Gold Surges to Nominal Euro and Sterling Records

Commodities / Gold and Silver 2011 Jul 11, 2011 - 07:52 AM GMTBy: GoldCore

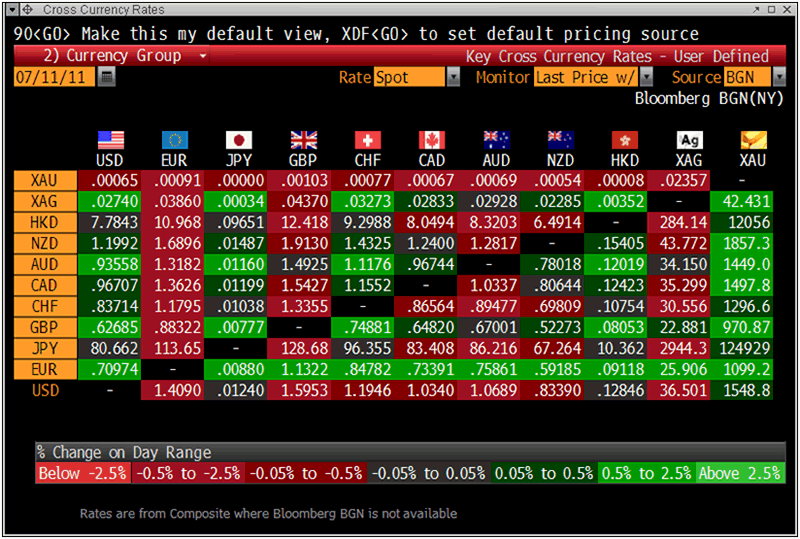

Gold is trading at $1,553.11/oz, €1,104.47/oz and £973.00/oz.

Gold is trading at $1,553.11/oz, €1,104.47/oz and £973.00/oz.

Gold has risen to new record highs in pounds and euros as concerns about contagion in the eurozone and stagflation in the UK deepen. The euro has fallen sharply in international markets and is down 1.5% against gold so far this morning. European Council President Herman Van Rompuy has called an emergency meeting of top officials dealing with the euro zone debt crisis as concerns deepen over the sovereign debt crisis spreading to Spain and Italy.

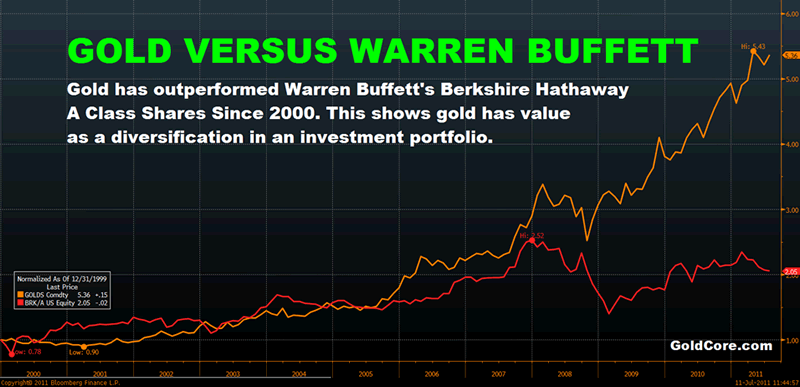

Gold in USD and Berkshire Hathaway A Class Shares in USD – January, 2000 until July 2010 (Daily - Rebased to 1)

Gold has risen to record nominal highs at EUR 1,100/oz, GBP 971/oz and at $1,549/oz is only a few dollars or some 0.5% from the record high close of $1,556.70 seen on April 29th. The very poor U.S. employment numbers Friday suggest that the very tentative U.S. recovery is tottering and a recession looks very likely which is leading to safe haven demand.

Gold has had another period of correction and consolidation and is looking well positioned to eke out further gains as we move into the seasonal strong Autumnal period which begins in August.

Cross Currency Table

Spain’s 10-year yield spread over Germany widened to a euro-era record of over 300 basis points. Italian and Portuguese bonds are also under pressure with Portuguese 10 year yields surging to 13.4%.

The risk of contagion affecting European and international banks and a new banking crisis rises by the day.

Meanwhile, in the U.S., President Obama is seeking a massive $4 trillion in a deficit reduction package. Failure to do so may lead to a U.S. and global sovereign debt crisis.

Jim Cramer Critiques Warren Buffett Over Anti Gold Bias

Jim Cramer, the host of "Mad Money" has critiqued the Sage of Omaha, Warren Buffett, and his anti gold bias. Buffett has said that gold isn't a sound long term investment because the precious metal has no ‘utility’.

