Gold and Silver Could Go Parabolic Due to Global Shockwaves if U.S. Defaults

Commodities / Gold and Silver 2011 Jul 15, 2011 - 07:34 AM GMTBy: GoldCore

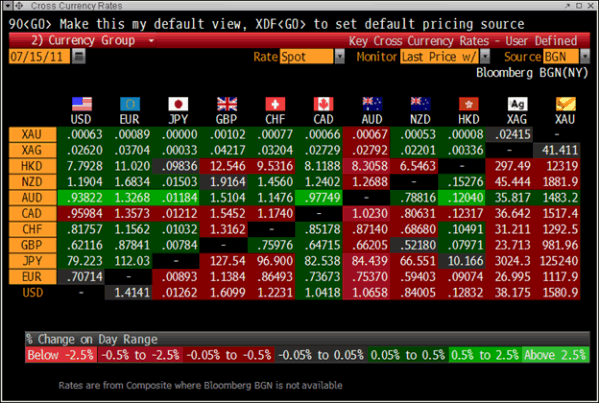

Gold is trading at $1,580.40/oz, €1,117.36/oz, £980.76/oz.

Gold is trading at $1,580.40/oz, €1,117.36/oz, £980.76/oz.

Gold is some 0.5% lower against the U.S. dollar and most currencies today but higher in Australian dollars as the Aussie fell on Australian and global economic growth concerns. Asian equity indices were mixed as are European indices.

Cross Currency Table

Bond markets have seen subdued trading but Greek bonds are again under pressure and the Greek 10-year yield has risen to 17.37% in increasingly illiquid trade.

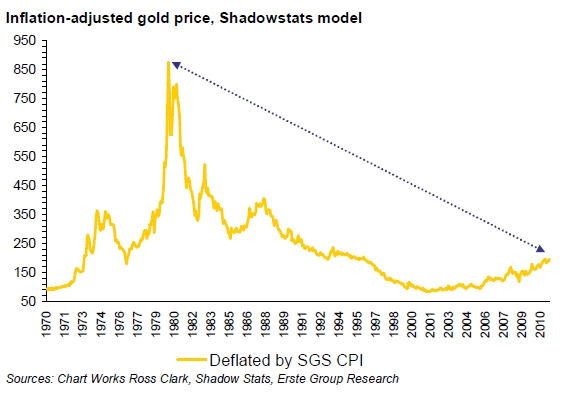

The dawning reality that the U.S. will be downgraded due to its appalling fiscal position led to new record nominal gold and silver prices yesterday.

Denial regarding the possibility of a U.S. default continues with some analysts denying that such an event is "possible". Such an event is possible and it grows more likely by the day.

US Federal Reserve Chairman Ben Bernanke warned overnight that a default on America's debt will spark a major crisis and send shockwaves through the global economy.

"The Treasury security is viewed as the safest and most liquid security in the world, and the notion it would become suddenly unreliable and illiquid would throw shockwaves through the entire global financial system," he told a congressional committee.

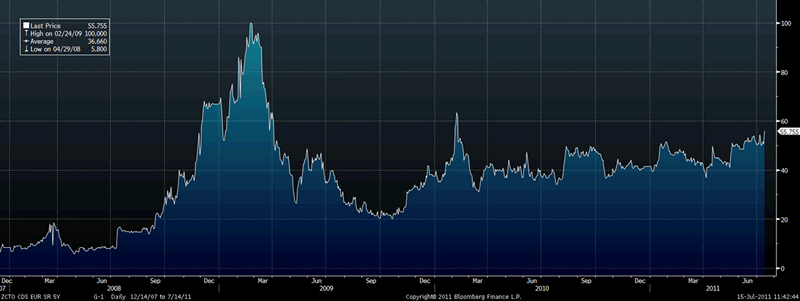

U.S. CDS - ZCTO CDS EUR SR 5Y Corp

US CDS has broken out to the upside and there is the potential for sharp moves up here as was seen in the aftermath of the Lehman and global financial crisis.

The fundamentals for gold and silver could not be better as the outlook for most paper currencies and government paper (sovereign debt) is not good. The precious metals are again being seen as safe haven assets to protect from government profligacy and currency debasement.

The risks of a "depression" and currency crises in Europe and the U.S. are rising and this is contributing to significant safe haven demand.

The fact that gold and silver have no counter party risk and cannot default and cannot be debased or printed into oblivion makes them crucial diversifications.

Gold, global equities and AAA rated, short dated bonds remain the best way for investors to protect themselves from today's growing sovereign debt and monetary risk.

Gold, silver, good equities and good bonds will be better than depreciating cash or currencies in the coming years. Real diversification will help protect preserve and grow wealth.

SILVER

Silver is trading at $38.09/oz, €26.93/oz and £23.64/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,748.00/oz, palladium at $770/oz and rhodium at $1,925/oz

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.