Stocks Cyclical Bull Market Topping Process

Stock-Markets / Stock Markets 2011 Jul 11, 2011 - 08:09 AM GMTBy: Toby_Connor

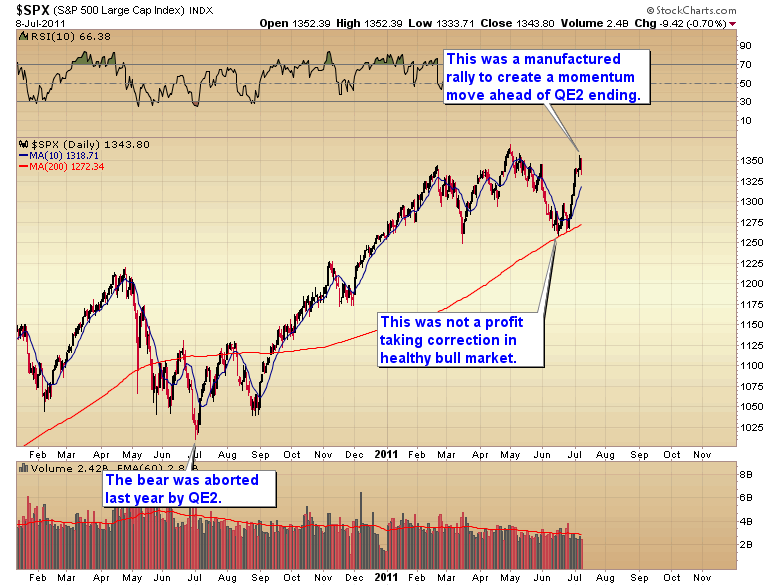

As many of you know I believe that we have begun the topping process of this cyclical bull market. In a healthy market an intermediate decline is a profit-taking event after a significant leg up. It should hold well above the prior intermediate bottom. The decline into the June low was not a profit-taking event. The market had not rallied long enough or far enough to warrant an intermediate correction and certainly not one that would test the March lows. The decline in May and June was the first shot over the bow that something is wrong with the fundamentals driving this market.

As many of you know I believe that we have begun the topping process of this cyclical bull market. In a healthy market an intermediate decline is a profit-taking event after a significant leg up. It should hold well above the prior intermediate bottom. The decline into the June low was not a profit-taking event. The market had not rallied long enough or far enough to warrant an intermediate correction and certainly not one that would test the March lows. The decline in May and June was the first shot over the bow that something is wrong with the fundamentals driving this market.

Now let me be clear because I think many people got the wrong idea from my last article. I don't recommend anyone sell short the market. All I'm saying is it is too late to have retirement funds positioned long at this time.

Asset appreciation is the FED’s stated third mandate. Bernanke is going to fight the bear tooth and nail. There will be continued interventions into the markets. The rules will be changed as we go. Anything and everything will be tried to keep stock and bond markets levitated. That is not the kind of environment conducive to making consistent gains on the short side. That is the kind of environment that can and will whipsaw traders to death.

Even in a market free of intervention the topping process is always volatile and dangerous. But in a market that is being actively managed it is especially dangerous on the short side. Case in point - the June bottom was way too early for a final intermediate bottom.

As I said in my previous articles we should have seen a counter trend bounce to relieve sentiment extremes followed by another leg down into a more lasting bottom. Unfortunately that was not allowed to happen. The powers that be manufactured an explosive rally on the low volume preholiday week in an attempt to create a massive momentum move ahead of the end of QE2 that would be hard to turn around. Needless to say Bernanke didn't want a repeat of last year when QE1 ended.

The Fed can temporarily turn the markets higher but what they cannot do is reverse the economy. I said when QE1 began that no amount of printing or stimulus would stop the underlying cancer in the economy. All it would do is create a brief reprieve which would be followed by an even deeper and more severe recession once the sugar high wore off.

The simple fact is that we cannot cure a problem of too much borrowing and too much spending with more borrowing and more spending. We tried this in the `30's and it caused a 15 year depression. Japan tried it and it led to two lost decades.

The cure is to bite the bullet and allow the deleveraging process to run its course. Yes it will be painful. We've put this off for so long that it isn't just going to be painful it's going to be catastrophic. But the longer we kick the can down the road the worse the endgame becomes. The only ray of sunshine I can offer is that if we let the markets work they will complete the deleveraging process fairly quickly. Within 2 to 3 years the world can be back on a sustainable path of growth. Continue to fight this and we could be stuck in an on-again off-again recession for another 20 years with the final end game collapse so devastating that it will make the Great Depression look like a picnic.

The last two employment reports are clearly showing that the economy is slipping back into recession. I suspect by August the employment report could, and probably will, turn negative. All the manufactured rallies in the world cannot prop up the stock market if the economy is rolling over into another recession. They can postpone the inevitable only so long and ultimately will just make the bear that much more severe.

The Fed's efforts have only extended the topping process, they haven't stopped it.

To sign up for the trial click here. Then click on the subscribe link on the right-hand side of the homepage. You will be linked to the subscriptions options page. Check the five dollar special and then follow the checkout instructions.

Toby Connor

Gold Scents

GoldScents is a financial blog focused on the analysis of the stock market and the secular gold bull market. Subscriptions to the premium service includes a daily and weekend market update emailed to subscribers. If you would like to be added to the email list that receives notice of new posts to GoldScents, or have questions,email Toby.

© 2011 Copyright Toby Connor - All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.