U.S. Dollar Could Send Stocks and Commodities Higher

Stock-Markets / Stock Markets 2011 Jul 11, 2011 - 04:37 AM GMTBy: Chris_Vermeulen

It’s been an exciting couple months as stocks and commodities have moved like they are a roller coaster at a theme park. We all know every good roller coaster has a few monster hills which make their clients scream in fear/excitement that’s what it’s all about!

It’s been an exciting couple months as stocks and commodities have moved like they are a roller coaster at a theme park. We all know every good roller coaster has a few monster hills which make their clients scream in fear/excitement that’s what it’s all about!

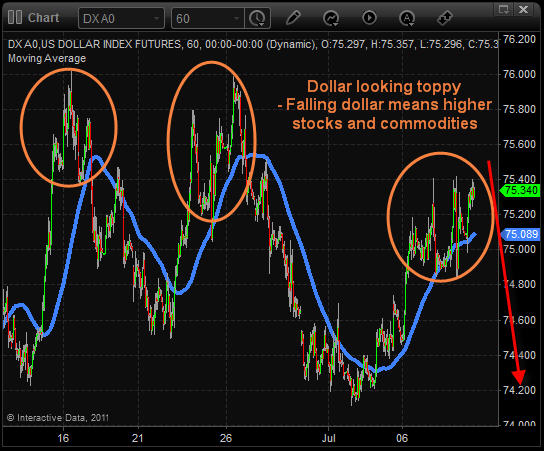

But if we step back into the financial world where fear/excitement cost people month it is not so fun. Look at the US Dollar index you will see three monster hills which investors/traders have just finished riding. These quick price movements were enough to make most traders hit the sell button in fear of wilder price action. This is the type of price action which can whip-saw traders in and out of positions for several back-to-back losses.

Having multiple losing trades back-to-back triggers a series of events causing most traders to lose large percentages of their trading capital.

First the trader starts to become frustrated and starts second guessing themselves. This causes revenge trading meaning they start to trade more frequently without proper setups and risk reward levels. Which lowers their confidence, while increasing the rate of their trading. This generally makes for a blowout trading session or week. Meaning they lose 20-50+% of their trading capital in a very short period of time all because they are trading off pure emotions and not clear trading rules.

Avoiding roller coaster rides with your trading capital/emotions is one of the things I do well. I do this by focusing on the US Dollar index because it plays a very large roll in what both stocks and commodities do. I analyze the dollar trends and use its price action to help gauge how big and long its next trend is. If the dollar index looks as though it may top, then I will be looking to buy/ accumulate some stocks and commodities simply because a falling dollar helps boost the value of stocks and commodities.

Take a look at the dollar index below. Just a quick glance and you get a gut feeling that it’s trying to top and could have another sharp sell off in the next 1-3 days.

Now if we take a look at the SP500 daily chart and use the dollar index analysis above, I would expect to see stock prices pause or pullback for a few days while the dollar tops and then look for a reversal pattern on the shorter time frame charts to add more to our position before stocks continues higher.

Looking at the price of gold we can see that it has been trading in a large sideways range since May and also near a resistance trend line (red line). We could easily see a 1-3 day pause/pullback in gold while it builds energy for another surge higher. Which could take it through the resistance level.

Pre-Week Market Trend Analysis:

In short, I feel the dollar is trying to put in a top which could take a few days to play out. If that unfolds then we should start seeing stocks pullback to support levels and then bounce with rising volume.

That’s all for now, but if you would like to get my pre-market video analysis each morning and intraday updates along with trade alerts be sure to join my premium service here:www.GoldAndOilGuy.com

By Chris Vermeulen

Chris@TheGoldAndOilGuy.com

Please visit my website for more information. http://www.TheGoldAndOilGuy.com

Chris Vermeulen is Founder of the popular trading site TheGoldAndOilGuy.com. There he shares his highly successful, low-risk trading method. For 6 years Chris has been a leader in teaching others to skillfully trade in gold, oil, and silver in both bull and bear markets. Subscribers to his service depend on Chris' uniquely consistent investment opportunities that carry exceptionally low risk and high return.

This article is intended solely for information purposes. The opinions are those of the author only. Please conduct further research and consult your financial advisor before making any investment/trading decision. No responsibility can be accepted for losses that may result as a consequence of trading on the basis of this analysis.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.