Will Bernanke Hint At QE3?

Interest-Rates / Quantitative Easing Jul 12, 2011 - 02:10 AM GMTBy: Asha_Bangalore

Chairman Bernanke presented his view about the economy last on June 7, 2011. He is scheduled to testify about the U.S. economy on July 13 and 14, 2011. On June 7, Chairman Bernanke, indicated that "U.S. economic growth so far this year looks to have been somewhat slower than expected." Incoming economic reports, in fact, do not present an improvement in business conditions since June 7.

The June speech also noted that "a number of indicators also suggest some loss of momentum in the labor market in recent weeks." The June employment report has not changed this view but raised the level of concern one notch higher. He listed significant headwinds -- higher energy and food prices, continued tightness in some credit markets, declining home values, and elevated unemployment rate -- which have taken a "toll on consumer confidence." Each of these headwinds remain largely in place, excluding higher energy prices.

Energy prices have come off their highs, the unemployment rate rose to 9.2% in June from 9.1% in the prior month, home prices continue to decline in most regions of the economy, and credit conditions have not improved. The nuances the Chairman uses to depict the June employment numbers will be one of the highlights.

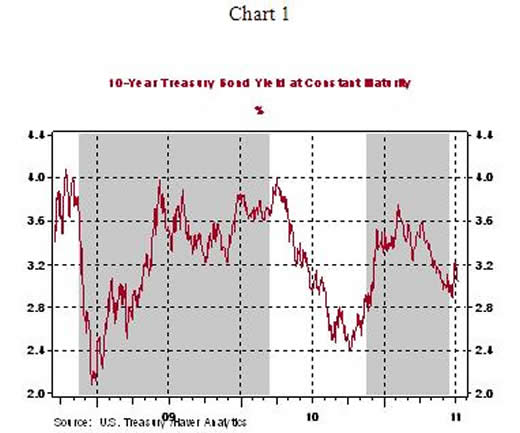

The bottom line is that the U.S. economy appears weaker today vs. June 7. Will Bernanke hint about the preconditions to justify the third round of quantitative easing? It is too early to offer hints about additional monetary policy easing as the QE2 program was completed on June 30. The Chairman could offer broad guidelines about the change in costs and benefits of additional easing compared with the action taken in November 2010 (which was presented at the press conference on June 22). Related information that is noteworthy is that the 10-year U.S. Treasury note yield has dropped after both QE1 and QE2 programs were completed, see Chart 1(The shaded region in the chart represents the time period of QE1 and QE2).

Asha Bangalore — Senior Vice President and Economist

http://www.northerntrust.com

Asha Bangalore is Vice President and Economist at The Northern Trust Company, Chicago. Prior to joining the bank in 1994, she was Consultant to savings and loan institutions and commercial banks at Financial & Economic Strategies Corporation, Chicago.

Copyright © 2011 Asha Bangalore

The opinions expressed herein are those of the author and do not necessarily represent the views of The Northern Trust Company. The Northern Trust Company does not warrant the accuracy or completeness of information contained herein, such information is subject to change and is not intended to influence your investment decisions.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.