Gold to Rise on $14.3 Trillion U.S. Debt Limit Increase

Commodities / Gold and Silver 2011 Jul 20, 2011 - 07:11 AM GMTBy: GoldCore

Gold is trading at $1,587.56/oz, €1,115.72/oz and £983.31/oz.

Gold is trading at $1,587.56/oz, €1,115.72/oz and £983.31/oz.

Gold is flat in U.S. dollars and New Zealand dollars but marginally lower in most currencies today as increased risk appetite has seen risk assets rally despite poor fundamentals. Most Asian indices were higher, except the Chinese and Indian markets, and European indices have also risen.

Gold is trading at USD 1,587.00, EUR 1,116.1, GBP 983.50 and CHF 1,302.10 per ounce.

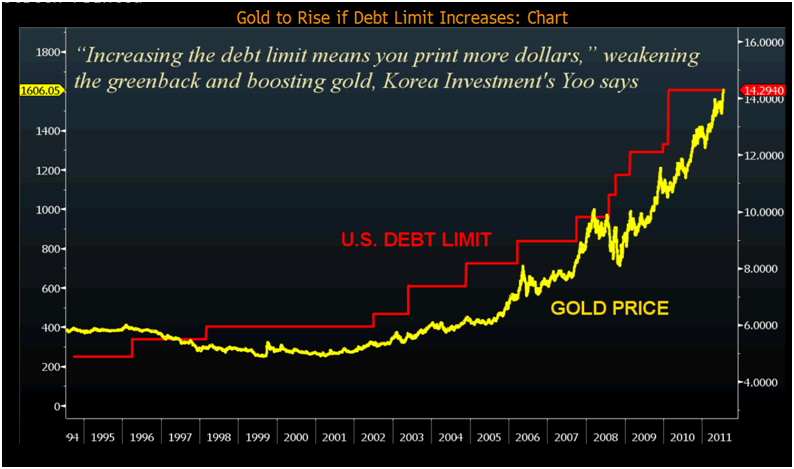

Bloomberg Chart of the Day from Korea Investment

Respite has also been seen in Eurozone debt markets with bond yields falling. Rumours of ECB intervention through peripheral bond buying have helped steady things but the ECB has not given any indication that it is supporting vulnerable European sovereign debt markets.

For now markets appear more interested in Apple’s massive profits than Uncle Sam’s massive debts.

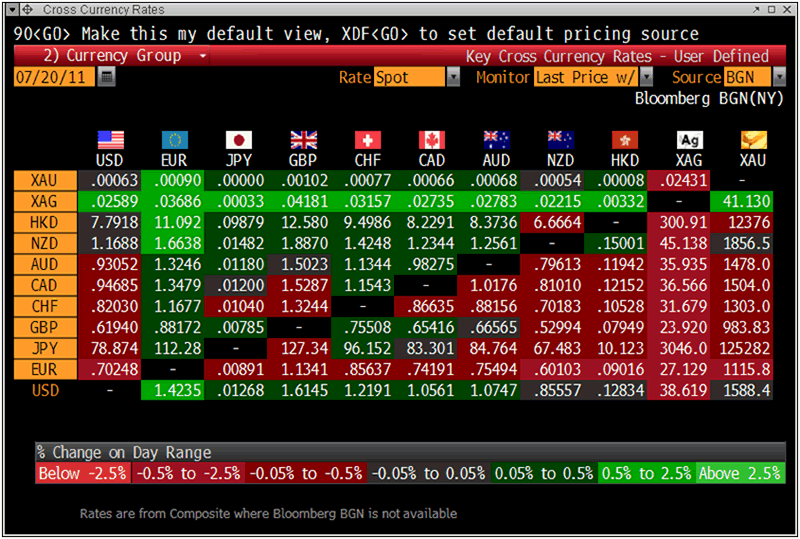

Cross Currency Rates

The Republican controlled U.S. House, defying a veto threat, voted last night (234-190) to slice federal spending by $6 trillion and require a constitutional amendment for a balanced budget to be sent to the states in exchange for averting a threatened Aug. 2 government default.

Treasury Secretary Timothy Geithner has said the government will run out of options to prevent a default by August 2 – in 13 days time.

Standard & Poor’s Ratings Services and Moody’s Investors Service have said they are likely to downgrade the U.S.’s credit rating if Congress doesn’t act.

An increase in the $14.3 trillion U.S. debt ceiling is inevitable and is a question of when rather than if.

The Bloomberg Chart of the Day (see above) shows how gold in dollars is correlated with increases in the U.S.’s debt limit, particularly in the last 10 years.

