The Politics of Debt Default: Roadmap to Debunk the U.S. Dollar

Currencies / Global Debt Crisis Jul 07, 2011 - 11:02 AM GMTBy: Axel_Merk

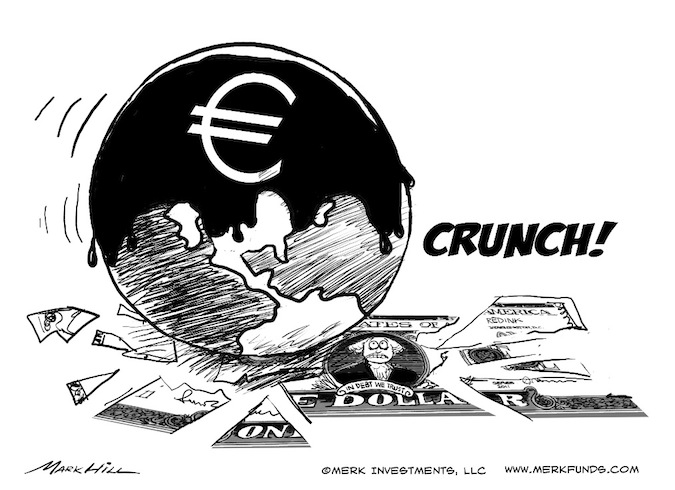

We were one of few who defended the euro when many pundits predicted parity to the U.S. dollar in the spring of 2010, when Greece’s issues first came to the fore. Since then, Old Europe’s currency has had a dramatic comeback, although not without significant jitters along the way. A roadmap is playing out that may lead the euro to debunk the dollar. Not convinced? Let’s look at what is and what isn’t working on both sides of the Atlantic, and how dynamics may play out.

We were one of few who defended the euro when many pundits predicted parity to the U.S. dollar in the spring of 2010, when Greece’s issues first came to the fore. Since then, Old Europe’s currency has had a dramatic comeback, although not without significant jitters along the way. A roadmap is playing out that may lead the euro to debunk the dollar. Not convinced? Let’s look at what is and what isn’t working on both sides of the Atlantic, and how dynamics may play out.

If one thing has been working in Europe, it’s the “dialogue” between the bond market and policy makers. Not too long ago, the types of reforms being implemented now would have been unthinkable. What’s more, in many cases, reform is being implemented by weak or minority governments. Reforms may not be implemented at the speed or as thoroughly as promised; as long as the bond market keeps up the pressure, however, an incentive is provided to continue to engage in reform, which makes it each individual country’s responsibility to sort out its problems, and thus influence the speed at which their cost of borrowing is reduced.

Except, of course, when a country receives a bailout in which the cost of borrowing is reduced. Note, though, that any country tapping a bailout facility may be shunned from the capital markets for an extended period. Portugal had resisted asking for help, because no other country that previously had was really much better off – at least when measured by the cost of borrowing imposed by private lenders. Private lenders won’t give countries a free pass unless economies are returned to a sustainable path.

Bailouts do serve a purpose though: countries that ask for help lose sovereign control over their budgeting. A country requiring outside assistance has to commit to painful structural reforms. The negotiation process is an ugly one; we have compared it to the healthcare reform debate in the U.S.: regardless whether you like the outcome, the process is akin to sausage making.

There are frequent calls for a fiscal union within the Eurozone; such a fiscal union would also impose some budget constraints on member countries, but likely lack the drama. However, odds are also high that it would be far easier to transfer money to weaker members, thus removing an important incentive for such members to engage in reform.

From a currency standpoint, such a development would be a negative for the euro. As it stands, it is simply more difficult to spend money in the Eurozone than in the U.S. But doesn’t that lead to less economic growth? To answer this question, consider that Japan has had lousy economic growth for two decades, yet a strong currency. Japan has historically financed its deficits domestically; as a result, in our assessment, the yen does not need economic growth to prosper. That’s very different from the U.S., where the U.S. current account deficit requires foreigners to invest billions, just to keep the dollar from falling: foreign capital may be more easily attracted when there’s a prospect of growth, making the U.S. dollar more sensitive to changes in perception of future economic growth. The Eurozone’s current account is roughly in balance; as a result, while economic growth plays a role in determining the value of the euro, it’s not as important a factor as it is in determining the value of the U.S. dollar.

