Stock Market Inflection Point

Stock-Markets / Stock Markets 2011 Jul 14, 2011 - 01:41 PM GMTBy: Tony_Caldaro

For those new to the blog we would like to restate something we did during the last bull market. The SPX/NDX can offer confusing patterns. Their futures contracts are heavily traded which causes volatility. In fact, occassionally a wave does not appear where it should, or a wave occurs that shouldn’t. How do we know? The DOW.

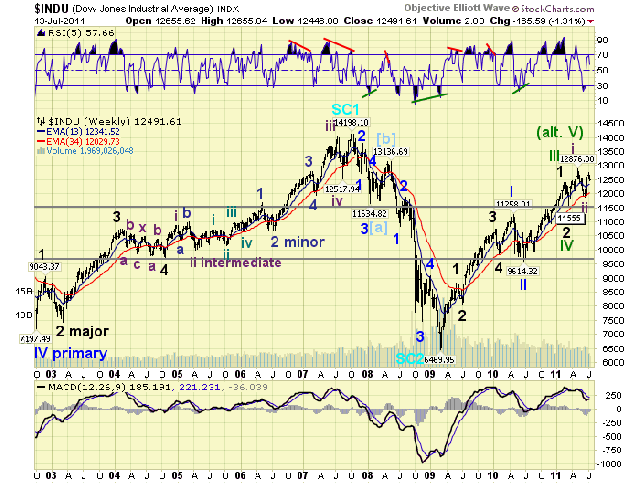

The DOW is, and has been, the key index for the US stock market. Yes, it has become more of an international index, but as the world’s largest consumer/innovator so has the US. For the past six years or so the SPX/DOW have remained in sync, wave for wave. So this fact is easy to forget. My point is this: When analyzing the US market the DOW should be reviewed first. Let’s look at the last nine years, starting in Oct 2002.

From Oct02 to early ’05 the DOW rallied in what could have been counted as five waves. The market was even threatening to break down as the weekly MACD hit neutral. After a small correction the DOW rallied to a new high around Mar05 and then broke to a lower low. Notice the MACD again went to neutral threatening to fall into bear market territory. The key level to watch was what we had marked as Major wave 4, around 9,700. The market had to make a decision: bull or bear, an inflection point. It chose bull.

Flash ahead to today. From Mar09 to present we can again count a potential five waves up in the DOW: Apr10, Jly10, Feb11, Mar11 and Apr11. After a minor correction we are now uptrending again. Notice where the MACD is this time. No threat of a breakdown.

If we count five waves up, the recent correction and current uptrend would be part of the next bear market. If we use the count posted, we’re looking for a significant uptrend to clear the bull market highs and allow enough room for a correction without an overlap. Notice the big difference in price between the Mar11 low and the Jun11 low. This can not be counted as a flat. These are separate waves. Also, it would be quite unusual to count it as a part of a triangle since the rally above Major 1 was quite high. This leaves us with two counts. The original one posted and the alternate count.

Should the DOW break down below the Mar11 low (11,555) the alternate count comes into play. Until then the market suggests it’s going higher.

CHARTS: http://stockcharts.com/...

http://caldaroew.spaces.live.com

After about 40 years of investing in the markets one learns that the markets are constantly changing, not only in price, but in what drives the markets. In the 1960s, the Nifty Fifty were the leaders of the stock market. In the 1970s, stock selection using Technical Analysis was important, as the market stayed with a trading range for the entire decade. In the 1980s, the market finally broke out of it doldrums, as the DOW broke through 1100 in 1982, and launched the greatest bull market on record.

Sharing is an important aspect of a life. Over 100 people have joined our group, from all walks of life, covering twenty three countries across the globe. It's been the most fun I have ever had in the market. Sharing uncommon knowledge, with investors. In hope of aiding them in finding their financial independence.

Copyright © 2011 Tony Caldaro - All Rights Reserved Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.