in advance. In doing so, I often ignore the day’s headlines completely and rarely if ever use them to forecast the next movements in the precious metals or broad stock markets.

Let me give some examples of why you should learn to ignore economic indicators, headlines, and talking heads on CNBC and elsewhere and focus on crowd behavioral patterns. Learning to scale in long when everyone is getting bearish and taking profits when everyone is universally bullish is much easier if you follow Elliott Wave Theory, and apply that theory correctly. If the matter between your ears is unabashedly biased, it will not work… one must be objective and open minded to change to survive these volatile markets.

Recently with Gold, we had a major drop from $1557 to $1482 over brief window of time. When I last wrote about Gold several weeks ago publicly, I presented a bullish and a bearish case. I had said Gold must close over $1551, otherwise it may have a truncated top and correct hard. Sure enough, a few days later Gold hit $1557 intra-day and could not get over $1551 on that close. Within days it collapsed and dropped below $1500. How did I know this in advance? Crowd Behavioral Patterns are repeated throughout the markets over and over again and again. Here is the original chart I sent out many weeks ago showing the possible drop:

Gold did end up dropping to the 20 week Exponential moving average at $1480 range, and as it did I noticed a clear “ABC” weekly pattern. Now this is an Elliott Wave pattern that can warn you of an imminent bottom in Gold in this case. In late June, after this major correction I wrote up another chart and showed a potential bottom coming in Gold around 1480, and then on July 5th I confirmed the Bull views on Gold were coming back into play, which you can see with the June 29th chart I did below for my TMTF subscribers:

We were able to adjust our views from short term bearish to moving back to bullish and still catch the big swing in Gold. The precious metal rallied from $1480 ranges to $1610 recently, and now is likely to go through a minor correction to $1568 or so. All of this is the crowd’s action together pushing positions into overbought stages of hysteria, and back to oversold stages of pessimism…I simply track those patterns and try to forecast the next move ahead of the crowd running in or out.

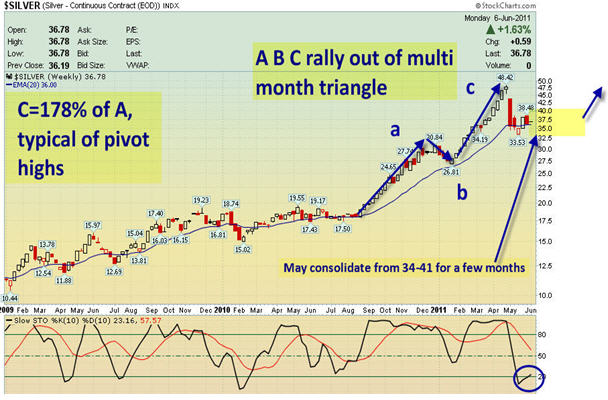

Another sample is Silver as it collapsed from $49 down to $32-$33 per ounce not long ago. After the dust settled I sent out a chart and told my TMTF subs we would likely see Silver trade in the $34-$41 range for quite a while, before mounting another attack back towards $50. Right now I see Silver soon running to $45-$47 per ounce once it takes a breath. Below is the original early June silver chart I sent to my TMTF subscribers: We had an ABC strong rally which we forecast at TMTF in late August 2010 ahead of time, and once those rallies are over it takes quite a while to work off the sentiment.

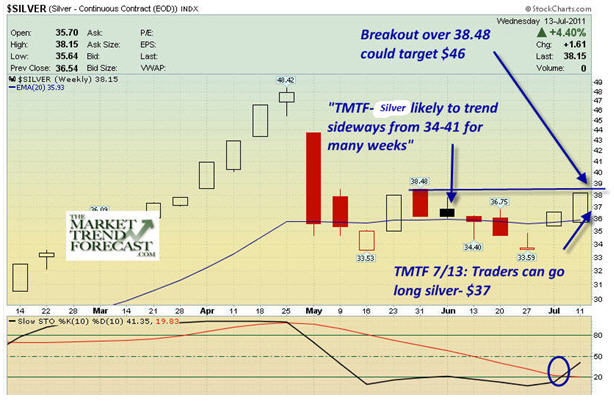

Silver has indeed consolidated as forecast for about 7 weeks now between 34-41, having recently hit $40.80 and backed off. I expect Silver to break out over this range soon and attack $60 by year end as possible, but certainly $46-$50 by the fall. Last Wednesday I finally went bullish again based on crowd patterns and told my subs to go long at $37 as you can see below in the chart sent out then with a target of $46 likely coming. The herd of investors had formed yet another ABC weekly pattern, and it was time to go long.

Finally we look at the SP 500 which I forecast on a regular basis as well using Elliott Wave Theory and other indicators. This past week or so we saw a huge drop in the SP 500 and broader markets supposedly on Italy concerns and Eurozone issues. Although I am well aware of these issues, they are used to explain what just happened in the stock market, but not forecast it. Late last week I sent out the chart below to my subscribers and said as long as 1294/95 pivot holds, I remain very bullish on the markets. The SP 500 hit 1295 and has since rallied 31 points in a few days catching everyone off guard. That is Crowd Behavior 101 if I ever saw it!

The bottom line is understanding that the precious metals and broader markets tend to move based on major swings in sentiment from optimistic to pessimistic. The collective psyche of the herd is the most important because we can have periods of very bad news where the market will continue to rally, and also periods of seemingly great news when the market is dropping. The perception of the news of the day and how the crowd decides to react is more important than the news itself! If you’d like to try the TMTF service and take advantage of a coupon as well, go to www.MarketTrendForecast.com and check us out. You can also sign up for an occasional but somewhat infrequent free reports.

Dave Banister

CIO-Founder

Active Trading Partners, LLC

www.ActiveTradingPartners.com

TheMarketTrendForecast.com

Dave Banister is the Chief Investment Strategist and commentator for ActiveTradingPartners.com. David has written numerous market forecast articles on various sites (SafeHaven.Com, 321Gold.com, Gold-Eagle.com, TheStreet.Com etc. ) that have proven to be extremely accurate at major junctures.

© 2011 Copyright Dave Banister- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.