Separate is the question whether structural reform does indeed lead to less economic growth. Structural reform is a way to get rid of the excesses built up during boom years. In the U.S., possibly the greatest impediment to economic growth is that structural reform is not taking place: consumers are subsidized to stay in their homes rather than encouraged to downsize to homes they can afford. The reason? It might be political suicide to promote “downsizing”, as it implies foreclosures and bankruptcies. However, getting rid of the excesses may be exactly what is required to build a sound foundation for sustainable growth.

But what if such “sustainable growth” is simply not in the cards: few believe that Greece will ever be on a sound footing again. Any country may default on its debt; trouble is that it may be difficult to obtain a loan at palatable terms upon default. Differently said, for default to be a viable option, a country must be willing to eliminate its primary deficit overnight (the primary deficit is a country’s budget deficit before interest payments); once the primary deficit is low or eliminated, it may be in Greece’s interest to take the pain associated with a default to reduce its debt burden. The reason why a country’s default is typically preceded by years of painful choices is because that’s exactly what’s necessary: make the tough structural adjustments to prepare for default. A default now is not in Greece’s interest, especially not if cheap loans are lined up by the IMF and Eurozone, as important reforms have not yet been tackled. Such reforms are rarely implemented as thoroughly as planned (after all, there is a reason why the country got into trouble in the first place), but substantial progress is typically made. Greece is in a very different situation now than it was just a few days ago: the country has secured financing until the end of 2013. This allows Greece two years to either prepare for default or have a credible turnaround strategy in place. Specifically, now is the time for financial institutions, including Greek banks to be recapitalized to stomach a Greek default.

As far as reform in Greece is concerned, there will always be political differences as to what the right recipe is to put a country on a sound footing. In times of crisis, thinking outside of the box, however, might be prudent. Greece’s opposition leader Samaras has a reform plan that includes, amongst others, the elimination of the requirement of proving the origin of money when purchasing a house. This idea may help get money back into Greece that has been fleeing the country, while lowering unemployment by fostering the labor-intensive construction sector. Importantly, elections in Greece should take place before the regularly scheduled date in 2013 to allow negotiations to take place on an orderly restructuring in late 2013, should that be necessary. While some have shrugged off opposition leaders Samaras’ call for tax cuts as unrealistic, he favors dismantling government bureaucracy, an issue the current Papandreou government has not been forceful enough on. Should there be elections, it’s likely that Papandreou’s government would lose its absolute majority in parliament; whether Samaras could gain enough votes to govern without a coalition partner is questionable. A strong vote for his party could end up in a coalition to engage in real reforms that go beyond austerity measures, but implement moderate, but urgently needed pro-growth measures. While a new government elected in 2013 might be effective, it may be more helpful to have an established government in place ahead of any 2013 negotiations.

Greece is relevant for the rest of the Eurozone to the extent that Greek debt is held by financial institutions. As such, it is paramount that the time until 2013 is used to finally clean up financial institutions in earnest, at risk of significant shareholder dilution. As this analysis is written, Nigeria warned it may nationalize its banks because financial institutions there, too, are dragging their feet. Is Nigeria more willing to get its house in order than France or Germany?

One lesson from the financial crisis is that rating agencies don’t want to be caught out again, downgrading any one institution or country too late; Portugal being the latest country to hit the news for yet another downgrade. There’s a fair concern that should countries bail out their banks, it would drag the banks down themselves. But the issues must be tackled more assertively, so that the markets don’t take care of them on behalf of policy makers. It appears to us that this might be taking place as policy makers are now considering more serious stress tests, amongst others.

Note, though, that one of the biggest contagion fears with regard to a European banking crisis is to U.S. money market funds. As we have discussed (see our June 22 analysis “Euro safer than U.S. dollar?”), many U.S. money market funds have dramatic exposure to European banks through U.S. dollar denominated commercial paper issued by them. As of this writing, three month U.S. Treasury bills just yielded a negative annualized 0.01%, a clear sign that there may be panic buying, quite possibly as a result of institutional investors fleeing money market funds (another interpretation is that investors are afraid of an upcoming shortage of Treasuries as the debt ceiling is reached).

