These Stocks Will Shine Through the Bulls and Bears Standoff

Companies / Company Chart Analysis Jul 11, 2011 - 06:15 AM GMTBy: Money_Morning

Jon D. Markman writes:

Market bulls and bears are at a standoff as global economic recovery struggles - but not all stocks are in danger of slipping.

Jon D. Markman writes:

Market bulls and bears are at a standoff as global economic recovery struggles - but not all stocks are in danger of slipping.

Major U.S. stock indexes inched higher by 0.5% to 1.5% over the past week as optimism that companies will report higher second-quarter profits outweighed fears that job growth is crashing. But the final day of the week was a downer, with losses across the board and across the world following a terrible report on U.S. employment.

Yet the mood remains strangely buoyant -- as if investors just can't believe that more than $2 trillion with of fiscal and monetary stimulus have bought the worst recovery in the postwar era.

Breadth has been the hallmark of the recent advance, but it was terrible on Friday -- with losers outpacing gainers by a four to one margin.

Stocks drifted in a range so narrow at midweek that if you turned it sideways you couldn't see it.

The bears had a chance to knock sentiment down once Moody's (NYSE: MCO) credit rating service kicked Portugal's sovereign debt down under the counter, below the sink and into the basement, and a fairly nasty report on the U.S. service economy followed. But bulls found a way to pump a few more molecules of helium into their uptrend, and the major indexes ended in the green.

And now we have a standoff, the bulls and bears looking at each other over the barricades with a gleam in their eyes -- each knowing without a doubt that they are about to take down the other.

I would love to be optimistic, but the data that I see suggests the world has entered into a cyclical industrial slowdown that has crippled business confidence and job growth. So even if second quarter earnings are good, outlooks will likely be poor. And ultimately that means stock prices will peak.

As for the situation in Europe, industrial growth is also probably peaking so the next quarter-point interest rate hike by the European Central Bank will likely be the last for a while. Capital Economics analysts expected German industrial production data to show a decline of 0.6% in the latest reporting period, sinking to the lowest level in nine months.

The European Community index of industrial sentiment, the IFO manufacturing index and the region's manufacturing PMI survey have also all fallen recently. Some recovery, huh?

And now I know you are dying to know what I think about Moody's downgrade of Portugal's credit rating to less than investment grade.

The move was mainly a reminder that troubles on the edge of Euroland extend well beyond Greece. Portugal used to have a buoyant industrial and international trade sector that was the envy of the region. But the country overspent on social programs and now is in the soup. Portugal is going to have trouble persuading markets that it can make progress on its loans by a 2013 deadline.

So expect it to be the cause of a lot of consternation when it returns to the market asking for an emergency bailout. In short, the sovereign debt crisis is going to keep resurfacing with negative headlines longer than anyone would like until global growth revs up again, generating the sort of exports and jobs that will help countries square up with creditors.

What to Play as Recovery Struggles

So what worked best in the market when it was rising in the past week? Whatever was messed up the most in the prior month. Real estate. Tech. The junky Chinese IPOs. Energy. The worst shall be first.

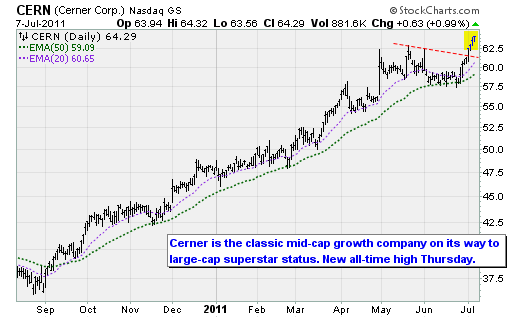

But that's not all. If that's what it was all about, we could easily get smug about the rebound and expect it to be very short-lived. The fact is, though, that a lot of very good stocks have been finding favor as well. Like electronic medical records standout Cerner Corp. (Nasdaq: CERN), on our StrataGem list again, as it has been many times in the past three years.

