Unfair U.S. Tax Burden Falls Disproportionately on Individuals and Small Business

Politics / Taxes Jul 18, 2011 - 11:28 AM GMTBy: Jesse

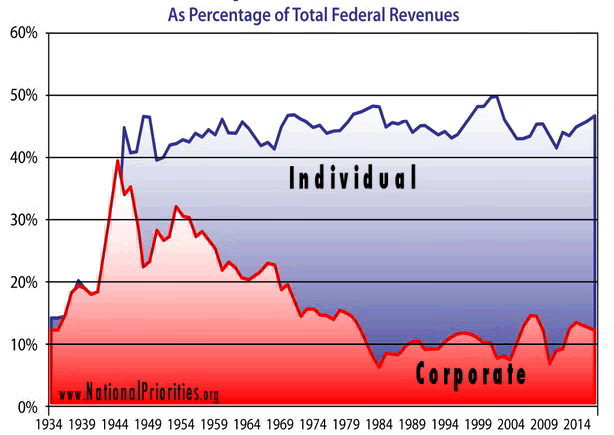

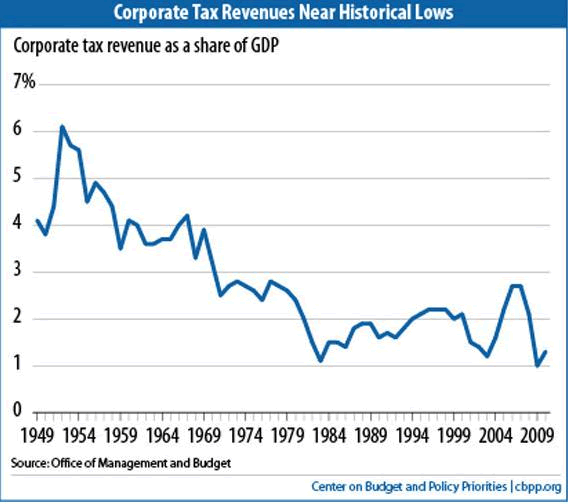

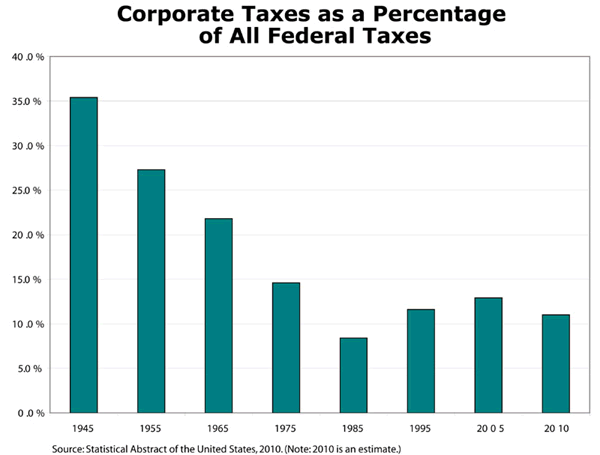

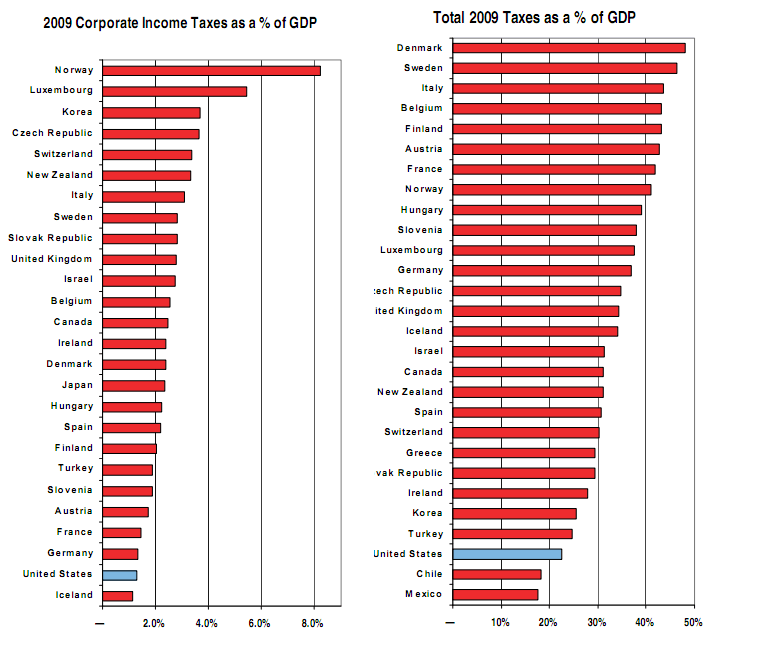

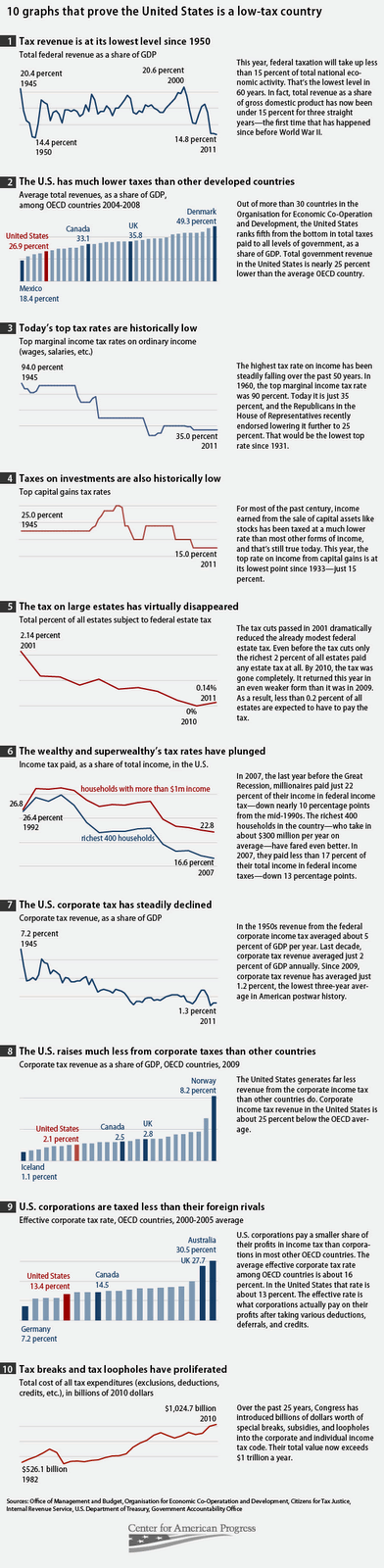

Although the nominal US corporate tax rate of 35% seems high, and especially so given all the corporate funded propaganda promoting more tax cuts and givebacks, in fact the realized corporate rates are relatively low both in terms of historical experience and other countries. This is because of the many loopholes, subsidies, and accounting gimmicks available to its more influential corporate citizens from the corporate friendly government.

Although the nominal US corporate tax rate of 35% seems high, and especially so given all the corporate funded propaganda promoting more tax cuts and givebacks, in fact the realized corporate rates are relatively low both in terms of historical experience and other countries. This is because of the many loopholes, subsidies, and accounting gimmicks available to its more influential corporate citizens from the corporate friendly government.

One could make the case that the tax burden is falling disproportionately on smaller businesses and individuals that do not have the infrastructure and latitude to take advantage of the loopholes available to the bigger business lobby companies.

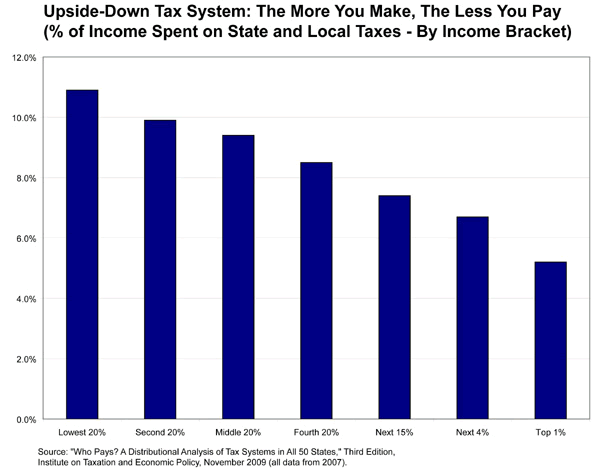

State and local taxes appear to be regressive. The top echelons of corporations and private individuals seem to be doing rather well for themselves. When the fortunate complain that the bottom percentiles pay little Federal tax, they overlook how regressive the consumption taxes on gasoline, food, and consumer non-discretionary items fall on those with little income. Even with property taxes, the wealthy often use the guise of 'farms' to avoid a sizable share of their local taxes by raising a few cows or a token crop.

No wonder that the corporate class economists promote increased consumption taxes, and the oligarchs spend millions to persuade the naive that their hell is a heaven.

P.S. Like a dog returneth to its vomit, so a few readers have made comments that depend on the efficient market hypothesis, some idealistic and simple model of macroeconomics, and the 'trickle down' theory of economic progress. There is little more theory behind this, and if I ask them about it they don't understand how it fits in. They have little knowledge other than sound bytes they have learned by rote from the corporate media and pundits, and a 'common sense' that is so far removed from reality as to be almost delusional.

To wit, if corporations pay more taxes, they will just raise prices, raising costs for the consumer. So we should reduce their taxes and take the 'savings.' And if the government raises more revenue from corporate taxes, it will reduce economic growth and freedom and provide them more money to waste on illegal immigrants and greedy old people.

Men do act madly in herds, especially with the right instruction and incentives, but regain their sensibility one at a time.

Download Ten Charts from Center for American Progress

By Jesse

http://jessescrossroadscafe.blogspot.com

Welcome to Jesse's Café Américain - These are personal observations about the economy and the markets. In providing information, we hope this allows you to make your own decisions in an informed manner, even if it is from learning by our mistakes, which are many.

© 2011 Copyright Jesse's Café Américain - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.