Finally, we have learned that central bankers are bad poker players. Be that the Federal Reserve (Fed) that may provide support to U.S. money markets or the European Central Bank (ECB) that is bending over backwards to find ways of accepting Greek debt as collateral. As a result, we come back to what we indicated earlier: the bond market imposes real reform in the Eurozone; and it’s more difficult to spend money in the Eurozone. Conversely, in the U.S., the bond market continues to give the government a free pass; while we believe the debt ceiling debate is mostly a game of chicken, we don’t expect true structural reform that would lead to manageable entitlements over the long-run. If and when the bond market in the U.S. imposes real reform, the U.S. dollar might be far more vulnerable than the euro given the U.S. current account deficit.

Please join us for a Webinar on Thursday, July 21, to discuss the future of the U.S. dollar in light of the looming debt ceiling in the U.S., crises in peripheral Eurozone countries and global inflationary pressures. You may also want to sign up to our newsletter to be in the loop as this discussion evolves. We manage the Merk Absolute Return Currency Fund, the Merk Asian Currency Fund, and the Merk Hard Currency Fund; transparent no-load currency mutual funds that do not typically employ leverage. To learn more about the Funds, please visit www.merkfunds.com.

By Axel Merk

Manager of the Merk Hard, Asian and Absolute Return Currency Funds, www.merkfunds.com

Axel Merk, President & CIO of Merk Investments, LLC, is an expert on hard money, macro trends and international investing. He is considered an authority on currencies. Axel Merk wrote the book on Sustainable Wealth; order your copy today.

The Merk Absolute Return Currency Fund seeks to generate positive absolute returns by investing in currencies. The Fund is a pure-play on currencies, aiming to profit regardless of the direction of the U.S. dollar or traditional asset classes.

The Merk Asian Currency Fund seeks to profit from a rise in Asian currencies versus the U.S. dollar. The Fund typically invests in a basket of Asian currencies that may include, but are not limited to, the currencies of China, Hong Kong, Japan, India, Indonesia, Malaysia, the Philippines, Singapore, South Korea, Taiwan and Thailand.

The Merk Hard Currency Fund seeks to profit from a rise in hard currencies versus the U.S. dollar. Hard currencies are currencies backed by sound monetary policy; sound monetary policy focuses on price stability.

The Funds may be appropriate for you if you are pursuing a long-term goal with a currency component to your portfolio; are willing to tolerate the risks associated with investments in foreign currencies; or are looking for a way to potentially mitigate downside risk in or profit from a secular bear market. For more information on the Funds and to download a prospectus, please visit www.merkfunds.com.

Investors should consider the investment objectives, risks and charges and expenses of the Merk Funds carefully before investing. This and other information is in the prospectus, a copy of which may be obtained by visiting the Funds' website at www.merkfunds.com or calling 866-MERK FUND. Please read the prospectus carefully before you invest.

The Funds primarily invest in foreign currencies and as such, changes in currency exchange rates will affect the value of what the Funds own and the price of the Funds' shares. Investing in foreign instruments bears a greater risk than investing in domestic instruments for reasons such as volatility of currency exchange rates and, in some cases, limited geographic focus, political and economic instability, and relatively illiquid markets. The Funds are subject to interest rate risk which is the risk that debt securities in the Funds' portfolio will decline in value because of increases in market interest rates. The Funds may also invest in derivative securities which can be volatile and involve various types and degrees of risk. As a non-diversified fund, the Merk Hard Currency Fund will be subject to more investment risk and potential for volatility than a diversified fund because its portfolio may, at times, focus on a limited number of issuers. For a more complete discussion of these and other Fund risks please refer to the Funds' prospectuses.

This report was prepared by Merk Investments LLC, and reflects the current opinion of the authors. It is based upon sources and data believed to be accurate and reliable. Opinions and forward-looking statements expressed are subject to change without notice. This information does not constitute investment advice. Foreside Fund Services, LLC, distributor.

Axel Merk Archive |

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.