Gold is Not Money

Commodities / Gold and Silver 2011 Jul 18, 2011 - 03:53 AM GMTBy: Bob_Kirtley

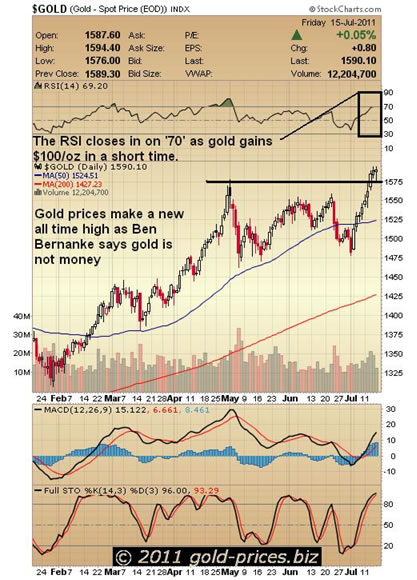

So there you have it, after 6000 years of being money, gold is not money according the Federal Reserve Chairman, Ben Bernanke. Ron Paul asked him directly and the answer was ‘no’ as you can see on this five minute clip. This is a strange comment coming at a time when gold prices are making all time highs as we can see on chart below, where gold is sitting at $1590.10/oz.

Our reading of history tells us that gold has long been recognized as a medium of exchange for international trade and a consistent store of value or wealth. We will have to agree to differ with Ben Bernanke on this point and try to make the best of the situation as we see it.

With real interest rates being negative an alternative to paper money is sort after by those who need to protect whats left of their wealth, hence both gold and silver prices have been making steady progress for the last ten years. Have the fundamentals changed for the precious metals, not in our humble opinion, the euro-zone is drowning in debt as clueless politicians dash from meeting to meeting in the hope that someone will pull a rabbit out of the bag. Some hope!

Across the pond we have a president, who like most politicians is focused on keeping his ass in the White House to the detriment of the American economy. All around us government, at all levels, has grown to monstrous proportions and now acts as a enormous drag on the private sector, which is battling to merely survive. There comes a time when we have to take medicine which is unpalatable, but necessary in order to recover, but those who are in a position to administer such medicine just don’t have the courage to do so and so we stagger from a sneeze to the flu to pneumonia in an economic sense.

We are stuck in this quagmire and can only anticipate that things are going to get worse before they get better. The tragedy here is that as things do get worse, those responsible for dragging us down will continue to interfere at a greater and deeper level making the situation worse. Under the banner of what is ‘good for us’ we will progressively lose our ability to operate as we see fit and will be corralled into a highly controlled state pig pen.

So, Defense how do we get the ball back?

First up is that the trend is your friend and both gold and silver have performed spectacularly well over the last decade so stick with them. Make sure that you can ‘touch’ your precious metals, keep them out of the banks and in a secure privately owned depository if its a large amount or in a safe place close to you if its a small amount.

The next step is to acquire a small number of quality mining stocks, something that we did some time ago and occasionally increase our exposure as and when the opportunity for a bargain presents itself. However, we are looking at the mining sector with some trepidation at the moment despite a growing call for these stocks to explode higher any minute now. As we see it the financial crisis is not behind us, it is in front of us and when it comes

there is the possibility that both gold and silver producers will be considered as ’stocks’ and will be sold off regardless of their fundamentals, in the rush to generate cash and meet margin calls, etc. So for now we are observers here rather being active participants, but we still hold a core position in stocks.

The question of leverage and how to use it is often put to us and yes it does have a place in an investment strategy. You could borrow money to make a purchase, you could do the same by buying on margin, however, we don’t recommend either as the downside can and has been a painful financial bath for some. You could sally forth into the futures market and some of our subscribers have been successful using such a vehicle, however, your loses can be limitless, which in turn can lead to a few sleepless nights. If you can’t sleep then you are in too deep and being tired is not conducive to good decision making. Our preference at the moment to utilize options to give our trading account a bit of a boost.

Once an option has been purchased then you can relax a little as the purchase price is the maximum that you can lose so your loses are limited. Although you do need to stay vigilant and disciplined as the time factor is working against you and is constantly decaying the value of your position. We cannot overstress the importance of you being absolutely confident in that your purchase has the ability to move into profit quickly. Not for those of a nervous disposition as you can imagine. However we did receive a really nice comment on our site this morning regarding our latest trae which read as follows: “Still in the trade at a nearly $7000 profit in addition to the other trades. I have nearly doubled our self-directed 401k in the last year with your service.

Thanks so much for your service.” So its not all doom and gloom out there, but it does take a little time to become aware of the state we are in and just what lies around the corner. Get your head up and take a good look at your surroundings, note the positives and the negatives and keep asking the question of just how can you best position yourself to get through the next few years, you may be surprised by the quality of your own skill sets and your own ability to apply them to great personal advantage.

Finally, try and trade in a relaxed manner, with a smile on your face and not when you are wound up as tight as a drum, you will make better judgment calls that way. For those subscribers who are too busy to trade their own accounts we are now able to offer an Autotrading program with our SK OptionTrader service, as we are pleased to announce that we have entered into a partnership with Global AutoTrading and therefore auto trading is now available for SK OptionTrader signals.

To stay updated on our market commentary, which gold stocks we are buying and why, please subscribe to The Gold Prices Newsletter, completely FREE of charge. Simply click here and enter your email address. (Winners of the GoldDrivers Stock Picking Competition 2007)

For those readers who are also interested in the silver bull market that is currently unfolding, you may want to subscribe to our Free Silver Prices Newsletter.

DISCLAIMER : Gold Prices makes no guarantee or warranty on the accuracy or completeness of the data provided on this site. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This website represents our views and nothing more than that. Always consult your registered advisor to assist you with your investments. We accept no liability for any loss arising from the use of the data contained on this website. We may or may not hold a position in these securities at any given time and reserve the right to buy and sell as we think fit. Bob Kirtley Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.