Will Gold GLD and Silver SLV ETF's Continue to Correct?

Commodities / Gold and Silver 2011 Jul 20, 2011 - 03:32 AM GMTBy: George_Maniere

There’s an old saying. “What goes around comes around.” Well today President Obama held a quick press conference and announced that the “Gang of Six” had presented him a compromise plan that he felt everyone could agree on. The market immediately spiked up on the news and gold and its baby brother silver did exactly what I thought it would do. It sold off. So what goes around comes around – just usually not that fast.

There’s an old saying. “What goes around comes around.” Well today President Obama held a quick press conference and announced that the “Gang of Six” had presented him a compromise plan that he felt everyone could agree on. The market immediately spiked up on the news and gold and its baby brother silver did exactly what I thought it would do. It sold off. So what goes around comes around – just usually not that fast.

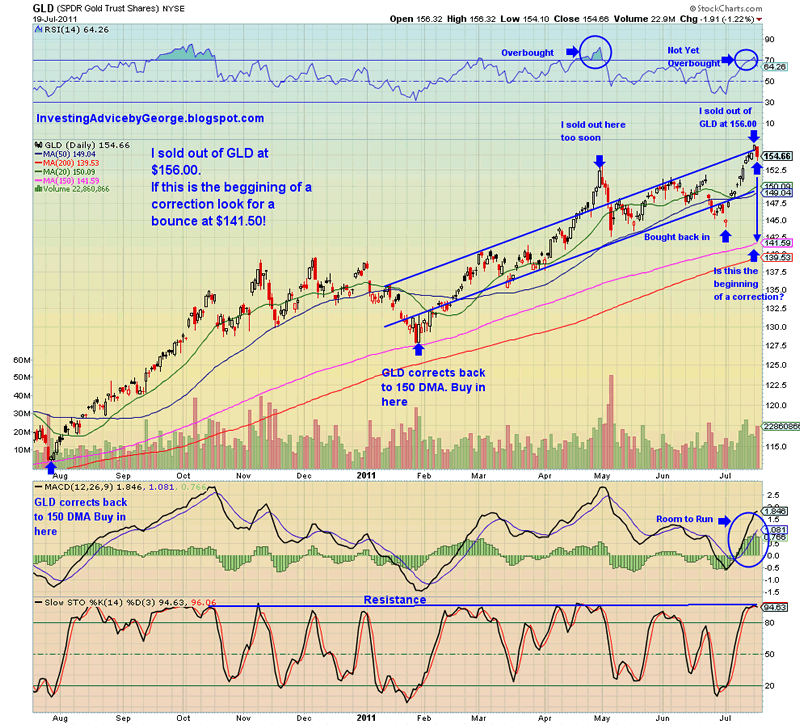

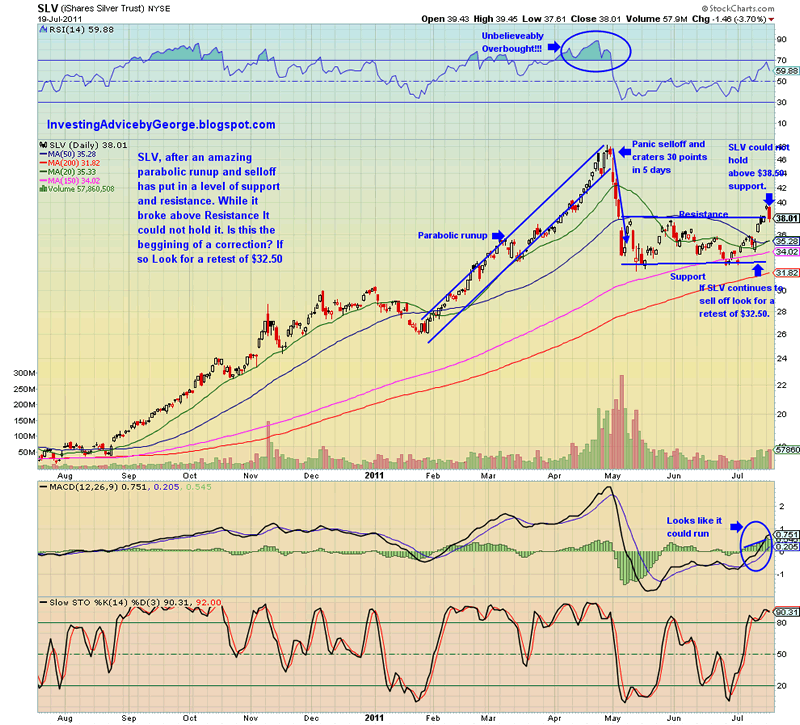

Gold and silver have both had an extraordinary run and they were showing signs of running out of steam. A pull back like this is both an expected and healthy event in the bull market they have just experienced. If this is the pullback I have been predicting we will see gold move to the 150 day moving average at around $141.00 and silver will pull back to $34.00 - $35.00. If it is the correction I’ve been predicting we’ll know about it soon. As at the end of April both gold and silver were trading on “irrational exuberance” and they both encountered a stunning selloff. I conclude that the only difference today was the impetus that both metals received from President Obama’s announcement.

I by no means want to imply that the gold and silver trades are finished, far from it. At times like this when a commodity like gold has experienced a parabolic run and broken the psychologically important $1600.00 level it is natural for institutional investors to take their profits and run for greener pastures like pork belly futures of frozen concentrated orange juice. Indeed from a contrarian point of view I see this as a very bullish indication for both gold and silver. This would lead me to believe that the precious metals trades are still engulfed by an underlying feeling of skittishness and could possibly continue to selloff. The would be very good news for my readers because I advised them to take their profits on GLD at $156.00. I reminded my readers of the teachings of Bernard Baruch who would rather sell a holding and watch it run up another twenty percent than watch it crater and lose all of his hard earned profits.