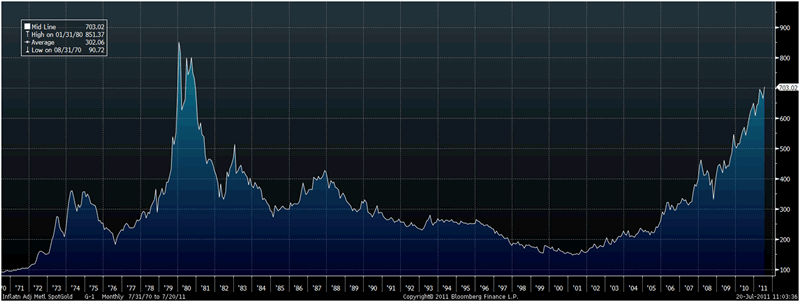

Bloomberg Composite Gold Inflation Adjusted Spot Price – 1970-2011

Julia Yoo, a Seoul-based analyst at Korea Investment told Bloomberg that “gold’s rally is quite explosive.”

“Increasing the debt limit means you print more dollars, which will weaken the dollar and consequently lift the gold price,” adding to gains this year that were driven by demand from countries including China.”

Gold is 12% higher in dollar terms so far in 2011 and is the best performing currency in the world in the last 12 months.

Gold has risen 33% against the U.S. dollar over the past year, outpacing all of the more than 150 currencies tracked by Bloomberg.

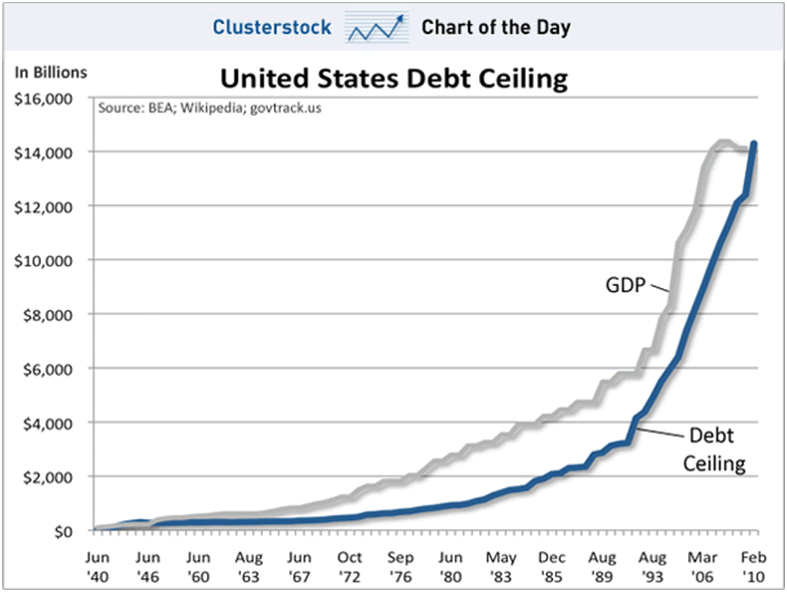

United States Debt Ceiling 1940-2011

However, over the long term gold remains undervalued or at worst fairly valued.

Admittedly, gold has risen by nearly 6.5 times in the last 11 years.

However, in the last bull market in the 1970’s, gold rose 24 times from $35/oz to over $850/oz in 9 years. Gold remains well below its 1980 record high of $2,400/oz when adjusted for inflation.

The macroeconomic conditions today are even more conducive to gold than they were in the 1970’s.

Most industrial nations such as the US, Japan, Germany etc were creditor nations in the 1970’s.

Today they are debtor nations with the US the largest debtor nation the world has ever seen. The fiscal situation in the US is appalling and deteriorating – with a National Debt of nearly $14.5 trillion and unfunded government liabilities of between $60 trillion and $100 trillion.

As long ago as 2003 we said that this inflation adjusted high price from 1980 would likely be reached and surpassed. We said that at that stage gold could be in a bubble and it would be time to reduce allocations while keeping a core financial insurance holding in gold.

In 2005, we said that the growing property bubbles in the UK, the U.S. and the massive debt levels in the western world (household, mortgage debt and in the banking system) would likely lead to a deterioration in government balance sheets and sovereign debt crises which in turn could lead to currency crises.

We are entering the late intermediate to final stage of this process and the real risk of a currency crises in any one of the major fiat currencies rises by the day.

SILVER

Silver is trading at $38.57/oz, €27.11/oz and £23.89/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,764.00/oz, palladium at $786/oz and rhodium at $1,900/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.