Bernanke Willings to Implement QE3, if Necessary

Interest-Rates / Quantitative Easing Jul 14, 2011 - 04:57 AM GMTBy: Asha_Bangalore

Bernanke's testimony this morning maintains optimism about the second-half of 2011. He noted that "once temporary shocks that have been holding down economic activity pass, we expect to again see the effects of policy accommodation reflected in stronger economic activity and job creation." The Fed's projections of economic growth have been published following the June21-22 FOMC meeting. The Fed expects the economy to grow 2.7% to 2.9% on a Q4/Q4 basis in 2011 after a 1.9% increase in the first quarter and an expected gain of a little over 2.0% in the second quarter. At the same time, Bernanke's remarks were indicative of the Fed's willingness to provide additional monetary policy support to the economy, if necessary:

Bernanke's testimony this morning maintains optimism about the second-half of 2011. He noted that "once temporary shocks that have been holding down economic activity pass, we expect to again see the effects of policy accommodation reflected in stronger economic activity and job creation." The Fed's projections of economic growth have been published following the June21-22 FOMC meeting. The Fed expects the economy to grow 2.7% to 2.9% on a Q4/Q4 basis in 2011 after a 1.9% increase in the first quarter and an expected gain of a little over 2.0% in the second quarter. At the same time, Bernanke's remarks were indicative of the Fed's willingness to provide additional monetary policy support to the economy, if necessary:

On the one hand, the possibility remains that the recent economic weakness may prove more persistent than expected and that deflationary risks might reemerge, implying a need for additional policy support. Even with the federal funds rate close to zero, we have a number of ways in which we could act to ease financial conditions further. One option would be to provide more explicit guidance about the period over which the federal funds rate and the balance sheet would remain at their current levels. Another approach would be to initiate more securities purchases or to increase the average maturity of our holdings. The Federal Reserve could also reduce the 25 basis point rate of interest it pays to banks on their reserves, thereby putting downward pressure on short-term rates more generally.

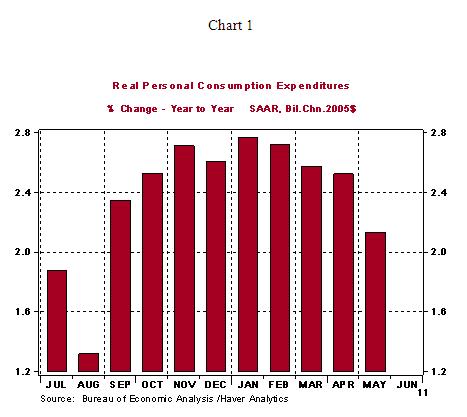

In Bernanke's opinion, a large part of the deceleration in aggregate demand in 2011 is traced to the household sector. He cites the adverse impact of higher gasoline and commodity prices on consumer spending and the negative implications on consumer sentiment arising from a declining trend of home prices and the associated loss of net worth of households. As shown in Chart 1, consumer spending has shown a sequentially slowing trend in the four months ended May. The future trajectory of consumer spending will be one of the key factors that will determine the need for QE3 in addition to developments in the labor market.

With regard to the labor market, Bernanke's observations were guarded. The disappointing employment reports of May and June were duly noted; Bernanke pointed out that the Fed's expectations were modest inclusive of only a gradual decline in the unemployment rate. He mentioned that payrolls had risen 160,000, on average, each month in the first-half of this year, which is stronger than the average gain of only 80,000 in the May-August 2010 period. The Fed predicts the unemployment rate to range between 8.6% and 8.9% during the final three months of 2011. A few more monthly reports of persistently weak conditions in the labor market, such as that of May and June 2011, should tip the balance in favor of additional monetary policy support.

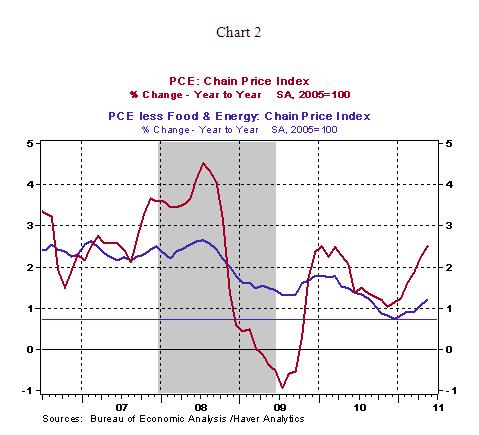

Higher readings of inflation continue to be portrayed as a transitory event and the Fed is comfortable with the turnaround in inflation readings after the implementation of QE2 which has prevented a deflationary situation from becoming entrenched in the economy. The Fed's view about inflation in the near term is captured in the following excerpt:

"Much of the acceleration was the result of higher prices for oil and other commodities and for imported goods. In addition, prices of motor vehicles increased sharply when supplies of new models were curtailed by parts shortages associated with the earthquake in Japan. Most of the recent rise in inflation appears likely to be transitory, and FOMC participants expected inflation to subside in coming quarters to rates at or below the level of 2 percent or a bit less that participants view as consistent with our dual mandate of maximum employment and price stability. The central tendency of participants' forecasts for the rate of increase in the PCE price index was 2.3 to 2.5 percent for 2011 as a whole, which implies a significant slowing of inflation in the second half of the year."

The minutes of the June 21-22 FOMC meeting provide more color about the range of views among members of the FOMC compared with the testimony. These minutes suggest (Could There Be QE3?) that there were different opinions about the need for more policy support within the Fed, implying that additional evidence will be necessary to support another round of quantitative easing. In fact, President Fisher of the Dallas Fed in this morning's speech indicated that he is unlikely to support more monetary policy easing in the near term. President Fisher is a voting member of the current FOMC.

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.