Academic Proof that Gold is an Important Diversification Against Inflation and Deflation

Commodities / Gold and Silver 2011 Jul 12, 2011 - 05:28 AM GMTBy: GoldCore

Gold is trading at $1,543.94/oz, €1,108.99/oz and £976.81/oz.

Gold is trading at $1,543.94/oz, €1,108.99/oz and £976.81/oz.

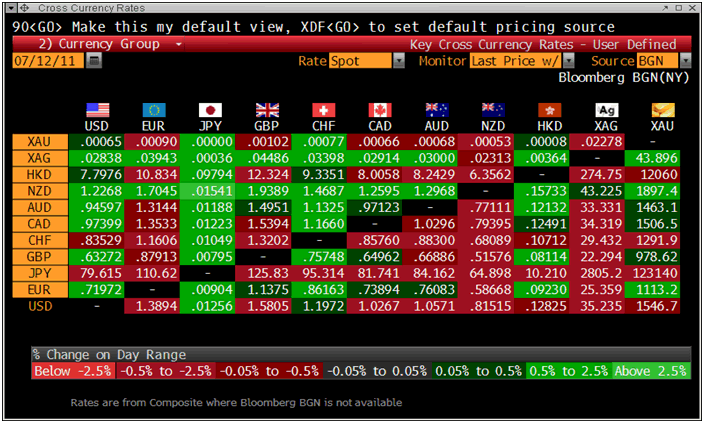

Equities internationally and bonds in Greece, Ireland, Spain and Italy have fallen this morning while gold rose to new record nominal highs in euros and pounds (over EUR1,118/oz GBP980/oz respectively). The Italian 10 year rose above 6% for the first time and the Spanish 10 year yield rose to 6.12%. US stock futures are pointing to losses on the U.S. opening.

Cross Currency Rates

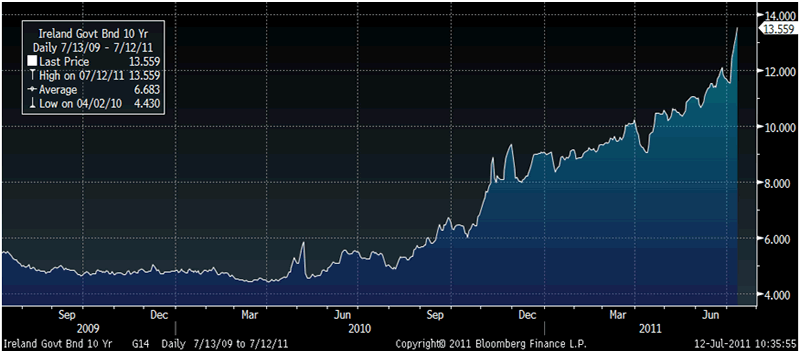

Irish government bonds have reached a new euro era record high with the 10 year rising to 13.57% - up from 11.6% only 5 days ago. Ireland’s “bail out” is clearly not working as contagion deepens in the eurozone.

Ireland Govt Bond 10 YR

Gold’s new record highs in euros and pounds was barely covered in the non specialist financial press in Europe. The fact that the safe haven remains the most poorly reported upon market in the world remains bullish from a contrarian perspective.

The lack of coverage is due to a lack of knowledge as to gold’s importance in a portfolio and also the blind belief that gold is a bubble. Some financial ‘experts’, normally ones who failed to warn regarding property bubbles, overvalued stocks and massive lack of diversification in investment and pension portfolios, continue to simplistically say that gold is a bubble and is ‘risky’.

A little knowledge remains a very dangerous thing.

Oxford Economics Report: Higher Allocations to Gold Can Benefit Portfolios in Deflation and Inflation

Oxford Economics have released a comprehensive and excellent report, ‘The impact of inflation and deflation on the case for gold’. It studies gold’s benefit to investment and pension portfolios in inflation and deflation. Founded in 1981, Oxford Economics is one of the world’s foremost global forecasting and research consultancies.

The report concurs with numerous other academic studies proving gold’s importance in investment and pension portfolios – for both enhancing returns but more importantly reducing risk.

The importance of owning gold has been proven conclusively in numerous studies. The importance of owning gold in a properly diversified portfolio has been shown in studies and academic papers by Mercer Consulting, Bruno and Chincarini, Scherer, Baur and McDermott and the asset allocation specialist Ibbotson.

Oxford Economics gold report shows how gold is a good hedge against inflation, as well as deflation.

It says that investors should allocate 5 percent of their portfolio to gold to best offset the effects of both inflation and deflation.

The analysis reflects a simple model including gold, cash, equities, bonds and commercial real estate. It goes on to add that the allocation rises (10%) in a higher inflation scenario, as well as for risk-averse investors in an environment of even weaker growth and lower inflation.

The entire report is excellent and well worth a read.

It concludes that gold’s price rise in recent years is justified by the macroeconomic and monetary fundamentals and that higher prices are more than possible.

“Historical analysis suggests gold could peak at levels even higher than the current ones, and both past experience and our estimated equation for the gold price also suggest that any ultimate adjustment from peak levels may not be rapid.”

This is especially the case given the risk of smaller nation sovereign defaults and “major sovereign defaults”.

It also indentifies inflation risk from extremely loose monetary policy, overheating emerging markets (such as China), the risks of a new oil crises and a “loss of international investor confidence” in the U.S dollar as factors likely to lead to higher gold prices.

The report concludes:

“Our scenario analysis using the Oxford Global Model shows that gold may perform especially strongly in more extreme economic scenarios featuring high inflation, a weak dollar and elevated levels of financial stress. But gold also performs well in our deflation scenario, where very high levels of financial stress triggered by sovereign defaults in the EU causes a flight to safe assets.

As such, gold’s potential role as “risk insurance” in a balanced investment portfolio is clear. Moreover, our optimisation analysis suggests gold’s lack of correlation with other assets means that it has a role to play in reducing the volatility of investment portfolios even in more benign scenarios when its long-run real return is negative

Gold’s optimal portfolio allocation in our baseline scenario is 4-9%, depending on risk appetite. These considerations may partly explain why gold’s use as an investment vehicle appears to be rising, with investment-driven demand up to around 40% of the total in 2010 from less than 15% in 2002. With central banks becoming net buyers of gold in 2010 for the first time since the late 1980s, there seems to be evidence of a reappraisal of gold’s value by various classes of investors.

GoldCore Editors Note:

To put it simply there is a huge amount of robust and compelling evidence and academic proof of the important, if not crucial, diversification benefits that gold brings to investment and pension portfolios.

Whether gold is a bubble or not is not relevant. What is relevant in these extremely uncertain times is the importance for people to be properly diversified and own some gold to protect themselves from macroeconomic, geopolitical and monetary risk and from the headwinds of deflation, inflation and stagflation.

SILVER

Silver is trading at $34.91/oz, €25.07/oz and £22.08/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,709.75/oz, palladium at $753/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.