And Caterpillar Inc. (NYSE: CAT), FedEx Corp. (NYSE: FDX), DuPont (NYSE: DD), Apple Inc. (Nasdaq: AAPL), and dare I say it, Google Inc. (Nasdaq: GOOG).

Luckily all of my recommended exchange-traded funds (ETFs) beat the market like a steel drum, lead by iShares S&P MidCap 400 Growth (NYSE: IJK), up 0.62%, and iShares Dow Jones US Health Care (NYSE: IHF), up 0.63%. These are your leaders.

And let's not forget to go for the gold.

Gold futures have been shooting higher over the past week in contravention of the usual seasonal pattern in which they normally move higher at the end of the summer. Part of the reason may be the downgrade of Portugal combined with turmoil in the Italian and Spanish stock markets, the widening of the spreads on Italian and Spanish credit and rumors of a coming downgrade of Irish debt.

A lot of people seem to think that the next round of downgrades and piling-on will wait until the Europeans complete their August vacations, but I really doubt they will wait.

Right now, gold is within an inch of its all-time high, yet shares of gold miners, as benchmarked by the Market Vectors Gold Miners (NYSE: GDX) is still 15% off from its high. We made very good money in the gold miners last year in the late summer, and I have been planning to wait again. There is no rule that says the miners' stocks have to follow the metal, and in fact many large South African miners are being hit by a wave of selling due to rumors of a potential nationalization.

Gold shares are certainly inexpensive now, and could become even cheaper in the next few weeks. Seasonally they usually start moving up in August, but as you can see in the chart above two years ago they began to rise in July, and last year it was mid-July. A new all-time high in the yellow metal may mean it's time to buy some GDX, even if the calendar says it's still a little early.

The Week Ahead

There is lots on the economic calendar this week, starting with the FOMC minutes on Tuesday and then inflation on Wednesday, retail sales on Thursday and industrial production on Friday.

July 11: No releases planned.

July 12: U.S. international trade balance; minutes of the June 21-22 Fed meeting at 2 p.m.

July 13: Import prices; U.S. Treasury monthly budget report.

July 14: Producer Price Index; Retail sales; initial jobless claims; business inventories.

July 15: Consumer price index; Empire state manufacturing index; industrial production; capacity utilization; Reuters/Univ. of Michigan consumer sentiment index

[Bio Note: Money Morning Contributing Writer Jon D. Markman has a unique view of both the world economy and the global financial markets. With uncertainty the watchword and volatility the norm in today's markets, low-risk/high-profit investments will be tougher than ever to find.

It will take a seasoned guide to uncover those opportunities.

Markman is that guide.

In the face of what's been the toughest market for investors since the Great Depression, it's time to sweep away the uncertainty and eradicate the worry. That's why investors subscribe to Markman's Strategic Advantage newsletter every week: He can see opportunity when other investors are blinded by worry.

Subscribe to Strategic Advantage and hire Markman to be your guide. For more information, please click here.]

Source :http://moneymorning.com/2011/07/11/these-stocks-will-shine-through-the-bulls-and-bears-standoff/

Money Morning/The Money Map Report

©2011 Monument Street Publishing. All Rights Reserved. Protected by copyright laws of the United States and international treaties. Any reproduction, copying, or redistribution (electronic or otherwise, including on the world wide web), of content from this website, in whole or in part, is strictly prohibited without the express written permission of Monument Street Publishing. 105 West Monument Street, Baltimore MD 21201, Email: customerservice@moneymorning.com

Disclaimer: Nothing published by Money Morning should be considered personalized investment advice. Although our employees may answer your general customer service questions, they are not licensed under securities laws to address your particular investment situation. No communication by our employees to you should be deemed as personalized investent advice. We expressly forbid our writers from having a financial interest in any security recommended to our readers. All of our employees and agents must wait 24 hours after on-line publication, or 72 hours after the mailing of printed-only publication prior to following an initial recommendation. Any investments recommended by Money Morning should be made only after consulting with your investment advisor and only after reviewing the prospectus or financial statements of the company.

Money Morning Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.