U.S. Q2 Retail Sales Suggest Mild Gain in Consumer Spending

Economics / US Economy Jul 15, 2011 - 03:25 AM GMTBy: Asha_Bangalore

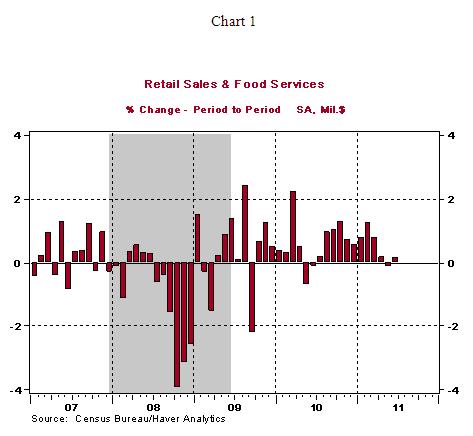

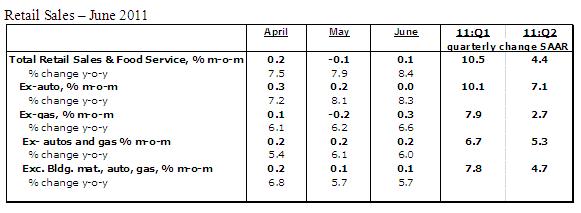

Retail sales rose only 0.1% during June after a revised 0.1% drop in May. The tally of retail sales for the second quarter shows a significant deceleration in the second quarter (+4.4%) after a 10.5% annualized gain in the first quarter, which partly reflects the vast swings of gasoline prices. Auto sales advanced 0.8% in June according to today's retail sales report, which is different from the unit sales data for June (11.5 million units vs. 11.8 million units in May).

Gasoline sales fell 1.3% in June, a price-related decline following a 0.5% increase in May. Excluding autos and gasoline, retail sales rose 0.2% in June, which matches the increase seen in the prior month. The bottom line is that consumer spending in the second quarter is most likely to post a mild gain and consequently result in a small increase in real GDP also.

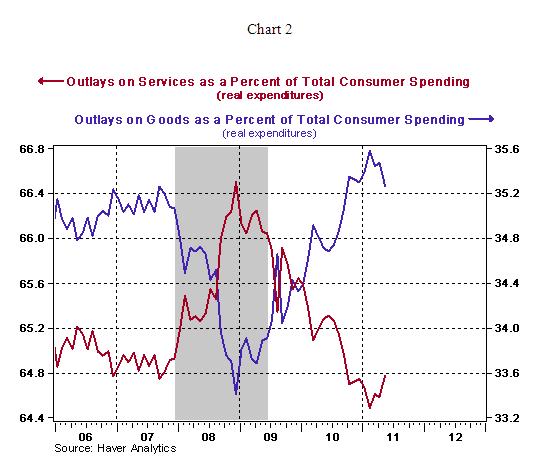

The deceleration in consumer spending is not entirely from retail sales. Retail sales data offer clues about outlays on the goods component of consumer spending. Purchases of services make up a larger component of consumer spending compared with goods. In the current recovery, service outlays have failed to pickup compared with goods (see Chart 2). Discretionary services such as recreation, food services, and transportation have been pared back by financial stressed households.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.