Why Gold, Silver and Copper Mining Investors Must Follow Peru

Commodities / Gold and Silver 2011 Jul 06, 2011 - 04:33 PM GMTBy: Jeb_Handwerger

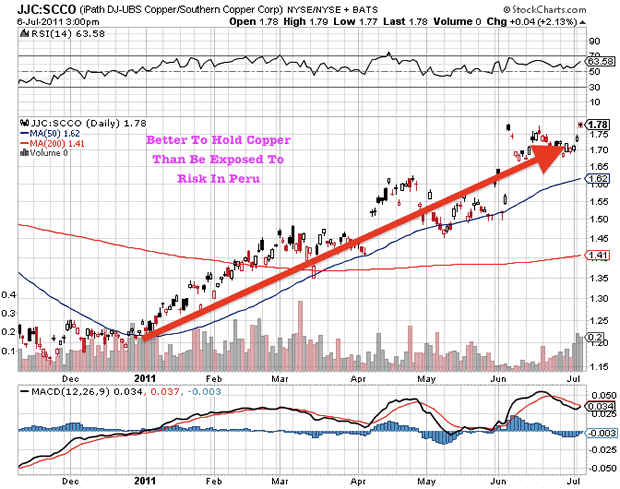

The elections in Peru of Humala, an avowed radical socialist, is an ongoing development of great significance for precious metals and mining investors. It is not an event that has gone unnoticed by experienced speculators. Mining investors (GDX) worldwide are watching July 28th when the new regime takes control. So far in 2011 investors have sold off mining assets in Peru and buying the underlying metal.

The elections in Peru of Humala, an avowed radical socialist, is an ongoing development of great significance for precious metals and mining investors. It is not an event that has gone unnoticed by experienced speculators. Mining investors (GDX) worldwide are watching July 28th when the new regime takes control. So far in 2011 investors have sold off mining assets in Peru and buying the underlying metal.

What we are witnessing is no less than the ongoing sophistication of the third world. Peru is only the latest development in this continuum. "Nationalistas" are raising the ante around the negotiating tables, Chavez in Venezuela, Morales in Bolivia and Lula's successor and protégée, Dilma Rousseff in Brazil. One can not help but wonder who is next? Mining investors are increasingly aware of civil unrest and geopolitical uncertainty. Recently they have been favoring holding the underlying metal, causing a major divergence. There may be a reversion to the mean where high quality projects in mining friendly jurisdictions receive a premium. We must not forget that Peru was lately regarded as a mining haven and a model exemplar for foreign investment with such mining giants as Southern Copper (SCCO) and Buenaventura(BVN). Unfortunately 2011 has not been kind to investors in Peruvian equities as Humala is an unknown and his election has significantly weakened Peruvian investment.

It does not take long for the internet to act as an electronic university. Obscure colonels are becoming skilled croupiers as they get voted in to represent their nations. Even the Saudis are granting pay raises and benefits to pacify an increasingly aware population. Smart phones are creating smarter masses who are voting for different dealers who they hope will represent them more effectively than the dealers they have had up to now.

There is a phrase in Spanish for this electorate. It is "Los Resentimendidos" which translates into "the ones who resent" in what they consider a more equitable cut of the pie. Make no mistake we are witnessing a revolution that can not but help to affect investments in gold and silver miners(SIL). Just as the invention of the Gutenberg Printing Press helped to contribute to the Industrial Revolution, so we are in the midst of the digital transformation of society.

Simply put nations are increasingly demanding a greater share of the jackpots of gold (GLD) and silver (SLV). The internet is their university and what they see is acting as their Cliff Notes in a game of oneupmanship. The price of profits is eternal vigilance. This new era will require examination of where we invest our monies. It will become increasingly important to consider investing in friendly jurisdictions that are amenable to reasonable negotiations.

Mining stocks are beginning to emerge from a severe selloff starting in April. No doubt technical damage was inflicted. The recent correction was the most severe downturn in the past two years and had all of the earmarks of a classic panic as it momentarily broke 2011 lows.

We are in the greatest gold bull market since the 1970's. Gold is up almost 500% over the last ten years. We went through an uncomfortable and painful short term correction in what has always been a volatile arena, add to this the summer doldrums, global unrest, economic uncertainty from the withdrawal from QE2 and the possible advent of QE3.

All of these imponderables add up to confuse and discourage investors. The markets have always done this in an attempt to create the transfer of wealth from weak hands to strong hands. This is the very essence of market place dynamics.

Mining stocks in mining friendly jurisdictions are regaining their technical strength. There is a divergence between the price of mining stock equities and its underlying assets in all sectors that we follow gold(GLD), silver(SLV), rare earths(REMX) and uranium(URA). However, to every action there is an equal and opposite reaction. The bounce could well be as frenetic on the rise as it has been panic ridden on the decline.

Start getting excited for the second half of 2011.

I invite you to partake of my members only stock analysis service for free by clicking here.

By Jeb Handwerger© 2011 Copyright Jeb Handwerger- All Rights Reserved

Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.