U.S. Treasury Spreads Widen on Debt Concerns; Bond Market Revolt Awaits QE3

Interest-Rates / US Bonds Jul 19, 2011 - 04:46 AM GMTBy: Mike_Shedlock

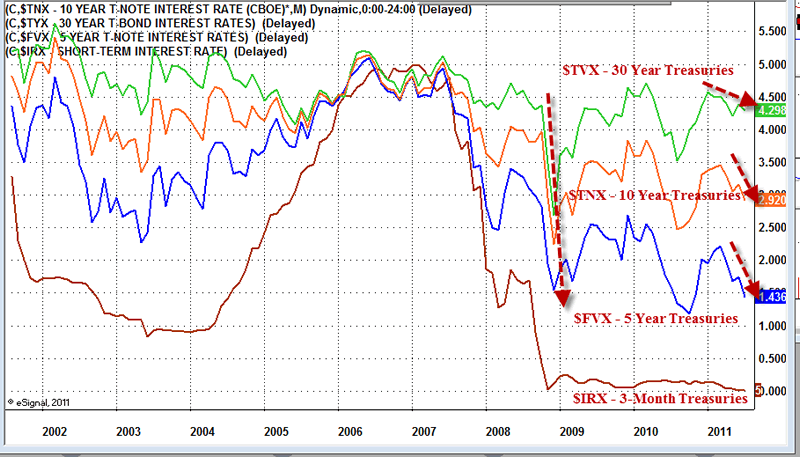

long-end of the treasury curve is acting sick, smack in the face of a clearly slowing global economy.

Please consider Treasury Five-to-30 Spread Near Widest This Year on Debt Ceiling Concern

The spread between five- and 30-year Treasury yields was near the widest since November as U.S. officials struggled to reach agreement on how to raise the debt ceiling to avoid a default.

Treasury 30-year yields climbed yesterday as President Barack Obama vowed to veto a Republican proposal to impose mandatory budget cuts.

Fitch Ratings reiterated its plan to reduce its U.S. rating in the event of a debt default.Treasury spreads, oil prices, and food prices would likely make Bernanke's life miserable should he decide any time soon to embark on another round of Quantitative Easing.

Sadly, some economists calling for QE3 simply cannot see the obvious. Please see University of California Economist Bradford DeLong is Blind: "I Don’t See Any Argument Against QE3" for a discussion.

Yield Curve 2011-07-18

Not Just a Debt Ceiling Concern

The long end of the curve is acting sick. I do not believe this is merely a "debt ceiling" concern, but rather a "debt" concern.

Democrats and Republicans alike have refused to do much of anything but point fingers and throw stones at the other party.

Bernanke has not helped matters by butting into fiscal issues and by threatening QE3 if the economy worsens. For further discussion, please see Bernanke Interferes in Fiscal Policy Yet Again, This Time Hoping to Place the Blame on Congress Rather than the Fed

In 2010, the bond market and stock markets were both cooperative with Bernanke's actions. However, it is a huge mistake to believe that will always be the case.

At some point the bond market will revolt when Bernanke gets too cute, too many times. That revolt may be sooner than anyone thinks

By Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com Click Here To Scroll Thru My Recent Post List

Mike Shedlock / Mish is a registered investment advisor representative for SitkaPacific Capital Management . Sitka Pacific is an asset management firm whose goal is strong performance and low volatility, regardless of market direction.

Visit Sitka Pacific's Account Management Page to learn more about wealth management and capital preservation strategies of Sitka Pacific.

I do weekly podcasts every Thursday on HoweStreet and a brief 7 minute segment on Saturday on CKNW AM 980 in Vancouver.

When not writing about stocks or the economy I spends a great deal of time on photography and in the garden. I have over 80 magazine and book cover credits. Some of my Wisconsin and gardening images can be seen at MichaelShedlock.com .

© 2011 Mike Shedlock, All Rights Reserved.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.