I also advised my readers to sell SLV yesterday. As I have been writing, I was still puzzled by SLV. I still had a nagging feeling that the faint of heart investors had not been sufficiently punished and I felt SLV would go back and test support at $32.50. Yesterday, I advised my readers and I sold out of my half position in SLV at 39.46. I must admit I questioned myself but as Gerald Loeb taught us, you can know everything about fundamental analysis and everything about technical analysis but in the end it’s the man who can tell which way the wind is blowing that will be successful. I trusted my instincts and sold the SLV. However to test my thesis, as an insurance policy I kept my position in PSLV and watched it close down 5% on the day.

While we enjoyed a strong market yesterday with the DOW closing up 202 points I am not buying into it for one minute. In fact I used it as an opportunity to build some cash. Yesterday Apple (AAPL) reported earnings and hit a grand slam home run. It closed at $377 and was trading over $400.00 in the after markets. This leads me to conclude that we may see yet another up day tomorrow and if we do I will be there selling into strength. The reason is that when the dust settles from these earnings reports I believe the market is going to sell off and I will have ample dry powder to put to work. These earnings reports are going to make it very difficult for Dr. Bernanke to make a case for another round of quantitative easing. I conclude that he will have to go in through the back door. We’ll call it stealth QE.

Let’s not forget that while the global corporations are hitting the ball out of the park the middle class common man is still nagged by the debt crisis in Europe, extremely high unemployment, sagging home prices, the nagging suspicion that another round of quantitative easing is just around the corner and the sad fact that despite what president Obama says until the partisan bickering is ended and some compromise is formalized we will continue to have the possible catastrophic possibility of default continue to hang over us like a dark cloud.

Please see the enclosed charts on GLD and SLV below.

Gold could not hold the psychologically important $1600.00 level. If it continues to sell off, look for a bounce at the 150 day moving average at 141.50.

Silver could not stay above resistance at $38.50. If it continues to sell off look for a retest of the $32.50 level.

In conclusion tomorrow will be a very interesting day. If gold and silver continue to sell off look for a bounce to the levels to buy back in. This trade may have to reset itself before it moves higher. However, have no fears. It is not a question of if they will both go higher, it is a question of when.

By George Maniere

http://investingadvicebygeorge.blogspot.com/

In 2004, after retiring from a very successful building career, I became determined to learn all I could about the stock market. In 2009, I knew the market was seriously oversold and committed a serious amount of capital to the market. Needless to say things went quite nicely but I always remebered 2 important things. Hubris equals failure and the market can remain illogical longer than you can remain solvent. Please post all comments and questions. Please feel free to email me at maniereg@gmail.com. I will respond.

© 2011 Copyright George Maniere - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.