How Commercial Paper Prices In Economic Recession

Interest-Rates / US Interest Rates Jul 06, 2011 - 02:34 AM GMTBy: Tony_Pallotta

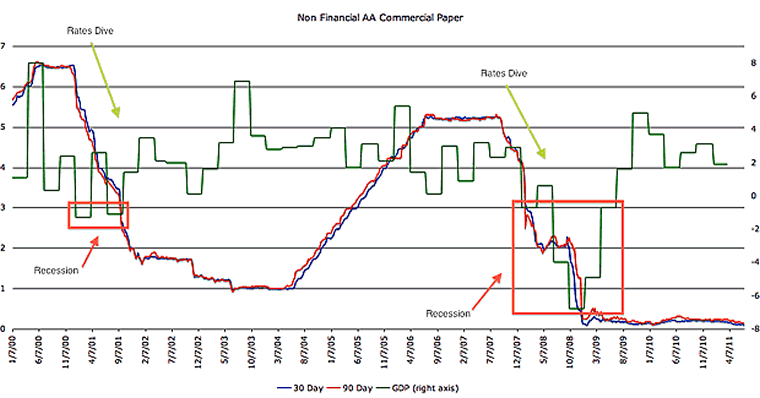

In what is becoming a multi part series on how various products price in recession tonight it is time to check out the commercial paper markets. Below are two charts (1) showing the last two recessions and how commercial paper rates performed and (2) commercial paper rates since Q2 2009. Both charts utilize non financial AA rated 30 and 90 day terms. The results were similar for financial paper as well.

Commercial paper seems to be an excellent market timer of economic recession. Notice the last two periods where rates began falling precipitously and the timing of economic contraction.

It is also interesting to note prior to the 2008 recession rates began moving higher as the economy expanded. Since the 08 recession theoretically ended no such move up in rates has occurred. Whether that is the reality that no real expansion has occurred and or simply an abundance of liquidity in the market is unclear.

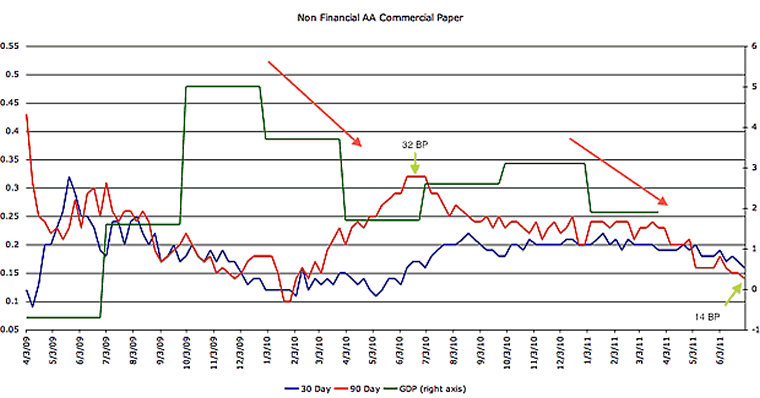

To capture changes in commercial paper rates since Q2 2009 a zoomed in chart is presented below. Again notice the fall off in rates albeit from lower levels and the corresponding move lower in GDP.

A similar pattern has developed where rates on 90 day paper have fallen from 34 to 14 basis points and GDP appears to be trending lower. What's "different this time" is the starting point of GDP versus the June 2009 drop off in rates was about 3% higher in real GDP terms.

Should GDP respond to changes in rates as it did in late 2009 then economic contraction is highly probable in 2011.

By Tony Pallotta

Bio: A Boston native, I now live in Denver, Colorado with my wife and two little girls. I trade for a living and primarily focus on options. I love selling theta and vega and taking the other side of a trade. I have a solid technical analysis background but much prefer the macro trade. Being able to combine both skills and an understanding of my "emotional capital" has helped me in my career.

© 2011 Copyright Tony Pallotta - Disclaimer: The above is a matter of opinion provided for general information purposes only and is not intended as investment advice. Information and analysis above are derived from sources and utilising methods believed to be reliable, but we cannot accept responsibility for any losses you may incur as a result of this analysis. Individuals should consult with their personal financial advisors.

© 2005-2022 http://www.MarketOracle.co.uk - The Market Oracle is a FREE Daily Financial Markets Analysis & Forecasting online publication.