Warren Buffet

Cramer says that he has heard from people saying they will not invest in gold since it was $700 per ounce because they “missed it” or because “someone like a Warren Buffett has said how valueless or silly it is”.

(GoldCore Editors note: George Soros cryptic comments about gold are similarly used by so called financial experts to dissuade people from owning gold)

“No one goes to Warren Buffett and says how have you done versus gold in the last 10 years. That is verboten. You are not allowed to ask him that.”

Cramer said that this “makes it very difficult to make headway with people” about owning gold.

While Buffett snubs the value of gold, Cramer emphasizes the limited amount of gold bullion available and gold’s rarity (see GoldNomics video), as well as the lack of new gold being mined. Cramer says that there is far less gold than there is Berkshire Hathaway B shares and that Buffett can just print the shares.

“Against all that is a grey beard investor who has already made a lot of money, who frankly could have his money devalued and still have a lot and I feel like … you know what Warren … give other people a chance to make some money here ok.”

“Give other people a chance to protect their assets, give people a chance to buy insurance.”

“I would rather buy the insurance policy of gold than the insurance policy of Geico … pretty simple.” (to laughter)

“It is such a shame that he (Buffett) does that, I mean all he has to do is say that I don’t really understand it. “

“He did with Tech, like I saw when Intel was the equivalent of $2 and Microsoft was … before the big run. I understood … listen he said ‘I don’t understand tech’. That’s fine.”

He should say “I don’t understand gold”. He shouldn’t pick Keynes, who of course got the gold market wrong repeatedly. He should just actually say “I don’t understand it.”

“He would does us all … he is doing everyone a disservice by saying that it’s a beauty contest.”

Conclusion

Cramer is a divisive figure and liked and loathed by investors but these are excellent points about Buffett’s and Munger’s anti gold bias – points we have made previously.

Cramer’s assessment of Buffett and his lack of appreciation of gold as financial insurance and bias against gold is an accurate assessment.

Buffett deserves the title ‘Sage of Omaha’ and is to be respected but his failure to appreciate gold’s importance as a diversification in a portfolio and his repeated negativity towards gold (in contrast to his father Howard Buffett), will not be judged kindly in history.

It is never too late to do the right thing and to ensure his legacy Buffett should acknowledge gold has intrinsic value, has utility as money, as monetary asset, a finite currency and as financial insurance in a portfolio.

Cramer’s interview is a must watch and it can be watched on the GoldCore YouTube Channel.

SILVER

Silver is trading at $36.64/oz, €26.05/oz and £22.95/oz.

PLATINUM GROUP METALS

Platinum is trading at $1,731.50/oz, palladium at $765/oz and rhodium at $1,925/oz.

GOLDNOMICS - CASH OR GOLD BULLION?

'GoldNomics' can be viewed by clicking on the image above or on our YouTube channel:

www.youtube.com/goldcorelimited

This update can be found on the GoldCore blog here.

Yours sincerely,

Mark O'Byrne

Exective Director

IRL |

UK |

IRL +353 (0)1 632 5010 |

WINNERS MoneyMate and Investor Magazine Financial Analysts 2006

Disclaimer: The information in this document has been obtained from sources, which we believe to be reliable. We cannot guarantee its accuracy or completeness. It does not constitute a solicitation for the purchase or sale of any investment. Any person acting on the information contained in this document does so at their own risk. Recommendations in this document may not be suitable for all investors. Individual circumstances should be considered before a decision to invest is taken. Investors should note the following: Past experience is not necessarily a guide to future performance. The value of investments may fall or rise against investors' interests. Income levels from investments may fluctuate. Changes in exchange rates may have an adverse effect on the value of, or income from, investments denominated in foreign currencies. GoldCore Limited, trading as GoldCore is a Multi-Agency Intermediary regulated by the Irish Financial Regulator.

GoldCore is committed to complying with the requirements of the Data Protection Act. This means that in the provision of our services, appropriate personal information is processed and kept securely. It also means that we will never sell your details to a third party. The information you provide will remain confidential and may be used for the provision of related services. Such information may be disclosed in confidence to agents or service providers, regulatory bodies and group companies. You have the right to ask for a copy of certain information held by us in our records in return for payment of a small fee. You also have the right to require us to correct any inaccuracies in your information. The details you are being asked to supply may be used to provide you with information about other products and services either from GoldCore or other group companies or to provide services which any member of the group has arranged for you with a third party. If you do not wish to receive such contact, please write to the Marketing Manager GoldCore, 63 Fitzwilliam Square, Dublin 2 marking the envelope 'data protection'

GoldCore Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.